Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

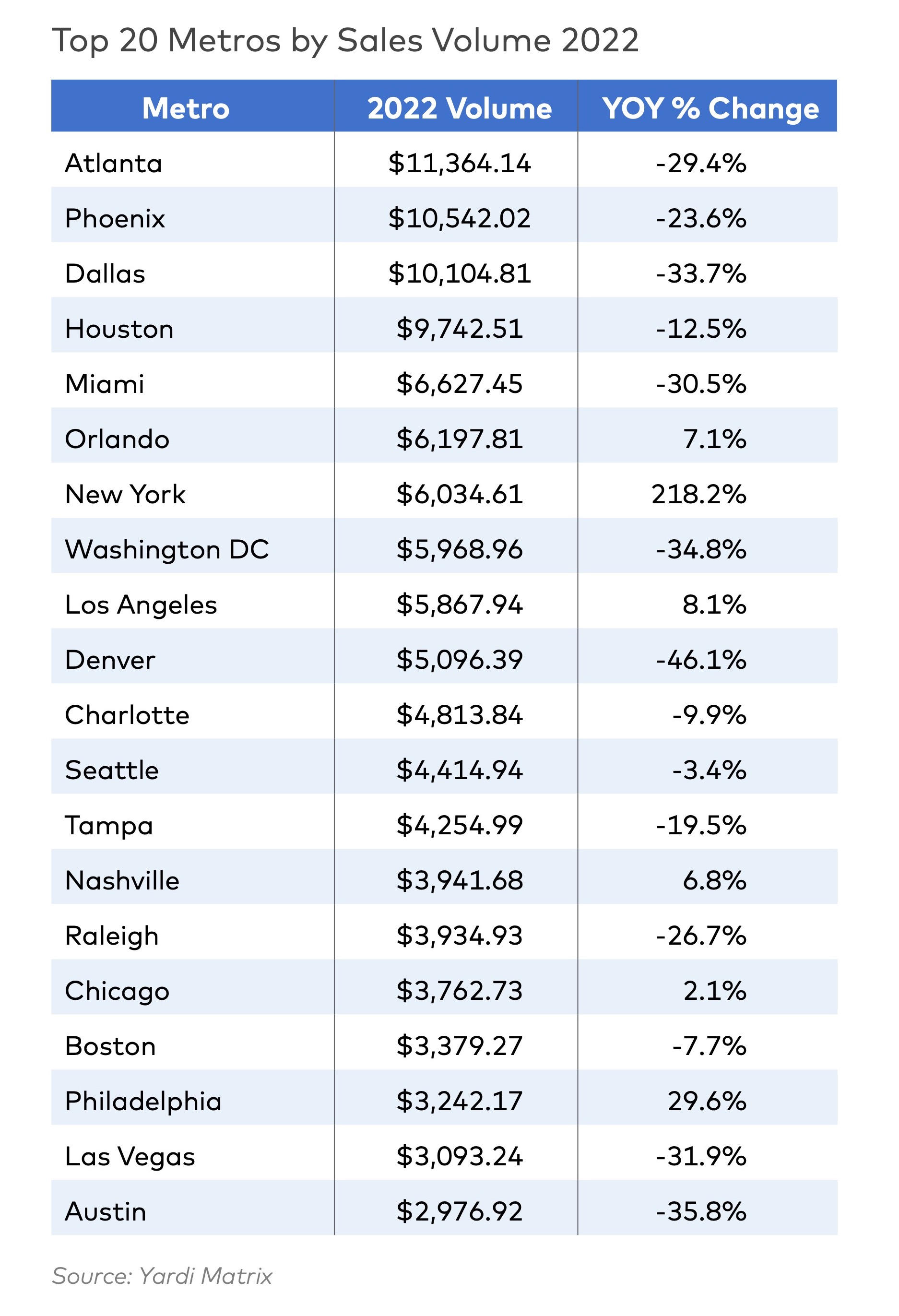

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

| Aug 11, 2010

RMJM unveils design details for $1B green development in Turkey

International architecture company RMJM today announced details of the $1 billion Varyap Meridian development it is designing in Istanbul’s new residential and business district, which will be one of the "greenest" projects in Turkey. The luxury 372,000-square-meter development on a site totalling 107,000 square meters will be located in the Atasehir district of Istanbul, which the Turkish government intends to transform into the country’s new financial district and business center.

| Aug 11, 2010

Urban Land Institute honors five 'outstanding' developments in Europe, Middle East, and Africa

Five outstanding developments have been selected as winners of the Urban Land Institute (ULI) 2009 Awards for Excellence: Europe, Middle East, and Africa (EMEA) competition. This year, the competition also included the announcement of two special award winners. The Awards for Excellence competition is widely regarded as the land use industry’s most prestigious recognition program.

| Aug 11, 2010

10 tips for mitigating influenza in buildings

Adopting simple, common-sense measures and proper maintenance protocols can help mitigate the spread of influenza in buildings. In addition, there are system upgrades that can be performed to further mitigate risks. Trane Commercial Systems offers 10 tips to consider during the cold and flu season.

| Aug 11, 2010

Brad Pitt’s foundation unveils 14 duplex designs for New Orleans’ Lower 9th Ward

Gehry Partners, William McDonough + Partners, and BNIM are among 14 architecture firms commissioned by Brad Pitt's Make It Right foundation to develop duplex housing concepts specifically for rebuilding the Lower 9th Ward in New Orleans. All 14 concepts were released yesterday.

| Aug 11, 2010

NAVFAC releases guidelines for sustainable reconstruction of Navy facilities

The guidelines provide specific guidance for installation commanders, assessment teams, estimators, programmers and building designers for identifying the sustainable opportunities, synergies, strategies, features and benefits for improving installations following a disaster instead of simply repairing or replacing them as they were prior to the disaster.

| Aug 11, 2010

MulvannyG2 Architecture wins “Best Mixed-use Development—Future” award

MulvannyG2 Architecture’s project, Aquapearl in Taipei, Taiwan, was honored by Cityscape Asia 2009 as the “Best Mixed-use Development -Future” on May 20, 2009 at the annual conference in Singapore.

| Aug 11, 2010

REDD and Corcoran Group Real Estate developing eco-friendly boutique condos in Brooklyn's Vinegar Hill

REDD and Corcoran Group Real Estate are developing 100 Gold, a 10-unit boutique condominium complex in Brooklyn's Vinegar Hill that consists of (6) one bedrooms, (2) duplex studios—one with a private yard, and (2) penthouses—duplex apartments with one bedroom and loft, and private terraces.

| Aug 11, 2010

AECOM, Arup, Gensler most active in commercial building design, according to BD+C's Giants 300 report

A ranking of the Top 100 Commercial Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Turner Building Cost Index dips nearly 4% in second quarter 2009

Turner Construction Company announced that the second quarter 2009 Turner Building Cost Index, which measures nonresidential building construction costs in the U.S., has decreased 3.35% from the first quarter 2009 and is 8.92% lower than its peak in the second quarter of 2008. The Turner Building Cost Index number for second quarter 2009 is 837.