Construction costs are expected to increase by around 6 percent in 2021, and grow by another 4 to 7 percent in 2021, according to JLL’s Construction Cost Outlook for the second half of this year.

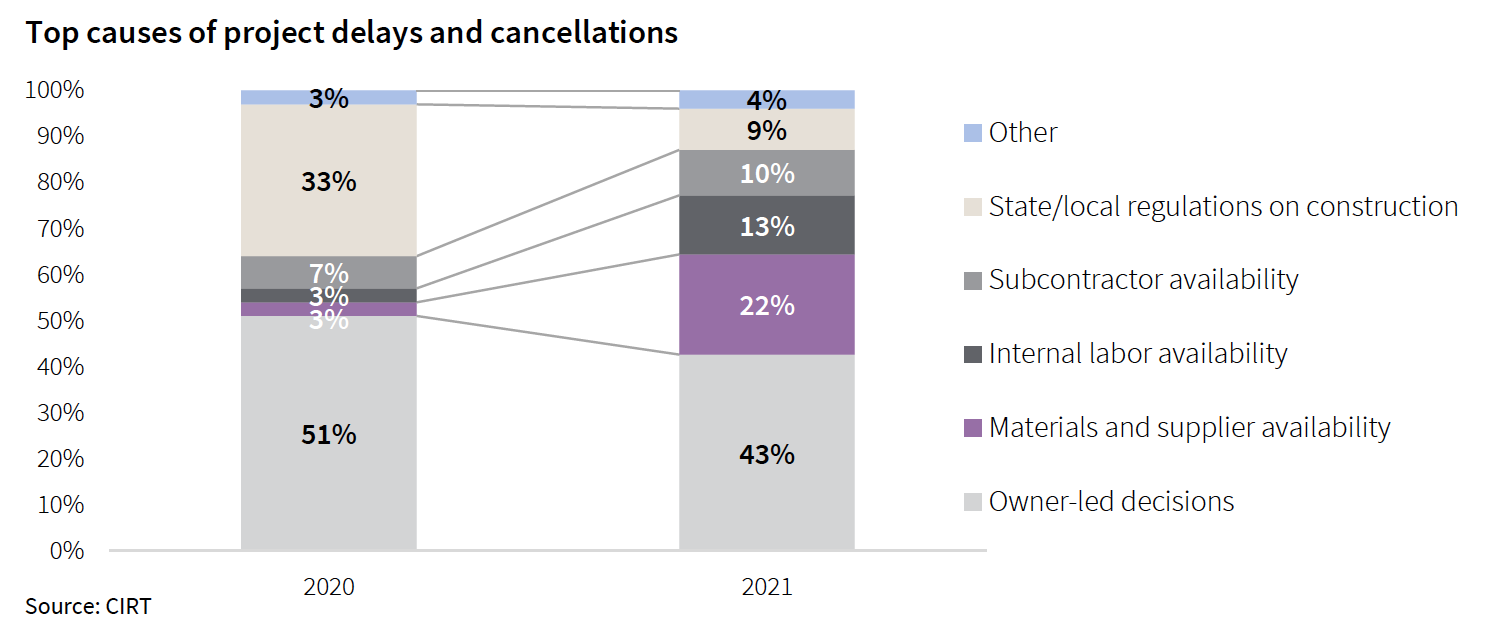

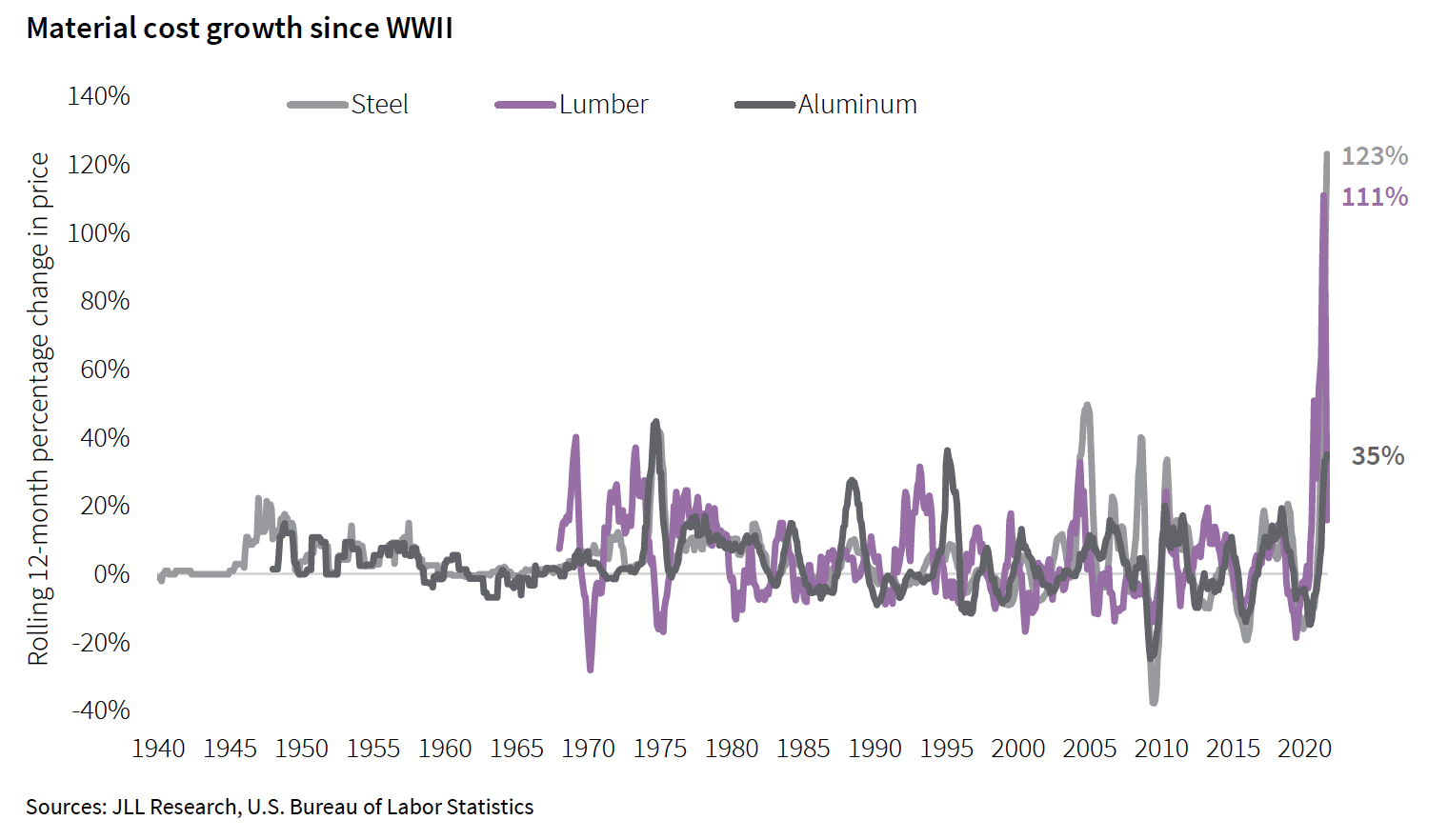

