When investor John Goense started Response Team 1 in 2010 by acquiring BKA General Contractors in Nashville, he anticipated that his company, as it expanded, would focus primarily on single-family disaster restoration projects from fires, flooding, snowstorms and other such events that were covered by homeowners insurance.

The early performance of that business certainly indicated that it was on the right track. Its revenue from 2010 to 2013 increased by 1,124%, making Response Team 1 one America’s fastest-growing private companies, according to Inc. magazine. It currently claims to be the country’s largest single-family restoration business.

During that four-year period, Response Team 1 also developed what Goense, its CEO and chairman, says was “a small, in-house renovation business” for commercial clients that had either bought a property or wanted to upgrade an existing building. Then, last November, the Wheeling, Ill.-based company acquired The Renovation Group (TRG) in Brentwood, Tenn. This deal catapulted Response Team 1 into the ranks of the country’s top multifamily renovators.

Multifamily and commercial projects now account for 50% of Response Team 1’s revenue, which last year hit $173 million.

The biggest commercial project Response Team 1 has taken on so far has been the restoration of a courthouse in Wisconsin. Its multifamily work, according to its website, includes fire and smoke damage restoration, mold removal and remediation, water damage repair, and remodeling. Most of its projects are for midrise apartment and college campus buildings. “We’re more focused on working with property owners and managers than with HOAs,” Goense explains. And campus projects are mostly restorations. (Arizona State University is one of its largest customers.)

Response Team 1, which operates 25 offices that serve 34 states in the West, Midwest, and Southeast, is one of several businesses owned by Chicago-based Goense & Company, a private equity investment firm that Goense and his partner Erik Bloom formed in 2008. Its investment strategy has been to target small to midsize companies with market niches or that operate in fragmented industries. The firm’s portfolio, according to its website, includes a document imaging dealer; a pharmacy automation company; electrical, plumbing, and drywall contractors; and a provider of maintenance and installation services for voice, data, wireless, paging, and point of sale systems for retailers.

Darren Magda, who started TRG as a deck builder 20 years ago and shifted to multifamily renovation a decade ago, says he became interested it joining forces with a larger enterprise when clients started asking TRG to do jobs on their apartment buildings in places like Texas and California, well beyond its geographic comfort zone. Magda says that because Response Team 1 has a “national footprint,” as well as a local presence in places like Denver and Phoenix, TRG can coordinate labor and project management for clients through with buildings in different parts of the country.

Response Team 1 merged TRG with CAPRO, a multifamily renovation company based in Raleigh, N.C., that Response Team 1 had spun off several years earlier. Combined, the two renovators generated about $24 million in revenue last year, and Magda—who stayed on as a vice president with Response Team 1—thinks that figure could rise by at least 50% in 2015 under Response Team 1’s corporate umbrella.

Goense expects Response Team 1, in total, to generate about $200 million from its existing offices in 2015, and another $50 million to $100 million from mergers and acquisitions. “I look at our service area, and it only represents 12% if the U.S. population.” When he spoke with BD+C in early March, Response Team 1 had just established a fourth region, the Mid Atlantic, that would serve residential and commercial customers in Philadelphia and southern New Jersey, Baltimore, and Washington D.C.

Response Team 1’s expansion is being driven primarily by its regional footprint; Goense’s goal is for his company to serve every 1 million-plus market within its regions.

Like other construction companies, Response Team 1’s ability to grow is contingent on maintaining a reliable workforce. “That’s one of the hardest things for businesses like ours,” he says. However, Goense states that his company “has a very active flow of people coming to us.” Response Team 1 recently set up an internal “university” for training purposes. And, he adds, “we use a lot of subs,” and has steady access to them because “we pay fairly and on time.”

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

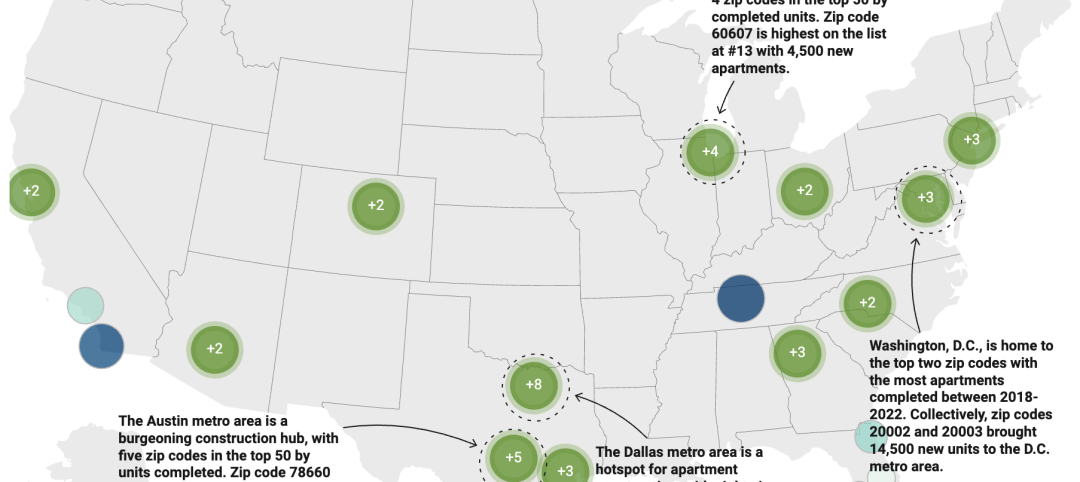

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”

Sponsored | MFPRO+ Blog | Oct 26, 2023

Unlock New Potential—Can Multifamily Pop-Up Hotel Concepts Transform Lease-Ups?

Dive into the new trend of multifamily pop-up hotels! Learn how they're changing the game in lease-ups, creating vibrant communities, and offering property managers a lucrative new revenue stream. Join the conversation on the future of multifamily living spaces.