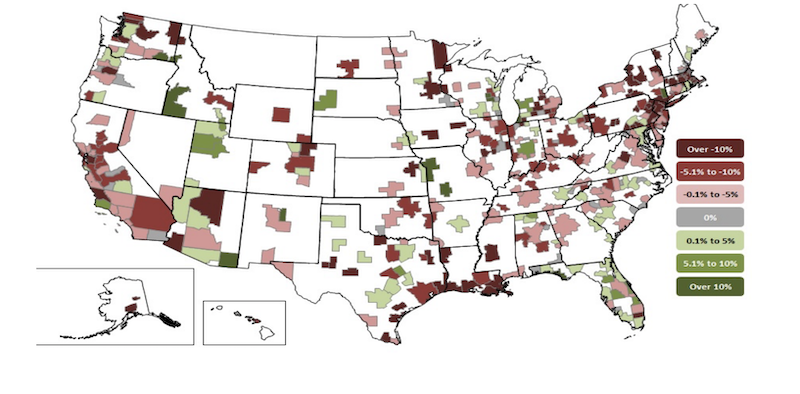

Construction employment in July remained below the levels reached before the pre-pandemic peak in February 2020 in 36 states, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said construction employment would benefit from new federal infrastructure investments and urged the House to quickly pass the bipartisan infrastructure bill.

“This data shows that full recovery remains elusive for construction in most states,” said Ken Simonson, the association’s chief economist. “In fact, the fast-spreading COVID-19 delta variant may make it harder to find employees eligible to work on restricted sites and may also depress demand if some owners defer projects.”

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 14 states and was flat in the District of Columbia. Texas shed the most construction jobs over the period (-56,200 jobs or -7.2%), followed by New York (-52,600 jobs, -12.9%) and California (-35,100 jobs, -3.8%). Louisiana recorded the largest percentage loss (-15.3%, -21,000 jobs), followed by Wyoming (-13.5%, -3,100 jobs) and New York.

Of the states that added construction jobs since February 2020, Utah added the most (7,900 jobs, 6.9%), followed by North Carolina (5,700, 2.4%) and Idaho (4,400 jobs, 8.2%). The largest percentage gain was in Idaho, followed by South Dakota (7.5%, 1,800 jobs) and Utah.

From June to July construction employment decreased in 18 states, increased in 30, and was unchanged in Kansas, Tennessee, and D.C. The largest decline over the month occurred in Colorado, which lost 1,600 construction jobs or 0.9%, followed by a loss of 1,500 jobs each in Oklahoma (-1.9%), Texas (-0.2%), and Pennsylvania (0.6%). The steepest percentage declines since June occurred in New Hampshire (-2.2%, -600 jobs), followed by 1.9% losses in Oklahoma and Arkansas (-1,000 jobs).

North Carolina added the most construction jobs between June and July (4,300 jobs, 1.8%), followed by New Jersey (4,000 jobs, 2.7%) and Illinois (3,700 jobs, 1.7%). The largest percentage gains were in New Jersey and Connecticut (2.7%, 1,500 jobs), followed by South Carolina (2.4%, 2,600 jobs).

Association officials warned that construction employment was being impacted in many parts of the country because of supply chain challenges and growing market uncertainty caused by the resurgent Delta variant. They said new federal infrastructure investments would provide a needed boost in demand and help put more people to work in construction careers.

“New federal infrastructure investments will help put more people to work in high-paying construction careers,” said Stephen E. Sandherr, the association’s chief executive officer. “The House can help put Americans back to work by immediately approving the infrastructure measure that passed the Senate with broad, bipartisan support.”

View state February 2020-July 2021 data and rankings, 1-month rankings.c

Related Stories

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.