As the nation’s economy continues to improve, the number of Americans forming households in the U.S. has recovered to a more normal pace. Ironically, the multifamily engine that helped sustain the housing market under bleaker economic conditions has been sputtering a bit as things have gotten better.

That assessment comes from The State of the Nation’s Housing 2019, the annual tracking of the nation’s housing pulse conducted by the Harvard Joint Center for Housing Studies. As has been the case in past reports, this year’s survey found persistent disparities in supply and demand, especially in affordable housing stock. Home values varied widely, too: they were more than five times greater than incomes in roughly one in seven metro areas (primarily on the West Coast), compared with less than three times in about one in three metros (primarily in the Midwest and South).

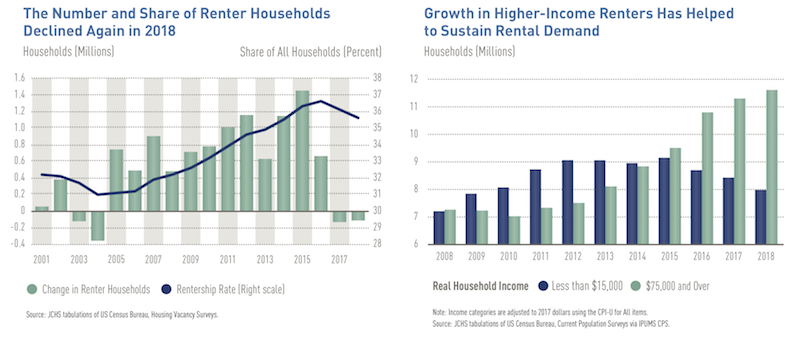

On the renter side (which is predominantly multifamily), households fell for the second consecutive year in 2018, a stark contrast to the increases of the 12 preceding years. Despite that decline, rents are rising at twice the rate of overall inflation.

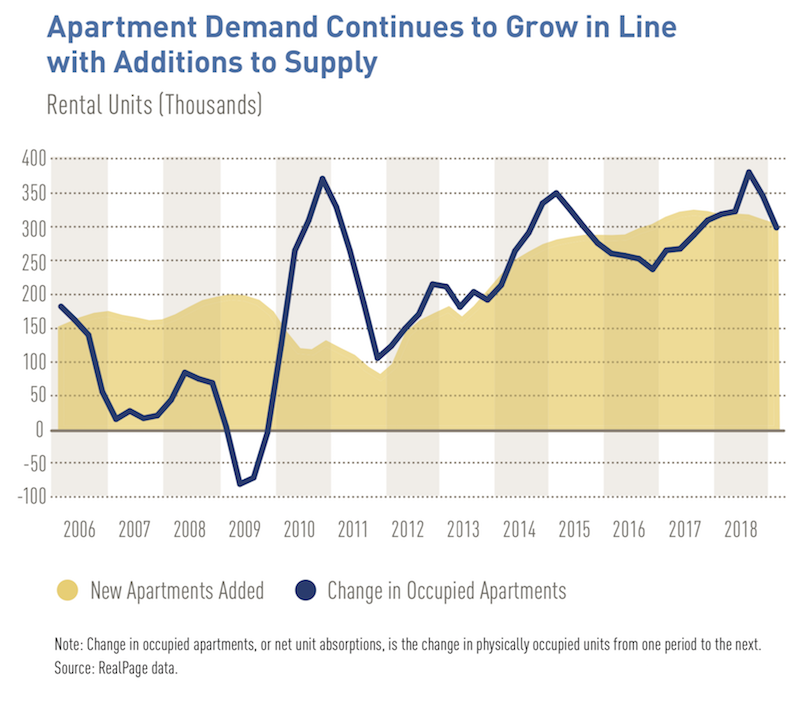

“The growing presence of higher-income renters has helped keep rental markets stable,” says Daniel McCue, a senior research associate at the Joint Center. “This has maintained demand for new apartments, even as overall rental demand has waned.” At the lower end of the market, the number of units renting for under $800 per month fell by one million in 2017, bringing the total loss from 2011–2017 to four million.

Looking forward, the report authors expect rental growth to be solid, with 400,000 additional renter households per year expected between 2018 and 2028. Whether these projections come to pass depends on a number of factors, including economic conditions, housing affordability, and the pace of foreign immigration.

