In the second quarter of 2021, analysts at Lodging Econometrics (LE) report that the top franchise companies with the largest construction pipelines are: Marriott International with 1,301 projects/170,847 rooms, Hilton Worldwide with 1,216 projects/139,172 rooms, and InterContinental Hotels Group (IHG) with 777 projects/78,929 rooms. Development projects with these three franchise companies comprise 69% of all projects in the total construction pipeline.

The largest brands for each of these companies are Marriott’s Fairfield Inn with 257 projects/25,051 rooms, Hilton’s Home2 Suites by Hilton, with 379 projects/39,584 rooms and IHG’s Holiday Inn Express with 303 projects/29,055 rooms. These three brands make up 20% of the total construction pipeline rooms in the U.S.

Other high-volume brands in the pipeline for each of these franchises are Marriott’s TownePlace Suites with 198 projects/19,422 rooms and Residence Inn with 189 projects/23,493 rooms; Hilton’s Hampton by Hilton with 269 projects/28,071 rooms and Tru by Hilton with 235 projects/22,521 rooms; and IHG’s Avid Hotel with 157 projects/13,842 rooms and Staybridge Suites with 122 projects/12,607 rooms.

In the second quarter of 2021, LE recorded 583 conversion projects/63,807 rooms. Of these conversion totals, Best Western leads with 116 conversion projects/10,289 rooms, accounting for 20% of the conversion pipeline by projects. Following Best Western is Choice Hotels, Marriott International, and Hilton Worldwide. Best Western and these three franchise companies combined account for 61% of all the rooms in the conversion pipeline across the United States.

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021. Marriott, Hilton, and IHG collectively opened 74% of the hotels. Marriott opened 152 hotels with 20,416 rooms, Hilton opened 125 hotels/16,970 rooms, and IHG opened 72 hotels/7,249 rooms.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

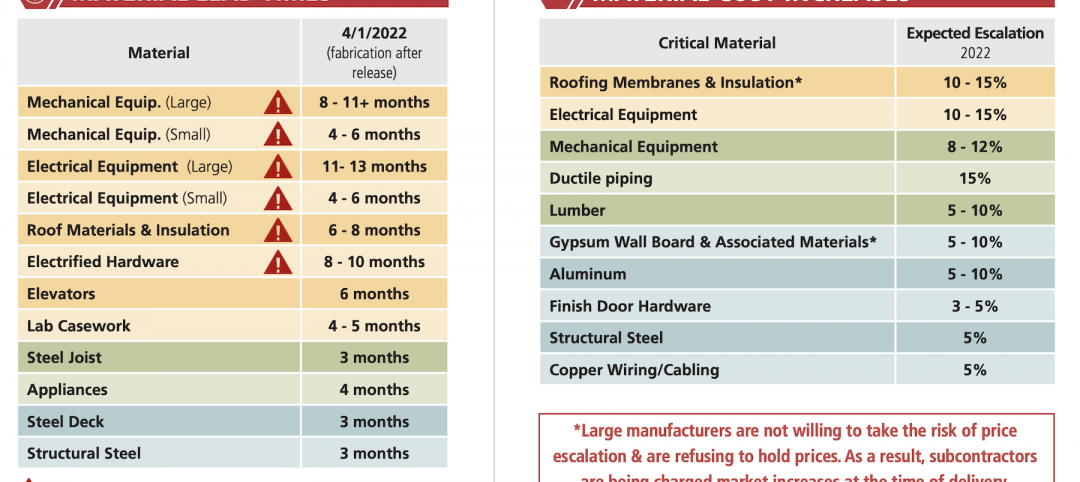

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

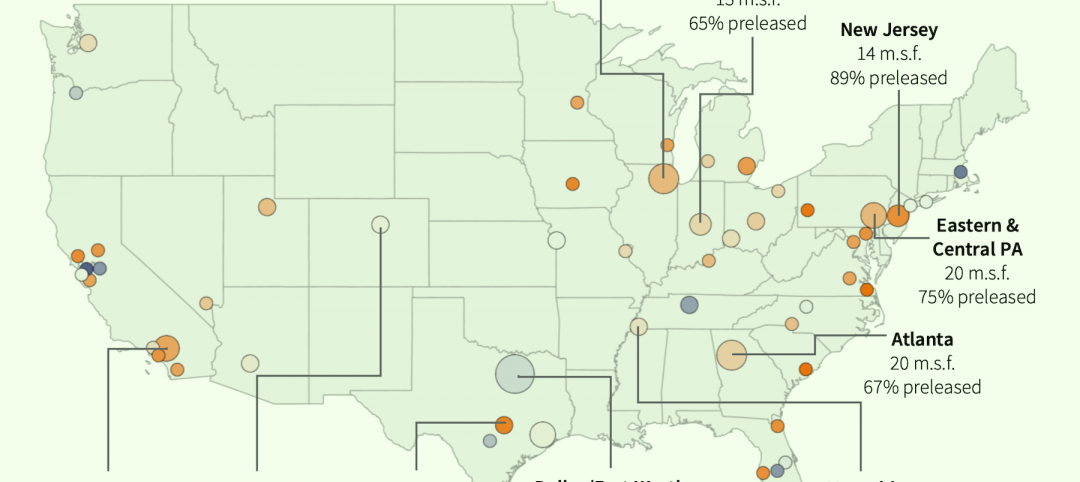

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment