According to the third quarter report by analysts at Lodging Econometrics (LE), the franchise companies leading the U.S. construction pipeline with the greatest number of new construction projects are Marriott International with 1,286 projects/166,174 rooms, Hilton Worldwide with 1,223 projects/139,742 rooms, and InterContinental Hotels Group (IHG) with 769 projects/77,558 rooms. The construction pipelines for these three franchise companies comprise an impressive 68% of the total construction pipeline projects.

The leading brands by project count in the construction pipeline for each of these three companies are Hilton’s Home2 Suites by Hilton with 402 projects/41,846 rooms, IHG’s Holiday Inn Express with 301 projects/28,852 rooms, and Marriott’s Fairfield Inn with 246 projects/23,653 rooms. These three mid-market brands alone account for 20% of the projects in the total construction pipeline.

Other significant brands in the pipeline for these franchises include Hilton’s Hampton by Hilton, reaching a cyclical peak, with 271 projects/28,311 rooms and Tru by Hilton with 224 projects/21,518 rooms; Marriott’s TownePlace Suites with 204 projects/19,5693 rooms and Residence Inn with 203 projects/25,132 rooms; IHG’s Avid Hotel with 152 projects/13,255 rooms and Staybridge Suites with 122 projects/12,564 rooms.

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S. Hilton opened 45 new hotels/4,923 rooms accounting for 19% of newly opened rooms and IHG opened 25 new hotels in Q3/2,459 rooms accounting for 9% of rooms. Year-to-date, through the end of the third quarter in 2021, Marriott has opened 212 new hotels/28,298 rooms accounting for 32% of new hotels and 33% of new rooms; Hilton has opened 169 new hotels/21,786 rooms, accounting for 25% of new hotels and 26% of newly opened rooms, and IHG opened 98 new hotels/9,828 rooms, accounting for 15% of new hotels and 12% of rooms opened in the U.S.

The LE forecast for new hotel openings in 2021 anticipates that Marriott will open 243 projects/32,944 rooms by year-end. Hilton is expected to open a total of 207 projects/26,056 rooms in 2021, and IHG is on track to open 145 projects/14,451 rooms. In 2022, LE forecasts Marriott will open 245 new hotels/31,470 rooms, IHG will open 204 new hotels/20,737 rooms, and Hilton is expected to open 192 new hotels/22,090 rooms.

Related Stories

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

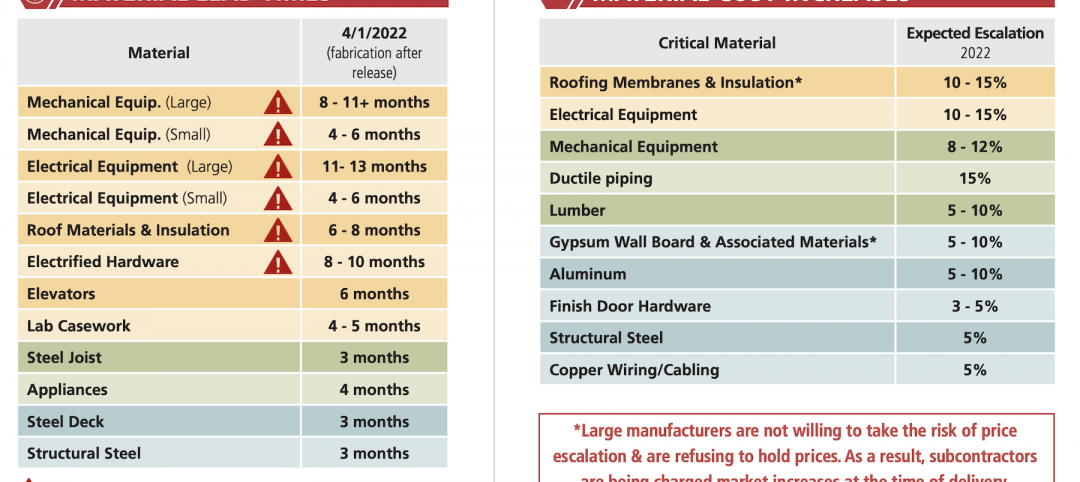

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

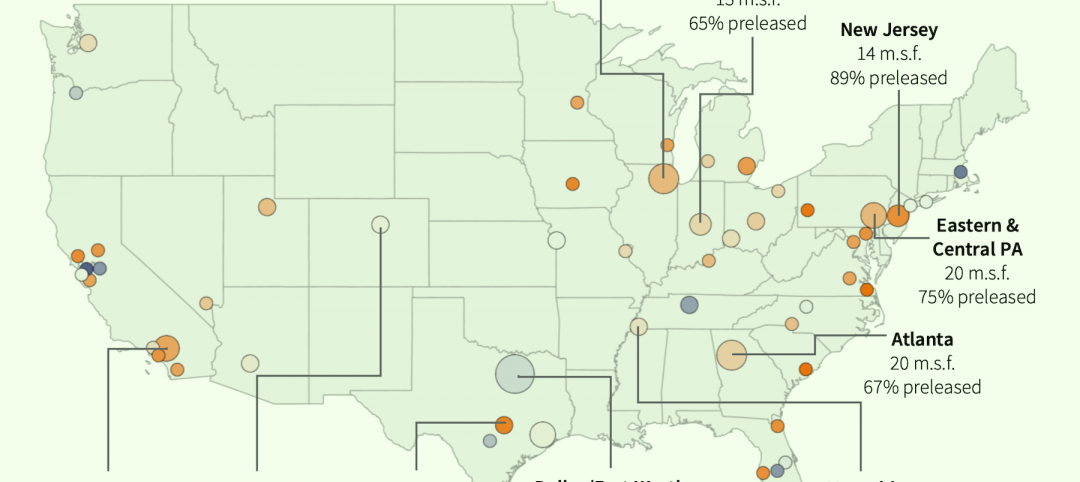

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.