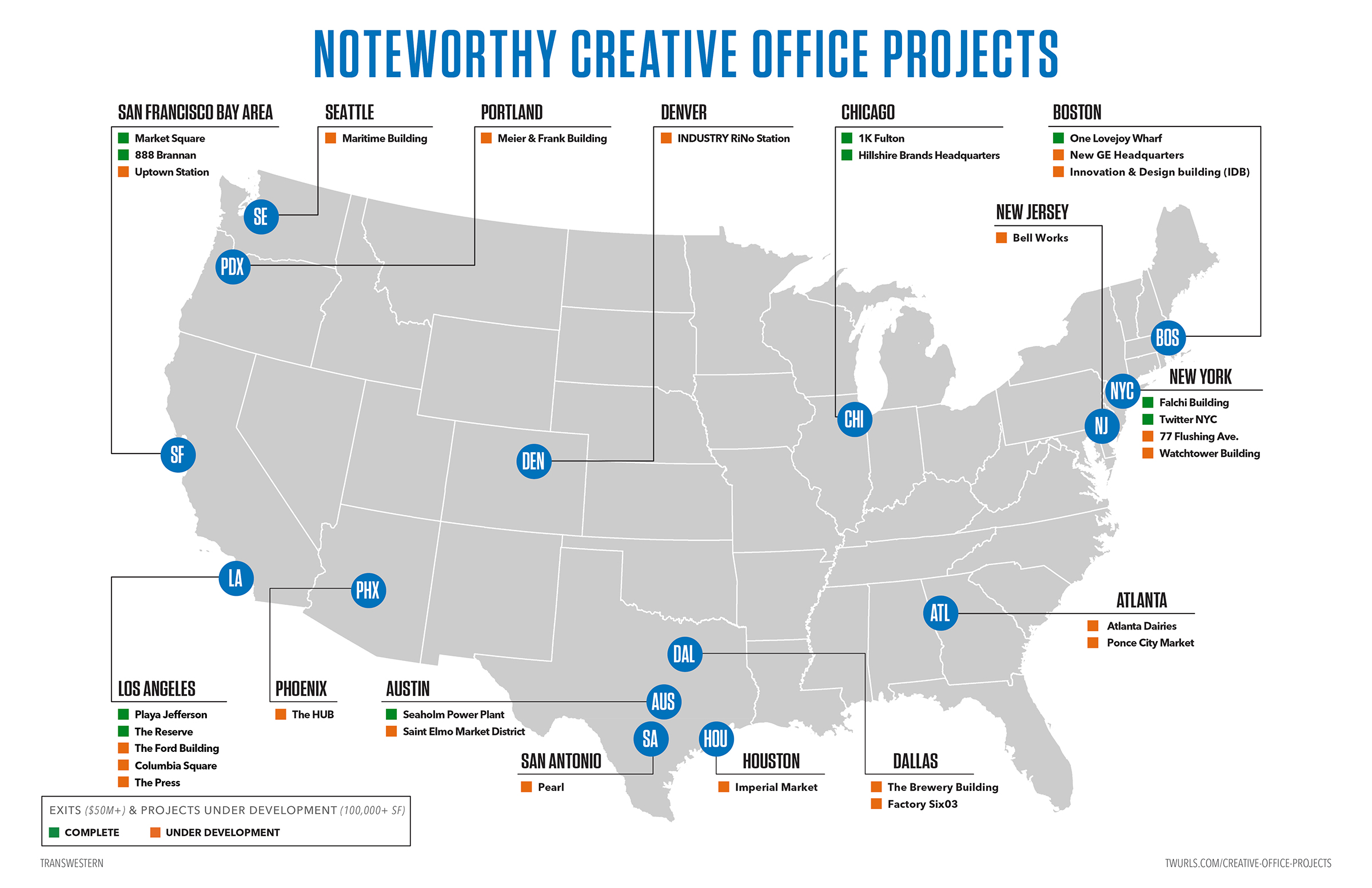

Transwestern has released a report examining a number of creative office projects that have generated substantial returns for investors upon completion. The adaptive reuse developments span Boston, Chicago, Los Angeles, New York, Phoenix, San Francisco, and Austin, Texas. The report also highlights 20 additional large creative office projects currently underway across the country.

