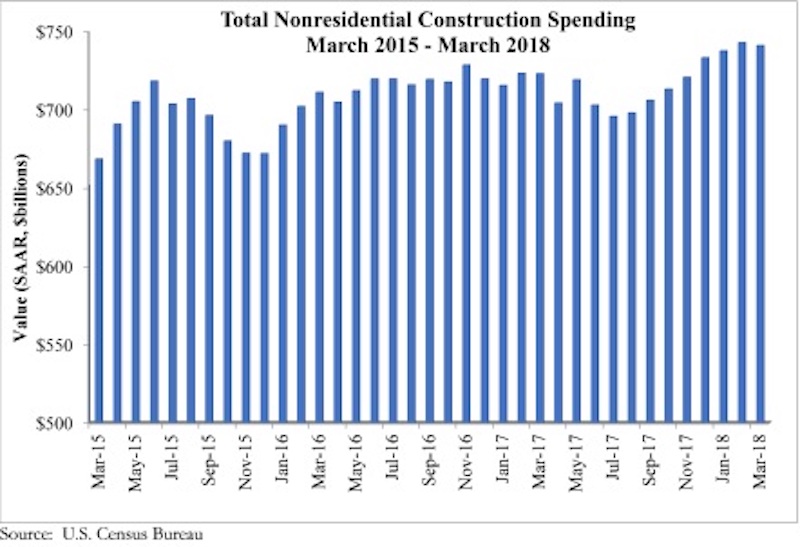

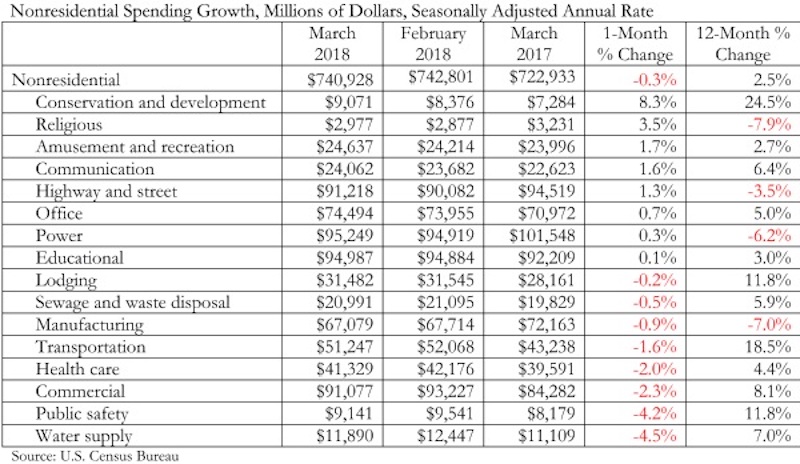

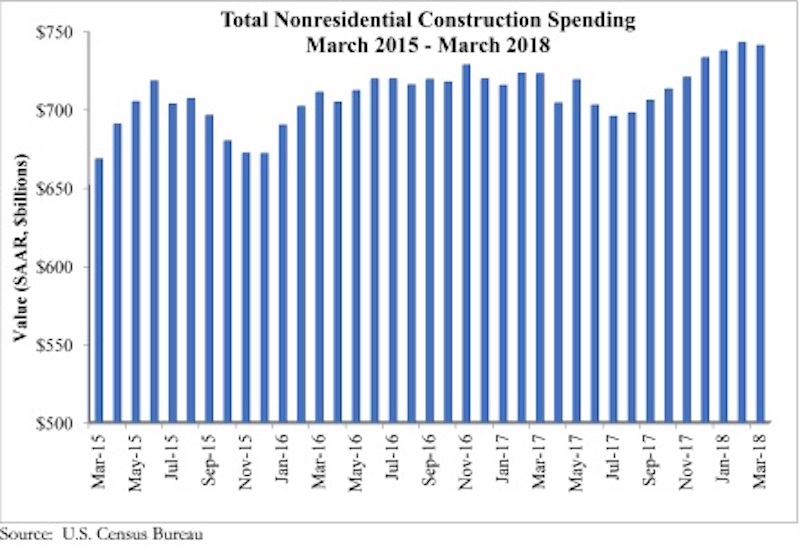

Nonresidential construction spending declined 0.3% in March, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data recently released. Nonresidential spending, which totaled $740.9 billion on a seasonally adjusted, annualized basis, has expanded 2.5% on a year-over-year basis. February’s spending estimate was revised roughly $10 billion higher, from $732.8 billion to $742.8 billion, rendering the March decline less meaningful.

