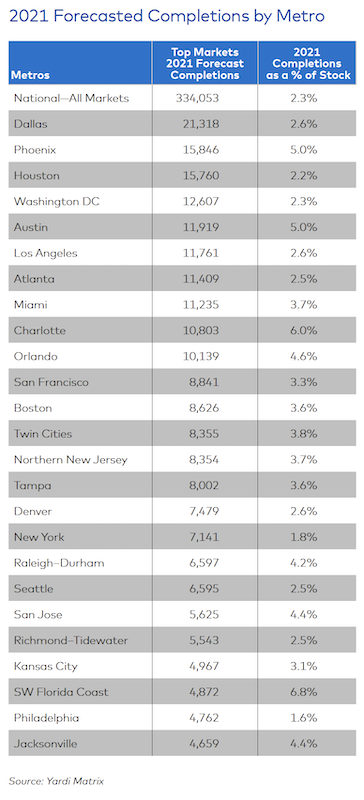

Having weathered the coronavirus pandemic somewhat better than the single-family home construction sector, new supply of multifamily housing delivered in 2021 is expected to increase by around 17% to 334,000 units, according to Yardi Matrix’s latest U.S. Outlook.

“Some 174,000 units were absorbed nationally through May, which puts 2021 on track to be among the hottest years since the 2008 recession,” states the report.

As of mid-year, some 863,500 multifamily units were under construction, representing 6% of the existing U.S. stock. That’s good and bad news, suggests Yardi Matrix, because such a large number of projects could impede the overall rent recovery in so-called “gateway” markets like Miami, whose forecasted deliveries are projected to equal 3.7% of its existing stock; Boston (3.6% of existing stock), San Francisco (3.3%), Los Angeles (2.6%), Washington D.C. (2.3%), New York (1.8%) and Chicago (1.3%).

“These new projects might have a difficult time leasing up, as there is already much supply in these metros with limited new demand, especially in the Lifestyle segment,” states the report.

The leaders in multifamily completions over the past 12 months include Austin (4.4% of total stock), Charlotte (4.3%), Minneapolis-St. Paul (3.7%) and Raleigh (3.6%). Yardi Matrix points out that among these four metros, Charlotte has been the only one able to sustain strong rent growth and deliveries simultaneously. Still, rents in all four metros have picked up in recent months, driven by a surge in migration and demand for apartments.

Yardi Matrix foresees Dallas leading the country in multifamily completions this year. Image: Yardi Matrix

SMALLER MARKETS, BIGGER DEMAND

Yardi Matrix looked at 136 markets, and found robust growth in tertiary metros like Northwest Arkansas (home to Walmart’s headquarters city of Bentonville) that led the list with 8.8% of its stock expected to be delivered this year from new construction. Next were Wilmington, N.C. (with 7% of its stock expected to be delivered), and the Southwest Florida Coast (6.8%). These metros had limited existing multifamily housing stock to begin with.

Measured by sheer units, Dallas is forecast to have the highest number of completions in 2021 (21,318 units), followed by Phoenix, Houston, Washington DC, Austin, L.A., Atlanta, and Miami. Yardi Matrix believes that while Dallas, Phoenix, and Houston should have little trouble absorbing new deliveries, “Washington DC might struggle,” because demand is lagging in part due to remote work requirements or preferences, and out-migration.

Material price hikes are the “wild card” in prognostications about apartment development, says Yardi Matrix. The extreme volatility of lumber prices over the past several months, coupled with increases in the cost of other building materials, could slow new starts and force developers “to choose between raising rents and reducing profit margins.”

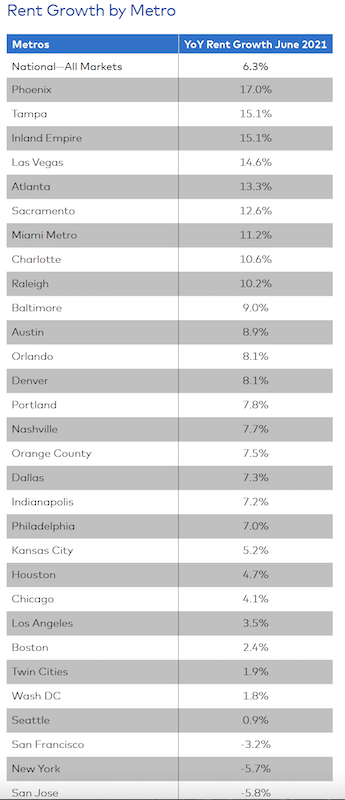

RENTS RISING AT UNSUSTAINABLE RATES

Through the first six months of 2021, national asking rents rose 5.8%. Yardi Matrix estimates that year-over-year asking rent growth, as of June, stood at 6.3%, “well above the [country’s] pre-pandemic performance.” Rent inflation is even more pronounced in tech hubs and tertiary metros, and asking rent growth in the Southwest and Southeast has been at levels “not seen in decades.”