Michael Soto, Director of Research in Southern California and co-author of the report, explains that while creative office conversions are not new, what is different this cycle is the sheer volume of creative office exits nationally at core/core-plus pricing that have occurred during the past five years – with the buyers being major institutional investors or well-known owner/users.

“The conversion of a property from industrial or retail use to creative office has become an increasingly popular value-add strategy for investors,” Soto says in a release. “Two trends are fueling demand for this type of differentiated office product: One, technology, advertising, media and other companies trying to attract millennials are interested in the characteristic features of creative office space – open floor plans, natural lighting, common spaces and amenities such as cafés and rec rooms. And two, tenants are returning to cities, where they can take advantage of live/work/play environments.”

Based on favorable exit pricing of some major creative office projects around the country, this type of value-add strategy, on this large scale, is now being considered by developers, either via direct investment or joint-venture partnerships with equity partners. Conversely, stabilized creative office properties are on the radar of many national and international institutional buyers that are paying traditional trophy Class A pricing for these types of properties, usually based on the credit-worthiness of the tenant, as well as the location of the project.

The report cautions, however, that many of these projects were acquired and developed under very different economic conditions than exist today.

“Rising land, building and construction costs – especially in hot neighborhoods – may add more risk when compared to a few years ago, when we were at a different point in the real estate cycle,” said Sandy McDonald, Director of Research in Chicago and co-author of the report. “In addition, adaptive reuse often comes with hidden costs and potentially expensive future property modifications.”

Moreover, the popularity of the creative office concept means that there is more inventory in the market today. Landlords that own existing office buildings or are doing ground-up development are realizing that they must consider strategic property enhancements and creative office-associated tenant amenities to stay competitive in the marketplace.

To view the complete report, titled Creative Office Projects: Adaptive Reuse Generates Staggering Returns for Investors, click here.

Related Stories

Giants 400 | Dec 1, 2022

Top 75 Office Building Core+Shell Engineering + EA Firms for 2022

Jacobs, Alfa Tech, Burns & McDonnell, and Arup head the ranking of the nation's largest office building core+shell engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Dec 1, 2022

Top 150 Office Building Core+Shell Architecture + AE Firms for 2022

Gensler, NBBJ, Perkins and Will, and Stantec top the ranking of the nation's largest office building core+shell architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Multifamily Housing | Nov 29, 2022

Number of office-to-apartment conversion projects has jumped since start of pandemic

As remote work rose and demand for office space declined since the start of the Covid-19 pandemic, developers have found converting some offices to residential use to be an attractive option. Apartment conversions rose 25% in the two years since the start of the pandemic, with 28,000 new units converted from other property types, according to a report from RentCafe.

Giants 400 | Nov 28, 2022

Top 130 Office Sector Contractors and CM Firms for 2022

Turner Construction, STO Building Group, Gilbane, and CBRE top the ranking of the nation's largest office sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 28, 2022

Top 85 Office Sector Engineering and EA Firms for 2022

Jacobs, Alfa Tech, AECOM, and Burns & McDonnell head the ranking of the nation's largest office sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 28, 2022

Top 200 Office Sector Architecture and AE Firms for 2022

Gensler, Perkins and Will, Stantec, and HOK top the ranking of the nation's largest office sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Data Centers | Nov 28, 2022

Data centers are a hot market—don't waste the heat!

SmithGroup's Brian Rener shares a few ways to integrate data centers in mixed-use sites, utilizing waste heat to optimize the energy demands of the buildings.

BAS and Security | Oct 19, 2022

The biggest cybersecurity threats in commercial real estate, and how to mitigate them

Coleman Wolf, Senior Security Systems Consultant with global engineering firm ESD, outlines the top-three cybersecurity threats to commercial and institutional building owners and property managers, and offers advice on how to deter and defend against hackers.

Giants 400 | Oct 6, 2022

Top 60 Medical Office Building Contractors + CM Firms for 2022

PCL Construction, Adolfson & Peterson, Swinerton, and Skanska USA top the ranking of the nation's largest medical office building (MOB) contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Oct 6, 2022

Top 50 Medical Office Building Engineering + EA Firms for 2022

Jacobs, Gresham Smith, KPFF Consulting Engineers, and IMEG Corp. head the ranking of the nation's largest medical office building (MOB) engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.