On March 29, Cushman & Wakefield brokered the $14.7 million sale of a two-story, 24,600-sf medical building in North Hills, N.Y., which traded at a 6% cap rate. Around the same time, an affiliate of Inland Real Estate Acquisitions sold four newly constructed medical buildings totaling 119,000 sf in the Houston, Raleigh, N.C., and Salt Lake City markets. And early this month in Scottsdale, Ariz., Helix Properties sold two Class A medical offices totaling 42,183 sf for $12.13 million.

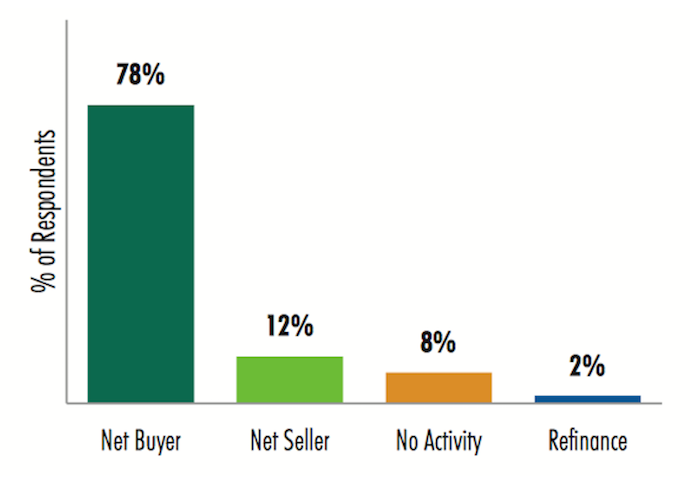

The market for quality healthcare-related buildings remains robust. A recent poll found the majority of real estate investors and developers expect to be “net buyers” of medical office buildings in 2017, and many believe health systems’ development requests for proposals would be higher this year than in 2016.

Those are some of the findings from a just-released 2017 Healthcare Real Estate Investor and Developer Survey conducted by CBRE’s U.S. Healthcare Capital Markets Group. The results of the 27-question survey are based on a total of 91 respondents.

Sixty three of those firms say they’ve allocated an aggregate of $14.9 billion in equity for healthcare real estate investment and development this year. That total represents about a 3% increase over what respondents said they allocated in 2016.

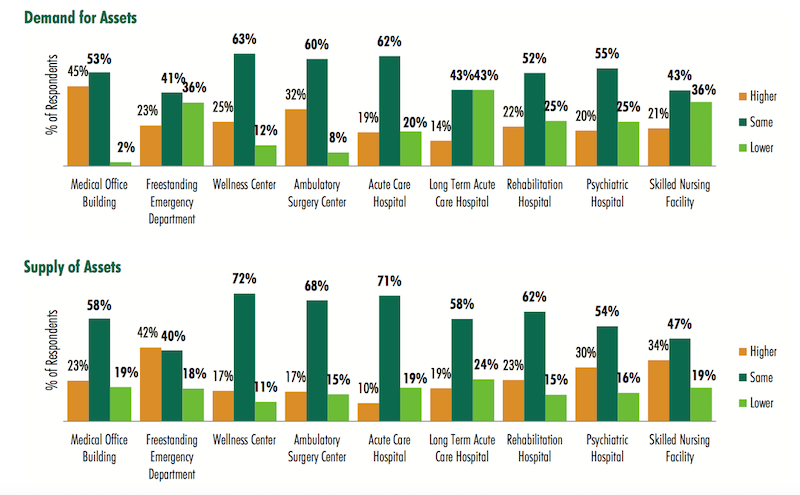

However, the survey notes that this sector’s supply-demand imbalance would continue this year, “as the total allocation of funds to purchase medical office buildings is far greater than the available supply.” Respondents expect that demand and supply for every healthcare real estate asset type would remain relatively the same in 2017. (At the time of the survey, 57% of respondents said the occupancy rates in their healthcare portfolios were about level with a year ago.)

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

The preferred transaction size for a sizable majority of respondents—72%—falls somewhere between $10 million and $50 million. Nearly all of the respondents indicated they were most interested in MOBs, followed by Ambulatory Surgery Centers (80%), Wellness Centers (36%), and Freestanding Emergency Departments (35%).

More than three-quarters of respondents rely on bank debt to finance their transactions, although nearly two fifths (39%) said they’d pay for purchases with cash exclusively.

Retention plans vary markedly, as 29% said they expected to hold onto their healthcare purchases for 5-7 years, whereas 28% would retain the asset for more than 10 years (that percentage goes up to 60% among healthcare REITs that responded to the survey).

The survey takes investors’ and developers’ pulses on their Internal Rate of Return requirements by product type. (For example, 42% indicated their target all-cash IRR this year ranges from 7% to 9.49%.)

