The Associated General Contractors of America today announced that the Trump administration released new guidance that now allows firms with 500 or fewer employees to qualify for the new Paycheck Protection Program Loans. Association officials noted that the administration released the new guidance after the association raised concerns over the weekend that many firms that employ 500 or fewer employees appeared to be excluded from the program.

“Administration officials have done the right thing and revised their guidance to allow, as Congress intended, for firms that employ 500 or fewer people to qualify for the Paycheck Protection Program loans,” said Stephen E. Sandherr, the Association’s chief executive officer. “This change means the program is now more likely to help smaller firms continue to operate and retain staff.”

On April 2, the Small Business Administration issued an “interim final rule” to the effect that a business must have 500 or fewer employees and fall below the agency’s small business size standards—which for construction businesses are generally determined by an average annual income threshold, not number of employees threshold—in order to qualify for the new Paycheck Protection Program. Congress, however, declared that the program shall be open to all businesses that have 500 or fewer employees or fall below those size standards. Over the weekend, AGC of America alerted the Trump Administration to the problem, and late last night the U.S. Department of Treasury released new guidance about the Paycheck Protection Program loans that now allows firms with 500 or fewer employees to qualify.

Specifically, the new guidance includes the following:

Question: Does my business have to qualify as a small business concern (as defined in section 3 of the Small Business Act, 15 U.S.C. 632) in order to participate in the PPP?

Answer: No. In addition to small business concerns, a business is eligible for a PPP loan if the business has 500 or fewer employees whose principal place of residence is in the United States, or the business meets the SBA employee-based size standards for the industry in which it operates (if applicable).

The new guidance also states that “[b]orrowers . . . may rely on the guidance provided in this document as SBA’s interpretation of the CARES Act” and its interim final rule. At the time it posted this guidance, the Treasury Department also notified the association of its action. Here is a copy of that notice.

The new Treasury Department guidance appears to clear the way for construction firms that employ 500 or fewer people to qualify for the new Paycheck Protection Program loans. They added that the association will work with administration officials to ensure that the Small Business Administration’s regulations and guidance are harmonized with this new Treasury guidance.

Related Stories

Coronavirus | Apr 2, 2020

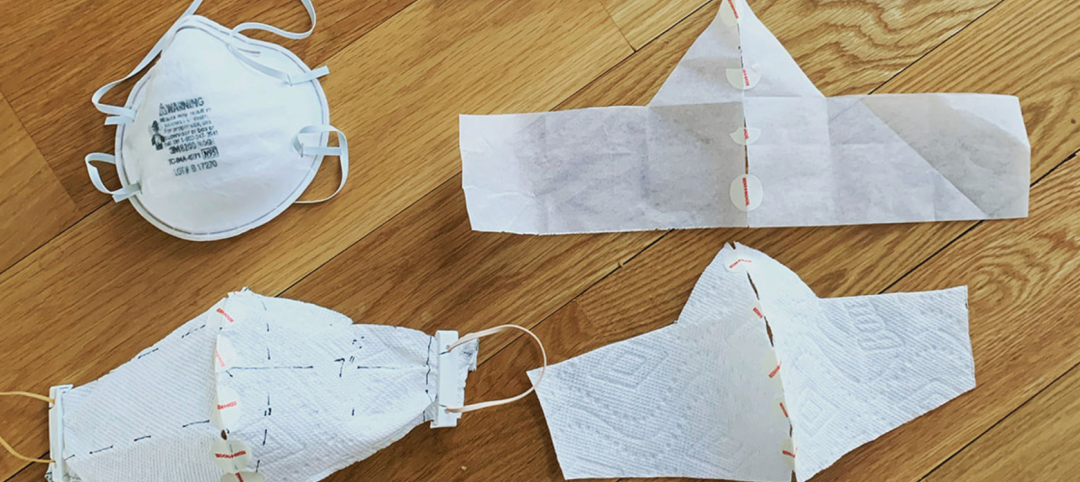

COVID-19: CannonDesign initiates industry coalition to make masks for healthcare providers

Coalition formed to make DIY face masks for healthcare workers in COVID-19 settings.

Coronavirus | Apr 2, 2020

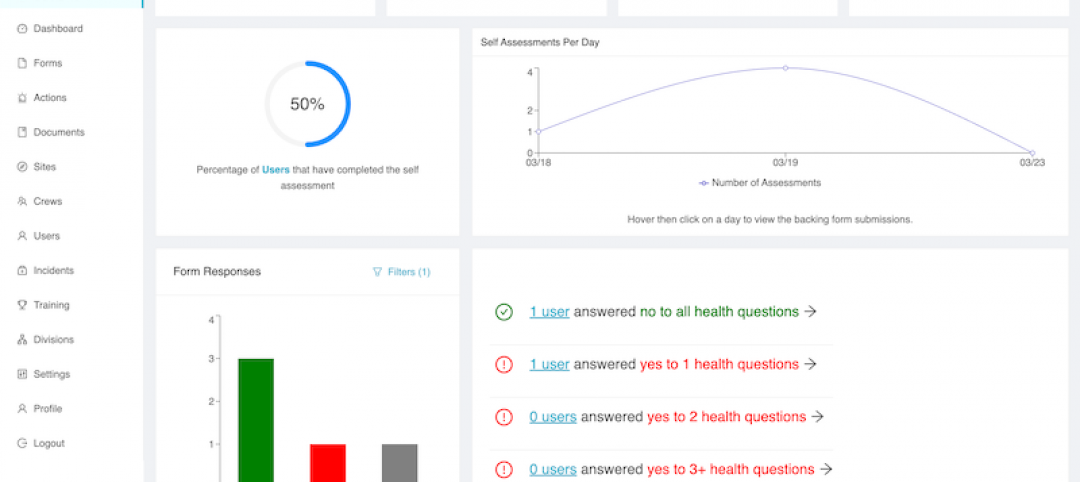

As virus spreads across North America, software providers step up with cost-free offerings

The goal is to keep construction projects moving forward at a time when jobs are being postponed or canceled.

Coronavirus | Apr 2, 2020

SBA and Treasury begin effort to distribute $349 billion in emergency small business capital

The new loan program will help small businesses with their payroll and other business operating expenses.

Coronavirus | Apr 2, 2020

New webinar explains how AIA Contract Documents can address business disruptions due to Covid-19

The webinar was recorded March 27.

Coronavirus | Apr 2, 2020

Informed by its latest Crane Index, Rider Levett Bucknall anticipates the effect of coronavirus on the construction industry

While total crane count holds steady, turbulent economic conditions indicate a recession-based drop in construction costs.

Coronavirus | Apr 1, 2020

How is the coronavirus outbreak impacting your firm's projects?

Please take BD+C's three-minute poll on the AEC business impacts from the coronavirus outbreak.

Coronavirus | Apr 1, 2020

Opinion: What can we learn from the coronavirus pandemic?

The coronavirus pandemic will soon end, soon be in the rear-view mirror, but we can still take lessons learned as directions for going forward.

Coronavirus | Apr 1, 2020

Three reasons you should keep sewing face masks (as long as you follow simple best practices)

Here are three reasons to encourage sewists coast to coast to keep their foot on the pedal.

Coronavirus | Apr 1, 2020

TLC’s Michael Sheerin offers guidance on ventilation in COVID-19 healthcare settings

Ventilation engineering guidance for COVID-19 patient rooms

Coronavirus | Apr 1, 2020

February rise in construction outlays contrasts with pandemic-driven collapse in March as owners, government orders shut down projects

Survey finds contractors face shortages of materials and workers, delivery delays and cancellations.