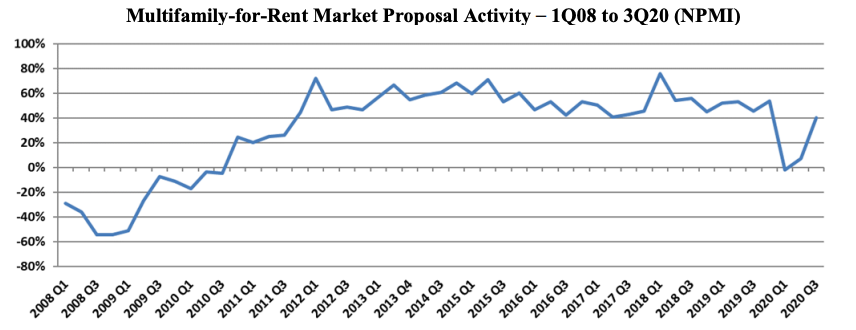

After dipping in the previous two quarters to levels unseen in nearly a decade, the Multifamily-for-Rent outlook for design and construction firms returned to pre-COVID levels in the 3rd Quarter, according to the PSMJ Resources’ Quarterly Market Forecast (QMF). The market’s net plus/minus index (NPMI) reached 40% for the 3rd Quarter, following quarters of -2% and +7%, respectively, in the first half of 2020. The negative index in the 1st Quarter was the first for the Multifamily market since 2010.

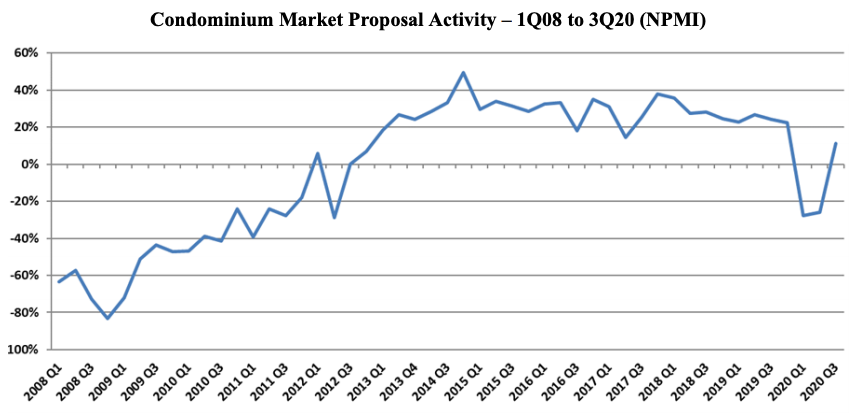

"The entire Housing market is showing impressive growth potential based on A/E proposal activity,” said PSMJ Senior Principal David Burstein, PE, AECPM. “This view is reinforced by government statistics for housing permits and new home starts. Multifamily housing (apartment buildings) took a brief pause from its 10-year growth surge when the COVID-19 crisis first hit in March, but has since recovered quite nicely. The condominium market actually saw a significant dip this spring, but more recently is showing signs of recovery, albeit not to the same levels as Multifamily-for-Rent.”

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the architecture and engineering (A/E) industry since its inception in 2003. A consistent group of over 300 A/E firm leaders participate regularly, with 162 contributing to the most recent survey.

Multifamily-for-Rent Market Proposal Activity – 1Q08 to 3Q20 (NPMI)

The Multifamily market returned to positive territory out of the Great Recession in the 4th Quarter of 2010 with an NPMI of 24%, then jumped to 44% in the 4th Quarter of 2011. It never dropped below 41% again until it plummeted from 54% in the 4th Quarter of 2019 to -2% in the 1st Quarter of 2020.

“Many of the factors that drove Multifamily's growth pre-COVID remain in place,” adds Burstein. “Plus, there is now a new factor – the potential flight of many people from cities to suburbs – which is shifting the location of the demand. So we believe the Multifamily market will continue to be strong into the foreseeable future.”

Condominium proposal activity soared to a positive NPMI of 11% in the 3rd Quarter, up from -26% in the 2nd Quarter. The Condo market took longer to recover from the last recession than Multifamily-for-Rent did, not rebounding to positive numbers until late 2012. Its NPMI generally stayed in the 20% and 30% range for the next seven years running, until plummeting from 22% in the 4th Quarter of 2019 to a nine-year low of -28% in the 1st Quarter of 2020.

Condominium Market Proposal Activity – 1Q08 to 3Q20 (NPMI)

The Multifamily rebound was part of overall improving conditions for the Housing market, which paced all 12 of the major markets assessed in the QMF with an overall NPMI of 38%. Among other Housing submarkets, Single-Family Property (individual houses) also recorded a 40% NPMI (up from 9%), with Single-Family Development (Subdivisions) at 27%, up from -12%, and Senior & Assisted Living (Independent Living) at 26%, up from -1%,.

Among the 12 major markets surveyed, Water/Wastewater was a close second to Housing at 37%, followed by Healthcare (30%), Energy/Utilities (28%) and Light Industry (27%). Overall proposal activity across all markets and submarkets returned to growth mode in the 3rd Quarter with an NPMI of 22%, up from -10% in the 2nd Quarter. The three worst-performing major markets in the 3rd Quarter were Education (-36%), Commercial Users (-31%) and Commercial Developers (-21%).

PSMJ Resources, a consulting and publishing company dedicated to the A/E industry, has conducted its Quarterly Market Forecast for more than 17 years. It includes data on 12 major markets and 58 submarkets served by A/E firms. For more information, go to https://www.psmj.com/surveys/quarterly-market-forecast-2.

Related Stories

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).