Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

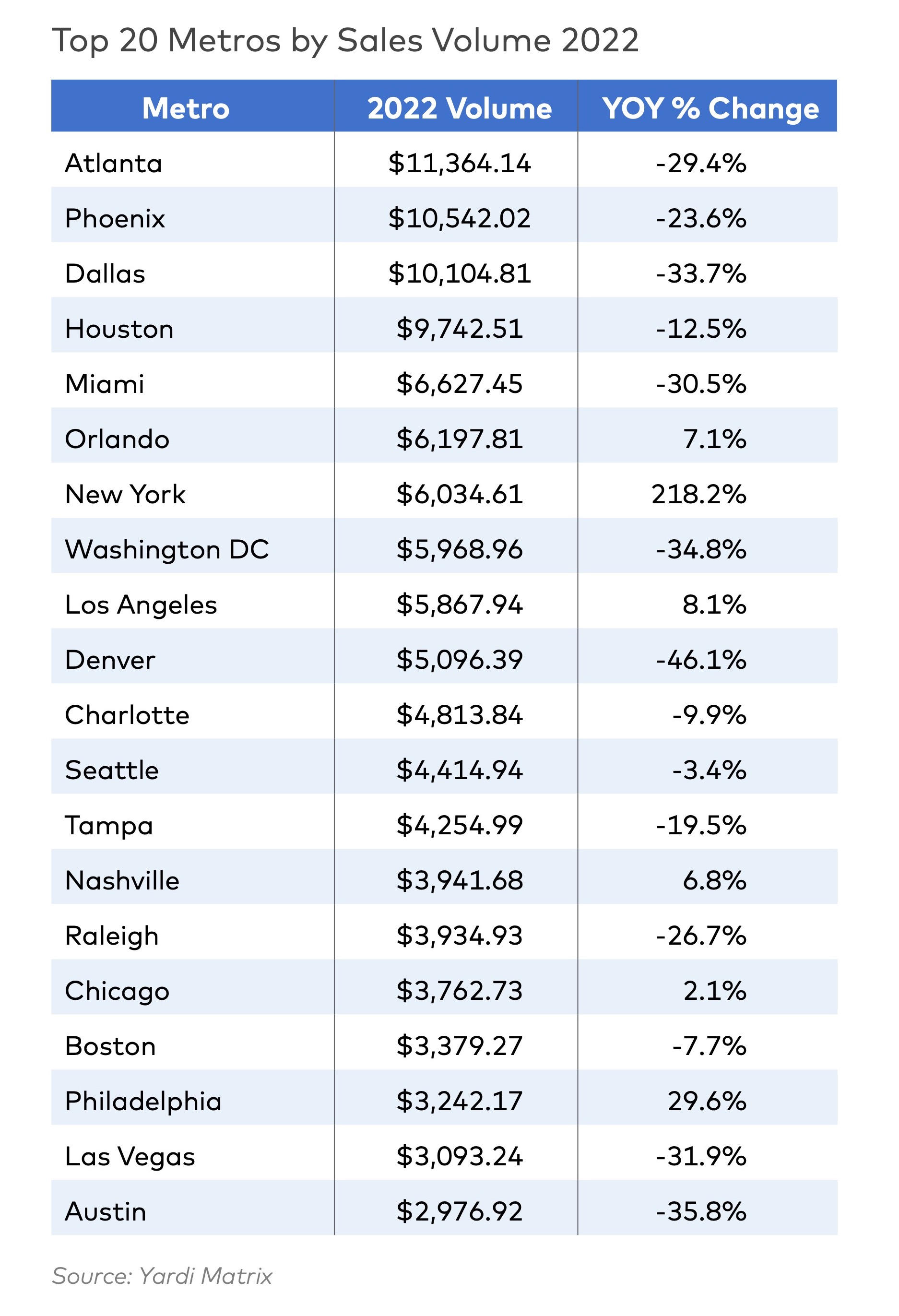

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

| Aug 11, 2010

Sustainable features central to independent-living building

Architecture firm Perkins Eastman, together with Saint Johns on the Lake retirement community, plans to open a 21-story, 88-unit independent-living building for seniors by mid 2011. When the $46-million project is complete, it will offer residents a streetside café, art gallery, spa and wellness center, classroom, and community performance space.