Private sector nonresidential construction spending fell 0.4% on a monthly basis, but rose 2.2% from a year ago. Public sector nonresidential spending remained unchanged in March, but it is up 2.9% year-over-year.

“The nonresidential construction spending data emerging from the Census Bureau continue to be a bit at odds with other data characterizing growth in the level of activity,” said ABC’s Chief Economist Anirban Basu. “For instance, first quarter GDP data indicated brisk expansion in nonresidential investment. Data from ABC’s Construction Backlog Indicator, the Architecture Billings Index and other leading industry indicators have also been suggesting ongoing growth. Despite that, private nonresidential construction spending is up by roughly the inflation rate, indicating that the volume of services delivered over the past year has not expanded in real terms.

“That said, most economists who follow the industry presumed that March data would be somewhat soft,” said Basu. “The Northeast and Midwest were impacted by unusually persistent storm activity in March. The same phenomenon impacted March’s employment estimates, which indicated that construction actually lost 15,000 jobs that month. Other weather-sensitive industries, including retail trade, also experienced slow to negative job growth in March.

“The upshot is that CEOs and other construction leaders should remain upbeat regarding near-term prospects despite today’s construction spending report,” said Basu. “Leading indicators, including a host of confidence measures, collectively suggest that business investment will be on the rise during the months ahead. Improved state and local government finances should also support additional nonresidential construction activity.

“At the same time, construction industry leaders must remain wary of a sea of emerging risks to the ongoing economic and construction industry expansions,” said Basu. “Interest rates are on the rise. Materials prices, including those associated with softwood lumber, steel and aluminum, are expanding briskly. Wage pressures continue to build. There are also issues related to America’s expanding national debt, increasingly volatile financial markets, geopolitical uncertainty that has helped to propel fuel prices higher, and lack of transparency regarding America’s infrastructure investment intentions. The challenge for construction CEOs and others, therefore, is to prepare for growing activity in the near-term, but for something potentially rather different two to three years from now.”

Related Stories

Hotel Facilities | Jul 28, 2022

As travel returns, U.S. hotel construction pipeline growth follows

According to the recently released United States Construction Pipeline Trend Report from Lodging Econometrics (LE), the total U.S. construction pipeline stands at 5,220 projects/621,268 rooms at the close of 2022’s second quarter, up 9% Year-Over-Year (YOY) by projects and 4% YOY by rooms.

Codes and Standards | Jul 22, 2022

Hurricane-resistant construction may be greatly undervalued

New research led by an MIT graduate student at the school’s Concrete Sustainability Hub suggests that the value of buildings constructed to resist wind damage in hurricanes may be significantly underestimated.

Market Data | Jul 21, 2022

Architecture Billings Index continues to stabilize but remains healthy

Architecture firms reported increasing demand for design services in June, according to a new report today from The American Institute of Architects (AIA).

Market Data | Jul 21, 2022

Despite deteriorating economic conditions, nonresidential construction spending projected to increase through 2023

Construction spending on buildings is projected to increase just over nine percent this year and another six percent in 2023, according to a new report from the American Institute of Architects (AIA).

Building Team | Jul 18, 2022

Understanding the growing design-build market

FMI’s new analysis of the design-build market forecast for the next fives years shows that this delivery method will continue to grow, despite challenges from the COVID-19 pandemic.

Market Data | Jul 1, 2022

Nonresidential construction spending slightly dips in May, says ABC

National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jun 30, 2022

Yardi Matrix releases new national rent growth forecast

Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021.

Market Data | Jun 22, 2022

Architecture Billings Index slows but remains strong

Architecture firms reported increasing demand for design services in May, according to a new report today from The American Institute of Architects (AIA).

Building Team | Jun 17, 2022

Data analytics in design and construction: from confusion to clarity and the data-driven future

Data helps virtual design and construction (VDC) teams predict project risks and navigate change, which is especially vital in today’s fluctuating construction environment.

Market Data | Jun 15, 2022

ABC’s construction backlog rises in May; contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.