After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

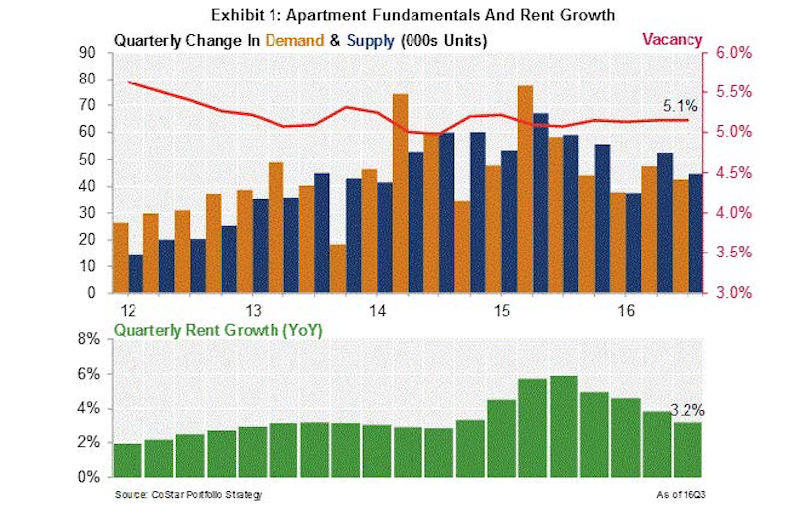

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Multifamily Housing | Jun 15, 2023

Alliance of Pittsburgh building owners slashes carbon emissions by 45%

The Pittsburgh 2030 District, an alliance of property owners in the Pittsburgh area, says that it has reduced carbon emissions by 44.8% below baseline. Begun in 2012 under the guidance of the Green Building Alliance (GBA), the Pittsburgh 2030 District encompasses more than 86 million sf of space within 556 buildings.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Engineers | Jun 14, 2023

The high cost of low maintenance

Walter P Moore’s Javier Balma, PhD, PE, SE, and Webb Wright, PE, identify the primary causes of engineering failures, define proactive versus reactive maintenance, recognize the reasons for deferred maintenance, and identify the financial and safety risks related to deferred maintenance.

Mixed-Use | Jun 12, 2023

Goettsch Partners completes its largest China project to date: a mixed-used, five-tower complex

Chicago-based global architecture firm Goettsch Partners (GP) recently announced the completion of its largest project in China to date: the China Resources Qianhai Center, a mixed-use complex in the Qianhai district of Shenzhen. Developed by CR Land, the project includes five towers totaling almost 472,000 square meters (4.6 million sf).

Mixed-Use | Jun 6, 2023

Public-private partnerships crucial to central business district revitalization

Central Business Districts are under pressure to keep themselves relevant as they face competition from new, vibrant mixed-use neighborhoods emerging across the world’s largest cities.

Multifamily Housing | Jun 6, 2023

Minnesota expected to adopt building code that would cut energy use by 80%

Minnesota Gov. Tim Walz is expected to soon sign a bill that would change the state’s commercial building code so that new structures would use 80% less energy when compared to a 2004 baseline standard. The legislation aims for full implementation of the new code by 2036.

Student Housing | Jun 5, 2023

The power of student engagement: How on-campus student housing can increase enrollment

Studies have confirmed that students are more likely to graduate when they live on campus, particularly when the on-campus experience encourages student learning and engagement, writes Design Collaborative's Nathan Woods, AIA.

Multifamily Housing | Jun 1, 2023

Income-based electric bills spark debate on whether they would harm or hurt EV and heat pump adoption

Starting in 2024, the electric bills of most Californians could be based not only on how much power they use, but also on how much money they make. Those who have higher incomes would pay more; those with lower incomes would see their electric bills decline - a concept known as income-based electric bills.

Multifamily Housing | May 30, 2023

Boston’s new stretch code requires new multifamily structures to meet Passive House building requirements

Phius certifications are expected to become more common as states and cities boost green building standards. The City of Boston recently adopted Massachusetts’s so-called opt-in building code, a set of sustainability standards that goes beyond the standard state code.

Multifamily Housing | May 30, 2023

Milhaus, Gershman Partners, and Citimark close on $70 million multifamily development in Indy

Versa will bring 233 studio and one- and two-bedroom apartments to Indianapolis's $271 million, Class-A Broad Ripple Village development enterprise.