Analysts at Lodging Econometrics (LE) report that at the close of the first quarter of 2020*, the top five U.S. markets with the largest total hotel construction pipelines are: Los Angeles with 166 projects/27,752 rooms; Dallas with 164 projects/19,999 rooms; New York City with 152 projects/26,111 rooms; Atlanta with 143 projects/19,423 rooms; and Houston with 132 projects/13,316 rooms.

Nationally, under construction project counts hit a new all-time high with 1,819 projects with 243,100 rooms. Markets with the greatest number of projects already in the ground are led by New York City with 108 projects/18,434 rooms. Atlanta follows with 48 projects/6,002 rooms, and then Dallas with 46 projects/5,603 rooms, Los Angeles with 43 projects/6,851 rooms, and Orlando with 39 projects/9,394 rooms. Collectively, these five markets account for 16% of the total number of projects currently under construction in the U.S.

In the first quarter, Dallas had the highest number of new projects announced into the pipeline with 13 projects/1,461 rooms. Washington DC follows with 8 projects/1,145 rooms, then Phoenix with 8 projects/904 rooms, Los Angeles with 7 projects/1,103 rooms, and Atlanta with 7 projects/774 rooms.

As has been widely reported, the majority of hotels across America are experiencing an extreme decrease in occupancy and some have even closed temporarily. Many companies are using this time to complete updates, plan or start renovations or reposition their assets. LE recorded renovation and conversion totals of 1,385 active projects/232,288 rooms in the first quarter of 2020. The markets with the largest count of renovation and conversion projects combined are Chicago with 32 projects/5,565 rooms, Washington DC with 26 projects/5,491 rooms, Los Angeles with 26 projects/4,271 rooms, New York City with 21 projects/8,151 rooms and San Diego with 21 projects/4,456 rooms.

FOOTNOTE:

*COVID-19 (coronavirus) did not have a full impact on first quarter 2020 U.S. results reported by LE. Only the last 30 days of the quarter were affected. LE’s market intelligence department has and will continue to gather the necessary global intelligence on the supply side of the lodging industry and make that information available to our subscribers. It is still early to predict the full impact of the outbreak on the lodging industry. We will have more information to report in the coming months.

Related Stories

Market Data | Mar 29, 2017

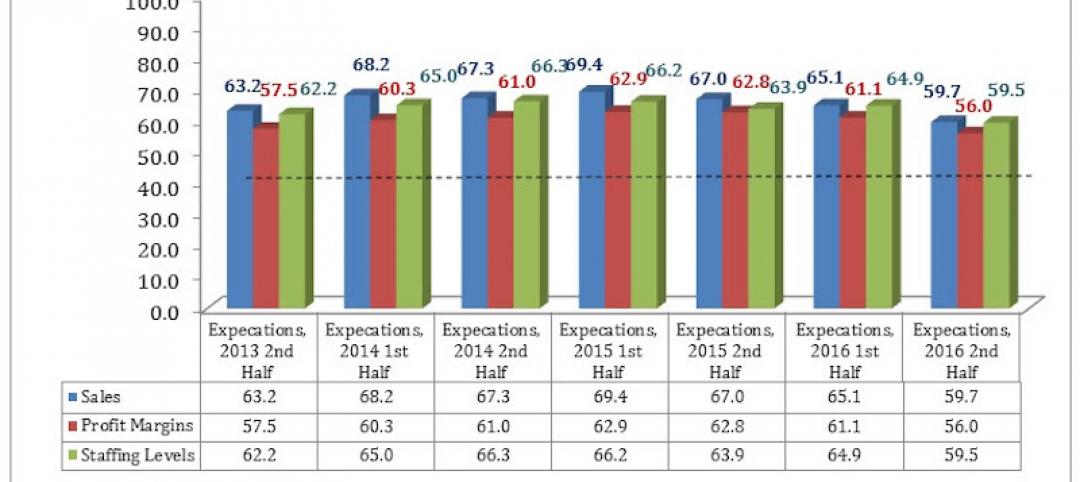

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

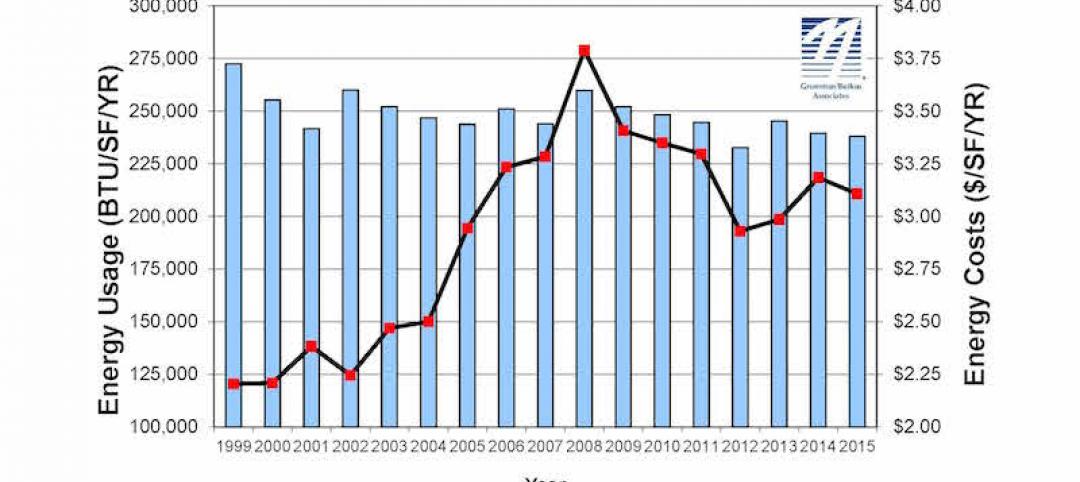

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

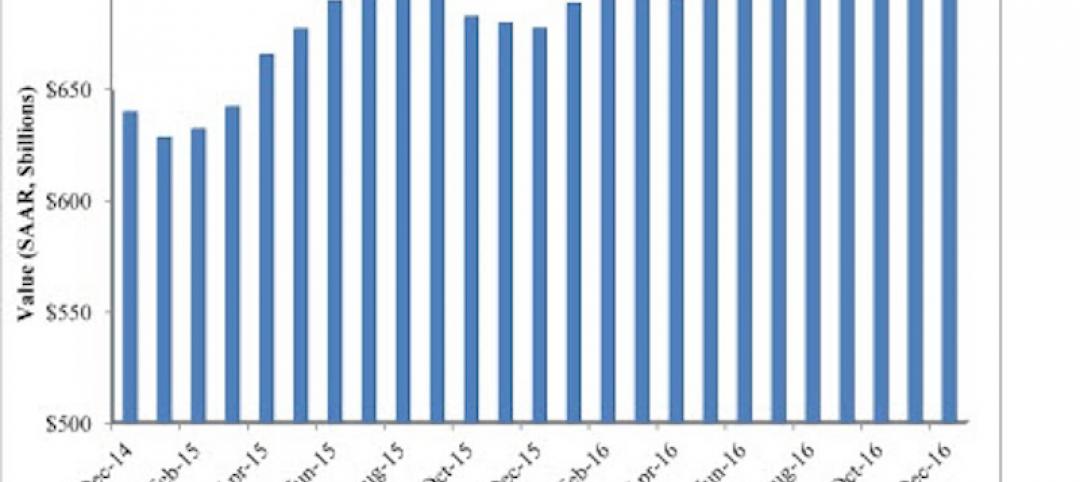

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.