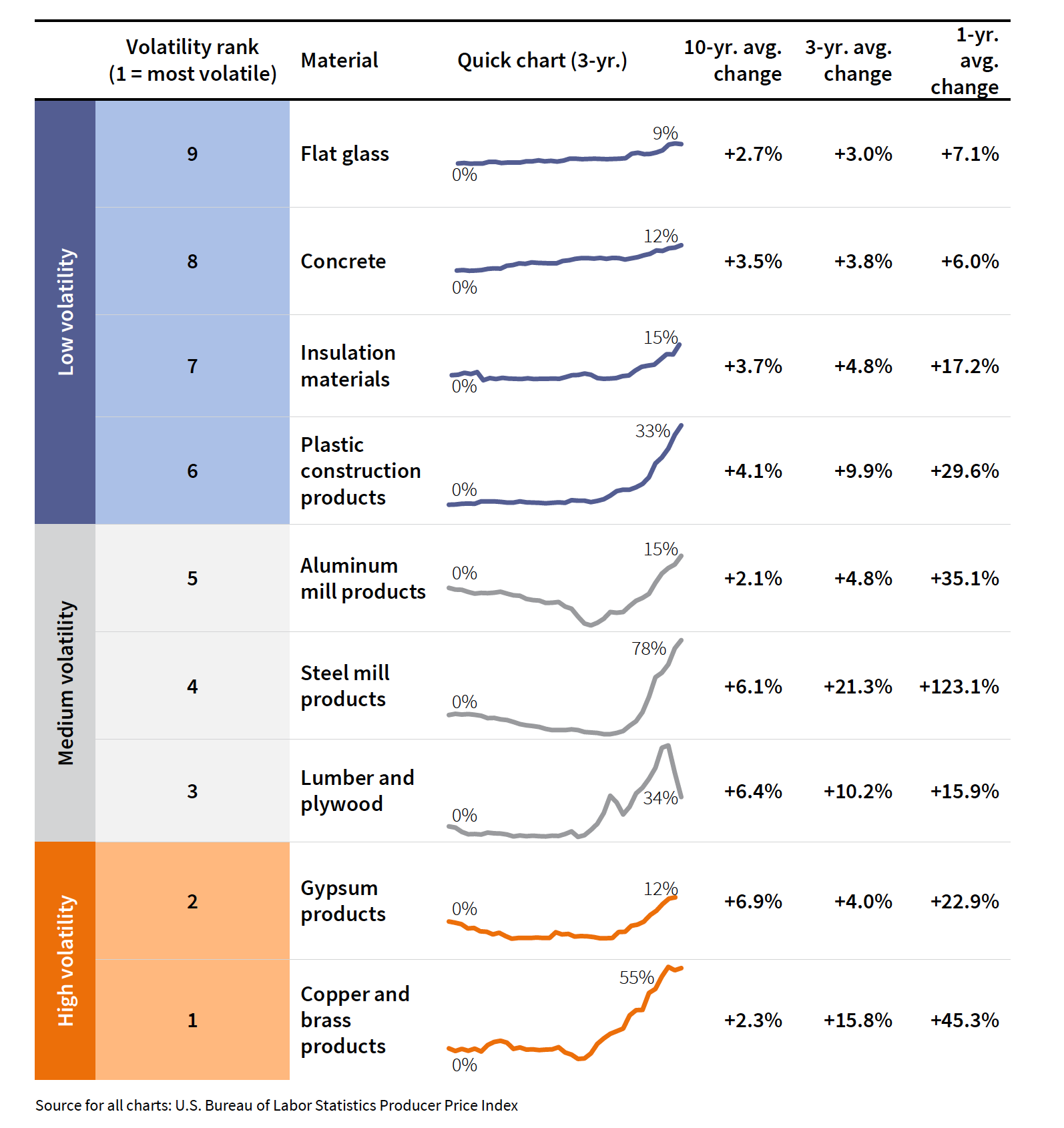

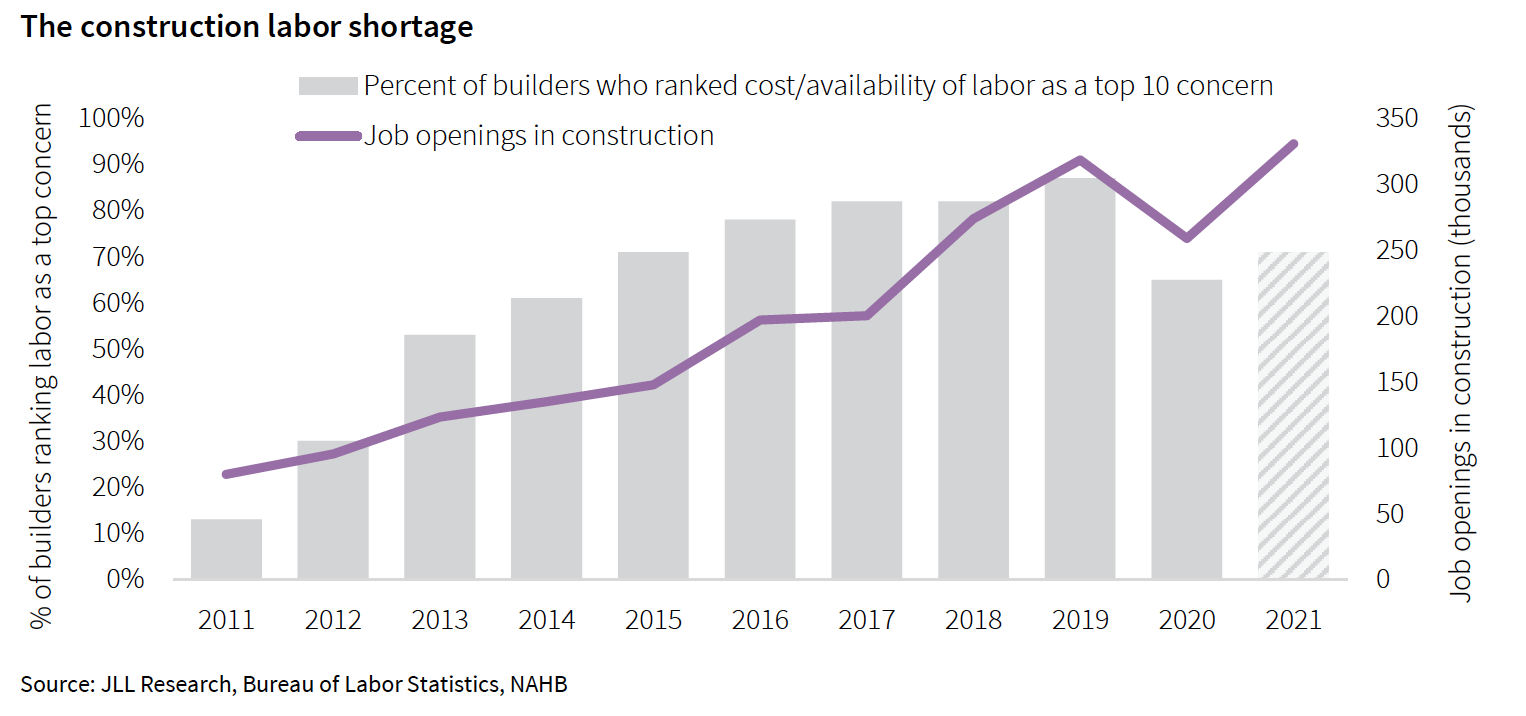

The Outlook tracks what has been “unprecedented” volatility in materials prices, which for the 12 months through August 2021 soared by 23 percent. Over that same period, labor costs rose by 4.46 percent, bringing total construction costs up by 4.51 percent. “The lack of available labor has led to more project delays so far in 2021 than a lack of materials, and conditions are expected to worsen over the coming year,” states Henry Esposito, JLL’s Construction Research Lead and the Outlook’s author.

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021. JLL does not expect a “true” rebound in that spending until the Spring or Summer of next year. And don’t count on any immediate jolt from the federal infrastructure bill that, even if it passes, won’t impact construction spending or costs for two to six years out.

Construction recovery also faces two big immediate challenges:

Supply chain delays and record-high cost increases continue to put pressure on project execution and profitability. And the delta variant and future waves of the pandemic have the potential to slow economic growth, weakening the construction rebound “and calling into question some of the rosier predictions for 2022.” The Outlook states.

SHORTAGES AND DELAYS WILL CONTINUE THROUGH ‘22

As demand for new projects continues to grow and contractor backlogs fill, there will be less incentive to bid aggressively, and contractors will aim to pass through cost increases to owners as soon as the market can bear it. This combination of factors leads JLL to extend its forecasts for 4.5 to 7.5 percent final cost growth for nonresidential construction in calendar year 2021 and to predict a similar 4 to 7 percent cost growth range for 2022.

Some materials costs will ease, but the average increase will land somewhere between 5 and 11 percent. Aside from costs, the most pressing issues for most construction materials right now are lead times and delays. “Hopes for major relief during 2021 have been largely dashed, with hope for a return to normal now pushed out into 2022,” says JLL. The most pressing development might be the recent coup d’état in Guinea, which is one the world’s largest exporters of bauxite, the ore needed to produce aluminum.

The industry’s labor shortage isn’t abating, either. From 2015 to 2019, the number of open and unfilled jobs in construction across the country doubled to 300,000. And while construction was one of the fastest sectors to recover from the pandemic, its workforce numbers still fall far short of demand, which is why JLL expects labor costs to grow in the 3 to 6 percent range. Construction also has the lowest vaccination rate, and the highest vaccine hesitancy rate, of any major industry, so jobsite workers remain more vulnerable to airborne infection that might sideline them.

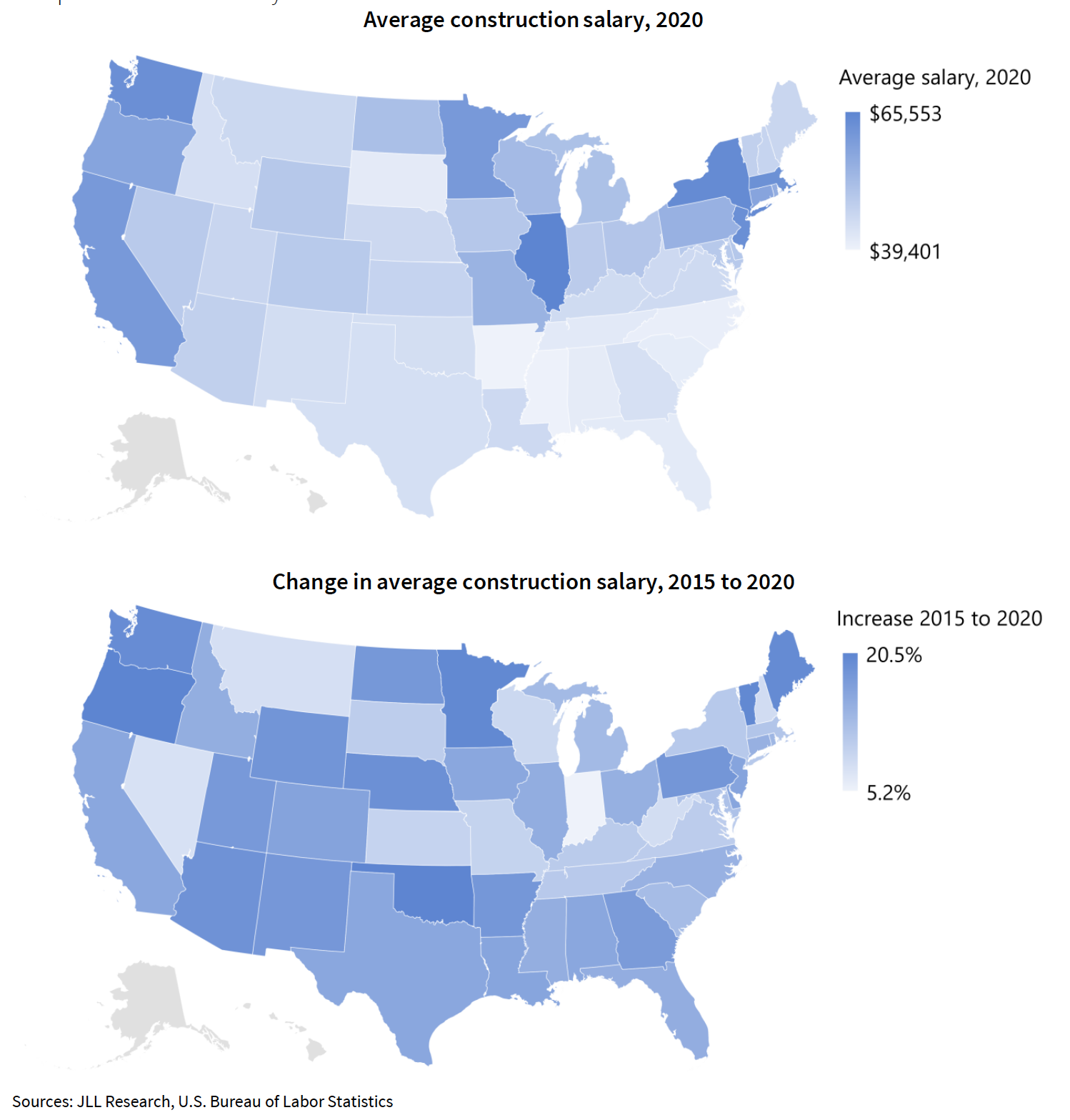

JLL shows that high-wage states are clustered in the Northeast corridor and the West Coast. The Midwest is also a high-cost region, with Illinois standing out as the top state, while the entire Southeast is the cheapest area of the country to hire workers. Wage growth across the country, on the other hand, is more evenly distributed, and some of the top states in total wages—such as Illinois, New York, and California—are only in the middle of the distribution pack.

Related Stories

Market Data | Apr 29, 2019

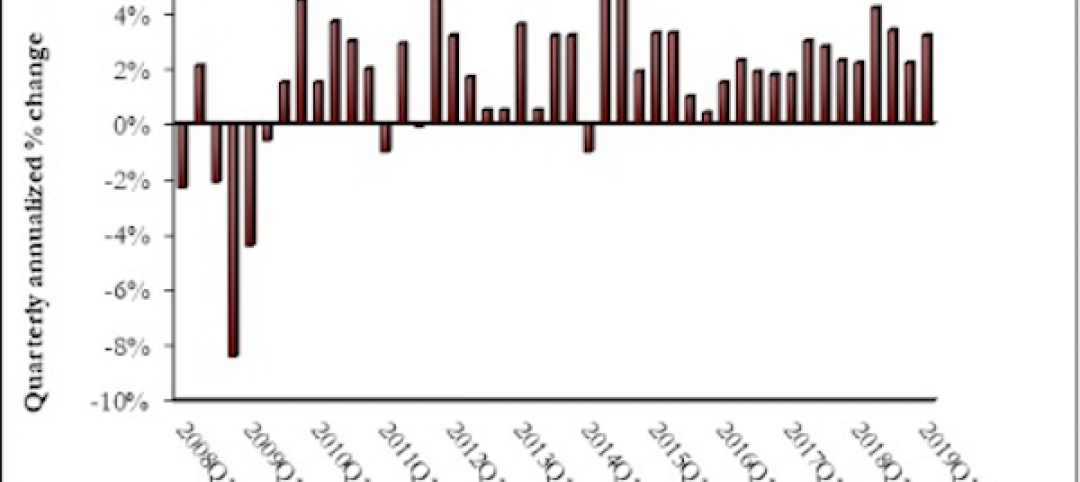

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.