| Aug 11, 2010

Historic building to be restored in Kansas City

Construction has begun on the conversion of the historic 17-story Home Savings Association building in Kansas City, Mo. The transformed structure, to be known as Grand Boulevard Lofts, will house 134 apartment units. The $18-million project, designed by architect Rosemann & Associates, follows a revitalization of downtown Kansas City, where there is high demand for affordable housing to ser...

| Aug 11, 2010

Old factory converted from hearth to home

A former briquette factory in Cologne-Frechen, Germany, was converted into a mixed-use building by Astoc Architects & Planners, Cologne, in association with Rheinischen Amt für Denkmalpflege—the Rhenish agency for historic preservation. The roughly 172,200-sf building includes a mix of residential condominiums, lofts, and leased commercial space.

| Aug 11, 2010

And the world's tallest building is…

At more than 2,600 feet high, the Burj Dubai (right) can still lay claim to the title of world's tallest building—although like all other super-tall buildings, its exact height will have to be recalculated now that the Council on Tall Buildings and Urban Habitat (CTBUH) announced a change to its height criteria.

| Aug 11, 2010

Luxury high-rise meets major milestone

A topping off ceremony was held in late October for 400 Fifth Avenue, a 57,000-sf high-rise that includes a 214-room luxury hotel and 190 high-end residential condominiums. Developed by Bizzi & Partners Development and designed by Gwathmey Siegel & Associates Architects, the 60-story tower in midtown Manhattan sits atop a smaller-scale 10-story base, which creates a street façade t...

| Aug 11, 2010

Mixed-use Seattle high-rise earns LEED Gold

Seattle’s 2201 Westlake development became the city’s first mixed-use and high-rise residential project to earn LEED Gold. Located in Seattle’s South Lake Union neighborhood, the newly completed 450,000-sf complex includes 300,000 sf of Class A office space, 135 luxury condominiums (known as Enso), and 25,000 sf of retail space.

| Aug 11, 2010

Triangular tower targets travelers

Chicago-based Goettsch Partners is designing a new mixed-use high-rise for the Chinese city of Dalian, located on the Yellow Sea coast. Developed by Hong Kong-based China Resources Land Limited, the tower will have almost 1.1 million sf, which includes a 377-room Grand Hyatt hotel, 84 apartments, three restaurants, banquet space, and a spa and fitness center.

| Aug 11, 2010

Brooklyn's tallest building reaches 514 feet

With the Brooklyner now topped off, the 514-foot-high apartment tower is Brooklyn's tallest building. Designed by New York-based Gerner Kronick + Valcarcel Architects and developed by The Clarett Group, the soaring 51-story tower is constructed of cast-in-place concrete and clad with window walls and decorative metal panels.

| Aug 11, 2010

RMJM unveils design details for $1B green development in Turkey

RMJM has unveiled the design for the $1 billion Varyap Meridian development it is master planning in Istanbul, Turkey's Atasehir district, a new residential and business district. Set on a highly visible site that features panoramic views stretching from the Bosporus Strait in the west to the Sea of Marmara to the south, the 372,000-square-meter development includes a 60-story tower, 1,500 resi...

| Aug 11, 2010

'Feebate' program to reward green buildings in Portland, Ore.

Officials in Portland, Ore., have proposed a green building incentive program that would be the first of its kind in the U.S. Under the program, new commercial buildings, 20,000 sf or larger, that meet Oregon's state building code would be assessed a fee by the city of up to $3.46/sf. The fee would be waived for buildings that achieve LEED Silver certification from the U.