Value for core product—namely, Class “A” on-campus medical office buildings—continues to be high, with 49% of the survey respondents projecting cap rates below 6%.

Single-tenant medical office buildings are being priced the most aggressively again this year, with the largest group of survey respondents (39%) indicating a cap rate range of between 6% and 6.49%. Ambulatory Surgery Centers followed medical office buildings, but respondents expressed a wide variety of expectations, with 26% projecting a cap rate between 6% and 6.49%, 26% of respondents projecting a cap rate in the range of 6.5% to 6.99%, and 28% of respondents projecting a cap rate between 7% and 7.49%.

More than two-fifths of respondents expect MOB lease rates to increase 1-2% this year, compared to 26% that predicted that rate level in 2016. There was also a drop—to 55% from 60%—of respondents to this year’s survey from last year’s that thought lease rates would increase 2-3%

Nearly 90% of respondents said the minimum lease term they would accept for a sale-leaseback by a healthcare system would be at least 10 years (it’s 10-14 years for 70%). More than two-fifths of respondents—42%—said the minimum annual rental rate hike they’d consider for a sale-leaseback would be 2-2.49%

The highest percentage of respondents said the minimum hospital credit rating they’d consider investing in would be BBB- to BBB+. Sixteen percent, though, said they wouldn’t go below A- to A+.

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

Twenty-seven percent said that 60-69 years was the minimum ground lease they would consider for investment, compared to a 50-59 year threshold that 35% responding to the 2016 survey would accept. When structuring a ground lease with a hospital for an MOB, 48% of respondents said a fair land value to use in the calculation to determine rent is 5-6%.

CBRE conducted this survey before Republicans pulled their bill to repeal and replace the Affordable Care Act. But developers and investors were asked to predict what they thought would happen, and majorities expected a repeal of the individual mandate for insurance coverage, a repeal of state and federal insurance marketplace exchanges, and a rollback of Medicaid funding.

They also predicted that health insurers would be allowed to sell policies across state borders; that the Trump administration would favor the expansion of Health Savings Accounts; and that insurers would funnel their most expensive patients into subsidized high-risk pools.

Related Stories

Healthcare Facilities | Mar 22, 2023

New Jersey’s new surgical tower features state’s first intraoperative MRI system

Hackensack (N.J.) University Medical Center recently opened its 530,000-sf Helena Theurer Pavilion, a nine-story surgical and intensive care tower designed by RSC Architects and Page. The county’s first hospital, Hackensack University Medical Center, a 781-bed nonprofit teaching and research hospital, was founded in 1888.

Project + Process Innovation | Mar 22, 2023

Onsite prefabrication for healthcare construction: It's more than a process, it's a partnership

Prefabrication can help project teams navigate an uncertain market. GBBN's Mickey LeRoy, AIA, ACHA, LEED AP, explains the difference between onsite and offsite prefabrication methods for healthcare construction projects.

Modular Building | Mar 20, 2023

3 ways prefabrication doubles as a sustainability strategy

Corie Baker, AIA, shares three modular Gresham Smith projects that found sustainability benefits from the use of prefabrication.

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.

Healthcare Facilities | Mar 13, 2023

Next-gen behavioral health facilities use design innovation as part of the treatment

An exponential increase in mental illness incidences triggers new behavioral health facilities whose design is part of the treatment.

Healthcare Facilities | Mar 6, 2023

NBBJ kicks off new design podcast with discussion on behavioral health facilities

During the second week of November, the architecture firm NBBJ launched a podcast series called Uplift, that focuses on the transformative power of design. Its first 30-minute episode homed in on designing for behavioral healthcare facilities, a hot topic given the increasing number of new construction and renovation projects in this subsector.

Sustainability | Mar 2, 2023

The next steps for a sustainable, decarbonized future

For building owners and developers, the push to net zero energy and carbon neutrality is no longer an academic discussion.

University Buildings | Feb 23, 2023

Johns Hopkins shares design for new medical campus building named in honor of Henrietta Lacks

In November, Johns Hopkins University and Johns Hopkins Medicine shared the initial design plans for a campus building project named in honor of Henrietta Lacks, the Baltimore County woman whose cells have advanced medicine around the world. Diagnosed with cervical cancer, Lacks, an African-American mother of five, sought treatment at the Johns Hopkins Hospital in the early 1950s. Named HeLa cells, the cell line that began with Lacks has contributed to numerous medical breakthroughs.

Healthcare Facilities | Feb 21, 2023

Cleveland's Glick Center hospital anchors neighborhood revitalization

The newly opened MetroHealth Glick Center in Cleveland, a replacement acute care hospital for MetroHealth, is the centerpiece of a neighborhood revitalization. The eleven-story structure is located within a ‘hospital-in-a-park’ setting that will provide a bucolic space to the community where public green space is lacking. It will connect patients, visitors, and staff to the emotional and physical benefits of nature.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.