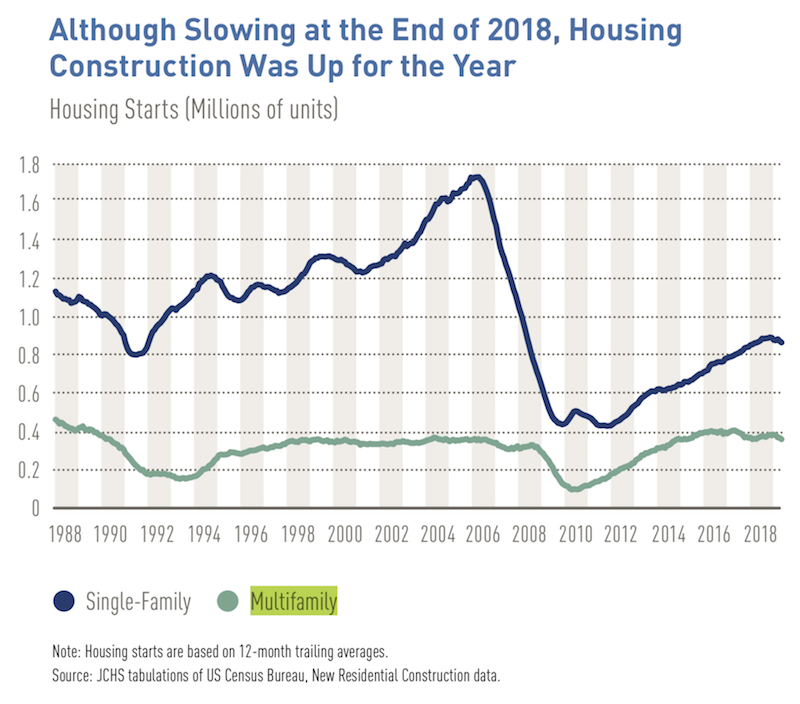

Construction rebounds

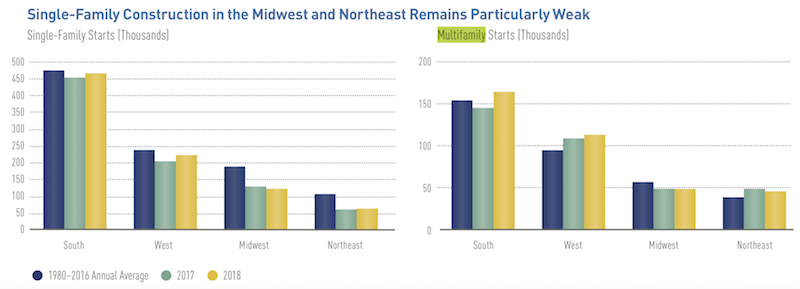

Multifamily construction starts last year picked up after two years of decline, rising 5.6% to 374,100 units. With the exceptions of 2015 and 2016, multifamily construction was higher in 2018 than in any other year since 1988. However, given the previous two-year dip in starts and the lengthy construction process for larger apartment buildings, the number of multifamily completions fell 3.6% last year, to 344,700 units, the first annual decline since 2012.

Image: Harvard Joint Center for Housing Studies

Construction of multifamily condominiums and co-ops held at near post-recession lows last year, with completions of just 27,000 units. Moreover, many condos are even more expensive than single-family homes because of their locations, with a median asking price of $521,200 for units completed in 2017. At the same time, construction of townhomes (attached single-family units) rose significantly over the past year, up 8% to 108,000 units—nearly double the level in 2011. Again, though, the number of new townhomes was still well below levels in the early 2000s.

Nearly three-quarters of multifamily rental units completed in 2018 were in the South (43 percent) and West (29 percent), where median asking rents topped $1,500 per month.

Rents nationwide continued to climb in 2018, up 3.6% for the year, according to the Consumer Price Index. While this was a slight deceleration from 3.8% in 2017, rent growth picked up pace again in the first months of 2019. Year-over-year rent growth hit 3.8% in April, more than double the rate of inflation for other items.

RealPage data for multifamily apartments in 150 metros also show an acceleration, with nominal rent growth increasing from 2.6% in the first quarter of 2018 to 3.3% in the first quarter of 2019. Meanwhile, CoreLogic data indicate that rent growth for single-family leased units increased to 3.2% in January 2019, from 2.7% in January 2018.

Property values rise

With steady rent gains and low vacancy rates, net operating incomes for multifamily properties remained strong in 2018. The National Council of Real Estate Investment Fiduciaries reports that annualized growth of net operating income jumped from 3.4% in the first quarter of 2018 to 7.5% in the first quarter of 2019.

At the same time, National Apartment Association data show a 2.1% nominal rise in operating expenses and an 11.3% increase in capital expenditures. As a result, annualized returns on investment held steady at 5.9% in early 2019— well below the 10.4% average in 2013–2016 but still far outstripping overall inflation.

Image: Harvard Joint Center for Housing Studies

The ongoing rise in property prices has increased the cost of investing. The Freddie Mac Apartment Investment Market Index, measuring the relative value of multifamily investments, dropped 7.5% year-over-year at the end of 2018, indicating that growth in net operating incomes did not offset the rise in prices. Declines in all 13 metros covered by that index suggest that conditions are becoming less favorable for new multifamily investors.

Multifamily financing activity should remain stable this year, although credit conditions may tighten. A moderate net share of banks responding to the Federal Reserve’s Senior Loan Officer Opinion Survey reported tightening lending standards. At the same time, a small net share of respondents also noted weakening demand for multifamily lending.

Affordable rentals scarcer

The supply of low-rent housing continues to decline in metro markets across the country. In 2016–2017 alone, the stock of units renting for less than $800 fell by one million, or 4.9 percent. The number of units in this rent range has decreased every year since 2011, bringing the total net decline to four million. Just over three-quarters of all 383 metros with populations of at least 50,000 lost nearly 20% of their low-cost stocks on average in 2011–2017.

