The design and construction outlook for Multifamily Housing is again moving in the right direction, according to the PSMJ Resources’ Quarterly Market Forecast (QMF).

After a first quarter that saw the multifamily market suffer its lowest level of proposal activity in nearly a decade, PSMJ’s quarterly survey of architecture, engineering, and construction firm executives reported a +7% net plus/minus index (NPMI), up from the -2% recorded in the first three months of the year.

PSMJ’s NPMI expresses the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease. The QMF has proven to be a solid predictor of market health for the AEC industry since its inception in 2003. A consistent group of over 300 firm leaders participate regularly, with 171 contributing to the most recent survey.

As unimpressive as multifamily’s second quarter NPMI is—particularly considering that it experienced seven consecutive years of quarterly NPMIs above 40% through the end of 2019—the upturn is significant. The market’s negative NPMI in the first quarter was its lowest since it capped 11 consecutive quarters of negative proposal opportunity growth with a -5% in the third quarter of 2010.

Multifamily Housing Market Proposal Activity – 1Q08 to 2Q20 (NPMI)

The multifamily rebound was part of overall improving conditions for most of the Housing market. Even with the COVID-19 crisis slowing down the overall economy, housing’s rebound may be driven in part by historically low mortgage interest rates.

Housing’s NPMI increased from -19% in the first quarter to +2% in the second quarter, making it one of only four major markets with a positive NPMI among the 12 assessed in PSMJ’s QMF. Water/wastewater (20%), energy/utilities (15%) and healthcare (10%) were the others.

Among the firms that work in the multifamily sector, 31% said that proposal activity increased in the second quarter, while 24% said it decreased. The remainder said the market was relatively flat.

PSMJ Senior Principal David Burstein, PE, AECPM, predicts that single-family housing will rebound faster and stronger than multifamily in the coming months.

“Overall, the housing market is very strong,” says Burstein. “For many years, this market has been dominated by multifamily housing as people moved into cities. Recently, that trend has reversed. Single-family housing in suburbs is now stronger than multifamily housing in large cities. This is even more true for new condominiums than for new apartment rental housing.”

Among housing’s other submarkets, single-family properties (individual) saw its NPMI improve from -31% in the first quarter to +9 in the second quarters.

Single-family developments remained well into the negative at -12%, but that was up from -28%.

Senior/assisted living ticked up from -3% to -1%, while condominiums continued to struggle (-28% in Q1 to -26% in Q2).

Related Stories

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

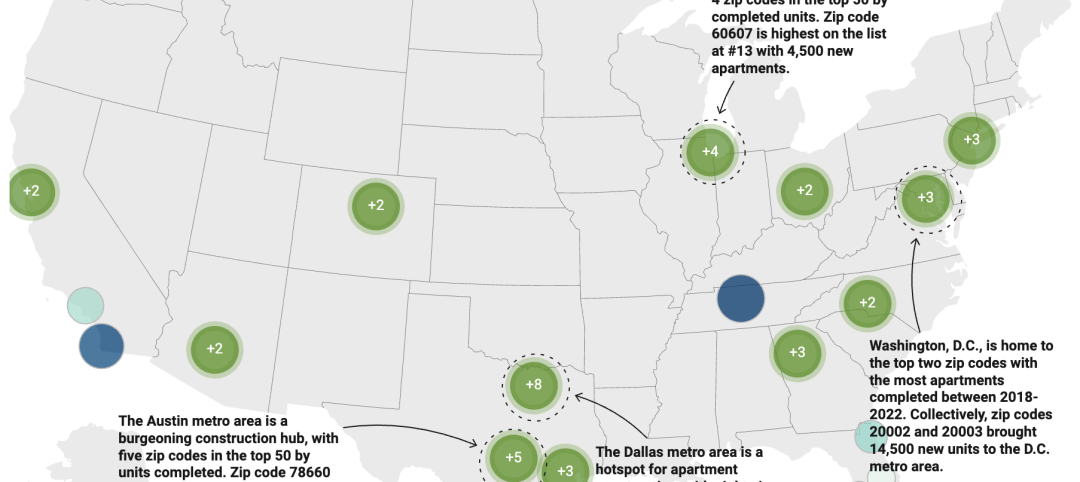

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.