Development will play a key role in the U.S. multifamily market in 2018. Developers are poised to register the second-highest annual completions count of this cycle, with as many as 258,000 units delivered. This is based on 62 markets tracked by CBRE Econometric Advisors.

This would be down by 9.2% from 2017’s cycle peak, projected at 284,000. Apartment starts began to slow in 2017, so the multifamily market will get a reprieve from new supply by late 2018 and throughout 2019.

Starts will continue to slow in 2018, as banks have scaled back development lending over the past two years. While other sources of development capital have emerged (e.g., debt funds) or reemerged (e.g., HUD financing), the climate for financing new development should remain more conservative, and debt capital costs more expensive.

For more, download CBRE’s free 2018 Multifamily Outlook report (registration required).

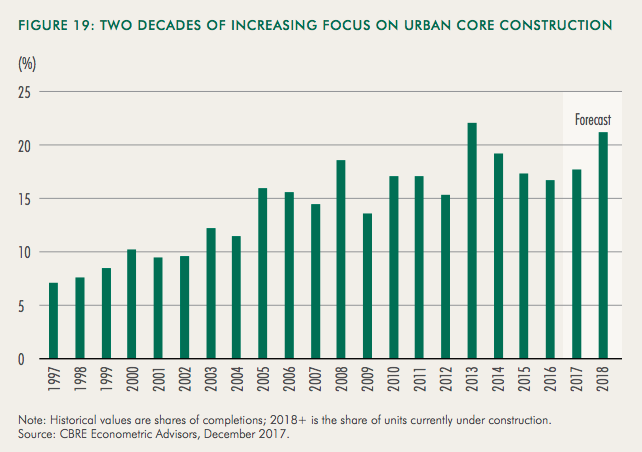

As of December 2017, nearly 23% of all units under construction in U.S. markets are in urban cores. In the long term, urban core multifamily will perform well, but for the short term, market statistics indicate that the best development opportunities are in the suburbs.

As of December 2017, nearly 23% of all units under construction in U.S. markets are in urban cores. In the long term, urban core multifamily will perform well, but for the short term, market statistics indicate that the best development opportunities are in the suburbs.

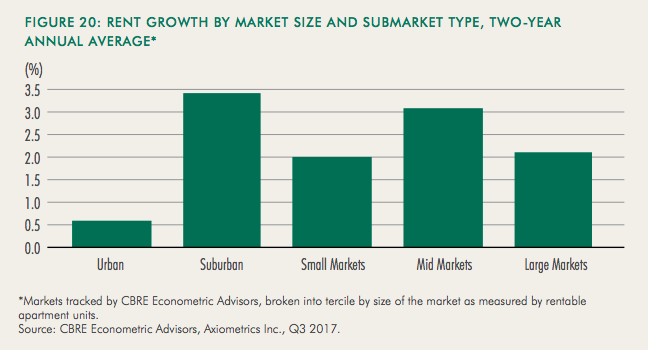

Suburban markets have seen the highest rent growth rate over the past two years.

Suburban markets have seen the highest rent growth rate over the past two years.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

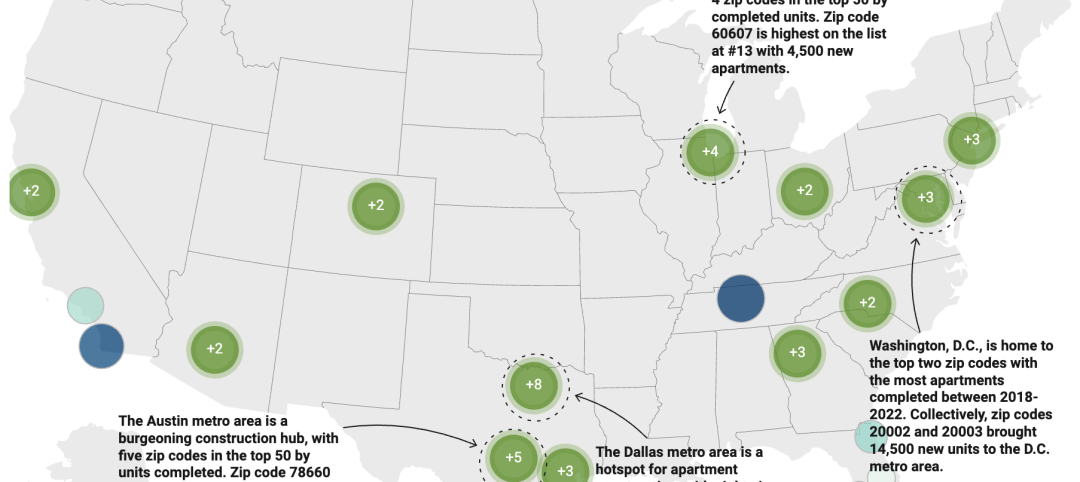

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”