New construction has not made up for these declines. According to the Survey of Market Absorption, only 9% of apartments in unsubsidized multifamily buildings completed in the first quarter of 2018 had asking rents below $1,050, and only 4% rented for less than $850.

The National Multifamily Housing Council also notes that new construction has not even served the middle of the market, with the share of new apartments affordable to median-income renter households dropping to less than 3 percent annually over the last decade. The focus of new construction on higher-cost units has thus shifted the overall distribution of rents upward.

Image: Harvard Joint Center for Housing Studies

Demographics will drive demand

The Joint Center’s outlook is that the modest decline in the number of renter households over the last two years might deliver some short-term relief from rising rents. Thus far, however, any positive impact of the decline has been offset by the ongoing increase in higher-income renters, who drive a growing share of market activity, and by low vacancy rates, which are keeping overall conditions tight.

That being said, going forward demographic trends should support strong rental demand. The Joint Center estimates that renter household growth will total 4.2 million by 2028 if homeownership rates remain near their current levels.

And even if the homeownership rate rises by 1.6 percentage points over the decade, the high-end projection indicates that renter household growth will still total at least 2.1 million, given expected increases in the adult population. On the supply side, however, conditions at the lower end of the market will remain challenging, as millions of low-income households compete for an already insufficient number of affordable rental units.

Related Stories

| Aug 11, 2010

Oldcastle Precast Building Systems wins PCI 2009 Sustainable Design Award

Oldcastle Precast Building Systems was part of the award winning team behind the affordable housing development Melrose Commons Site 5 situated in the South Bronx. PCI (Precast Concrete Institute) recently selected Melrose 5 for the “2009 PCI Design Award for Best Sustainable Project”.

| Aug 11, 2010

National Intrepid Center of Excellence tops out at Walter Reed

SmithGroup and The Intrepid Fallen Heroes Fund (IFHF), a non-profit organization supporting the men and women of the United States Armed Forces and their families, celebrated the overall structural completion of the National Intrepid Center of Excellence (NICoE), an advanced facility dedicated to research, diagnosis and treatment of military personnel and veterans suffering from traumatic brain injury.

| Aug 11, 2010

USGBC honors Brad Pitt's Make It Right New Orleans as the ‘largest and greenest single-family community in the world’

U.S. Green Building Council President, CEO and Founding Chair Rick Fedrizzi today declared that the neighborhood being built by Make It Right New Orleans, the post-Katrina housing initiative launched by actor Brad Pitt, is the “largest and greenest community of single-family homes in the world” at the annual Clinton Global Initiative meeting in New York.

| Aug 11, 2010

Trump luxury condos in Jersey City get more luxurious

Only two years after opening, Jersey City-based Trump Plaza Residences is getting a facelift. Interior designer Benjamin Noriega-Ortiz of BNOdesign has been commissioned to create a fresh design for the residential tower's entrance and outdoor pool, cabana, and lawn spaces. Renovations on the 55-story, 443-unit luxury high-rise will be completed in two phases.

| Aug 11, 2010

Apartments offer skyline view of Houston

Perched atop a hill near downtown Houston, the Gables Memorial Hills residential tower will rise to eight stories and cover 2.68 acres. With an average unit size of 965 sf, the brick and cast-stone complex will consist of 70% one-bedroom units and 30% two-bedroom units, some of which overlook downtown.

| Aug 11, 2010

Sustainable features central to independent-living building

Architecture firm Perkins Eastman, together with Saint Johns on the Lake retirement community, plans to open a 21-story, 88-unit independent-living building for seniors by mid 2011. When the $46-million project is complete, it will offer residents a streetside café, art gallery, spa and wellness center, classroom, and community performance space.

| Aug 11, 2010

Historic building to be restored in Kansas City

Construction has begun on the conversion of the historic 17-story Home Savings Association building in Kansas City, Mo. The transformed structure, to be known as Grand Boulevard Lofts, will house 134 apartment units. The $18-million project, designed by architect Rosemann & Associates, follows a revitalization of downtown Kansas City, where there is high demand for affordable housing to ser...

| Aug 11, 2010

Old factory converted from hearth to home

A former briquette factory in Cologne-Frechen, Germany, was converted into a mixed-use building by Astoc Architects & Planners, Cologne, in association with Rheinischen Amt für Denkmalpflege—the Rhenish agency for historic preservation. The roughly 172,200-sf building includes a mix of residential condominiums, lofts, and leased commercial space.

| Aug 11, 2010

And the world's tallest building is…

At more than 2,600 feet high, the Burj Dubai (right) can still lay claim to the title of world's tallest building—although like all other super-tall buildings, its exact height will have to be recalculated now that the Council on Tall Buildings and Urban Habitat (CTBUH) announced a change to its height criteria.

| Aug 11, 2010

Luxury high-rise meets major milestone

A topping off ceremony was held in late October for 400 Fifth Avenue, a 57,000-sf high-rise that includes a 214-room luxury hotel and 190 high-end residential condominiums. Developed by Bizzi & Partners Development and designed by Gwathmey Siegel & Associates Architects, the 60-story tower in midtown Manhattan sits atop a smaller-scale 10-story base, which creates a street façade t...