Market Data | Apr 18, 2019

ABC report: 'Confidence seems to be making a comeback in America'

The Construction Confidence Index remained strong in February, according to the Associated Builders and Contractors.

Market Data | Apr 16, 2019

ABC’s Construction Backlog Indicator rebounds in February

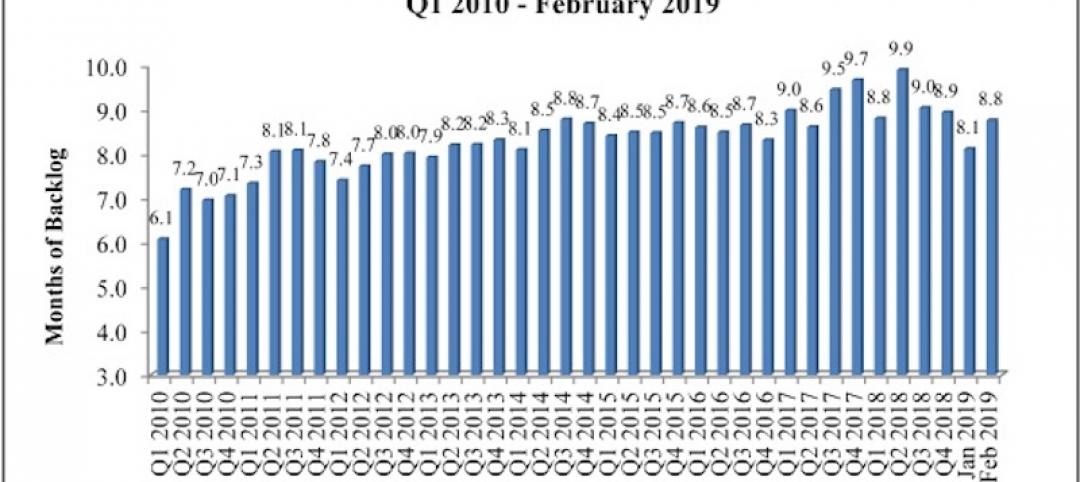

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

Nonresidential spending expands again in February

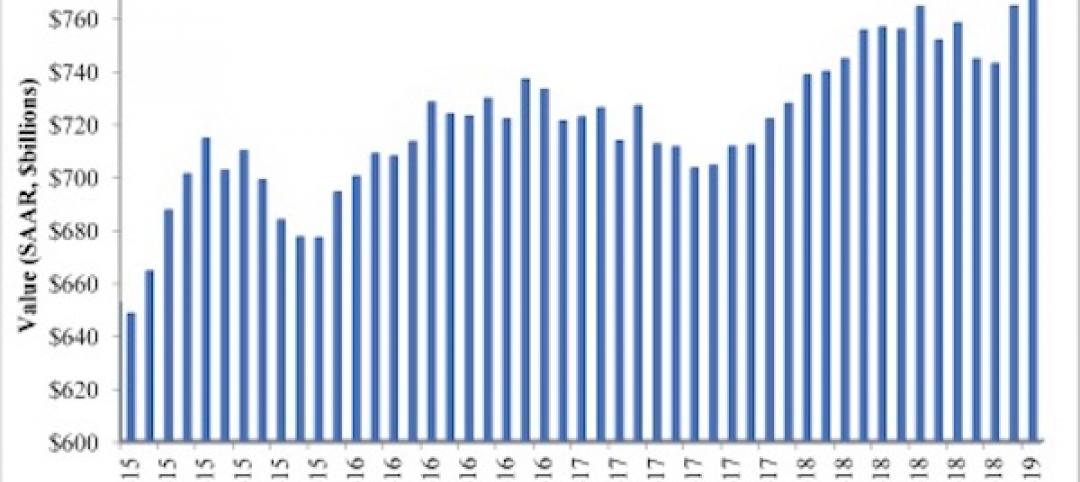

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.