While this escalation for multifamily units probably isn’t sustainable, Yardi Matrix expects conditions for above-average rent growth to persist in many metros “for months.” The report points out that rents are driven by “buoyant” demand. In the 12 months through May, 378,000 multifamily units were absorbed nationwide. The top markets for absorption as a percentage of total inventories were Miami (8,500 units, or 2.7% of stock), Charlotte (4,500, 2.4%) and Orlando (4,900, 2.1%).

Through June of this year, rent growth in Phoenix was nearly three times the national average. And despite its year-to-year rent decline, New York bounced back in the first half of 2021. Image: Yardi Matrix

By units, Chicago topped the list with almost 7,800 multifamily units absorbed, or 2.2 % of the Windy City’s stock. And for all the talk about New Yorkers evacuating in droves during the pandemic, rents actually rose by 6% during the first half of this year, and more companies are now requiring employees to return to office work. Rent recoveries through the first half of 2021 were also in “full swing” in Chicago (up 6.5%), Miami (6.4%), Boston (5%), Los Angeles (4%) and D.C. (3.3%).

Yardi Matrix’s report offers an economic outlook that foresees a flat labor participation market, and questions about rising inflation. Economic volatility “is likely to continue” globally until markets get a handle on controlling their virus outbreaks. “However, that does not mean there won’t be strong economic growth in certain sectors and geographies in the short term,” the report states.

Related Stories

Multifamily Housing | Aug 24, 2023

A multifamily design for multigenerational living

KTGY’s Family Flat concept showcases the benefits of multigenerational living through a multifamily design lens.

Multifamily Housing | Aug 23, 2023

Constructing multifamily housing buildings to Passive House standards can be done at cost parity

All-electric multi-family Passive House projects can be built at the same cost or close to the same cost as conventionally designed buildings, according to a report by the Passive House Network. The report included a survey of 45 multi-family Passive House buildings in New York and Massachusetts in recent years.

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Adaptive Reuse | Aug 16, 2023

One of New York’s largest office-to-residential conversions kicks off soon

One of New York City’s largest office-to-residential conversions will soon be underway in lower Manhattan. 55 Broad Street, which served as the headquarters for Goldman Sachs from 1967 until 1983, will be reborn as a residence with 571 market rate apartments. The 30-story building will offer a wealth of amenities including a private club, wellness and fitness activities.

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.

Sponsored | Multifamily Housing | Aug 15, 2023

Embracing Integrations: When Access Control Becomes Greater Than the Sum of Its Parts

Multifamily Housing | Aug 11, 2023

Hotels extend market reach with branded multifamily residences

The line separating hospitality and residential living keeps getting thinner. Multifamily developers are attracting renters and owners to their properties with hotel-like amenities and services. Post-COVID, more business travelers are building in extra days to their trips for leisure. Buildings that mix hotel rooms with for-sale or rental apartments are increasingly common.

MFPRO+ New Projects | Aug 10, 2023

Atlanta’s Old Fourth Ward gets a 21-story, 162-unit multifamily residential building

East of downtown Atlanta, a new residential building called Signal House will provide the city with 162 units ranging from one to three bedrooms. Located on the Atlanta BeltLine, a former railway corridor, the 21-story building is part of the latest phase of Ponce City Market, a onetime Sears building and now a mixed-use complex.

Senior Living Design | Aug 7, 2023

Putting 9 senior living market trends into perspective

Brad Perkins, FAIA, a veteran of more than four decades in the planning and design of senior living communities, looks at where the market is heading in the immediate future.

Multifamily Housing | Jul 31, 2023

6 multifamily housing projects win 2023 LEED Homes Awards

The 2023 LEED Homes Awards winners in the multifamily space represent green, LEED-certified buildings designed to provide clean indoor air and reduced energy consumption.