Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Long-term leases have propped up the office market since the Covid pandemic struck. When those leases expire, companies will have the option of reducing the amount of office space they rent.

With two years of experience managing remote work environments enabled by technology advances, companies looking to cut costs have more confidence to trim real estate commitments. Class A properties in good locations are the most desirable, and are well poised to retain tenants.

Older office buildings and those in less desirable locales, on the other hand, may be challenged to hold onto tenants and attract new ones.

Related Stories

Market Data | Oct 14, 2021

Climate-related risk could be a major headwind for real estate investment

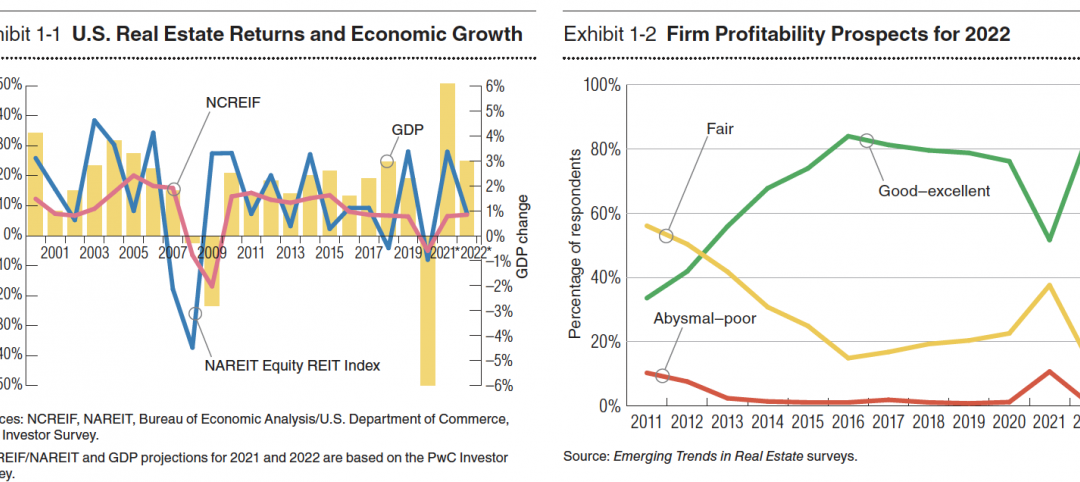

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

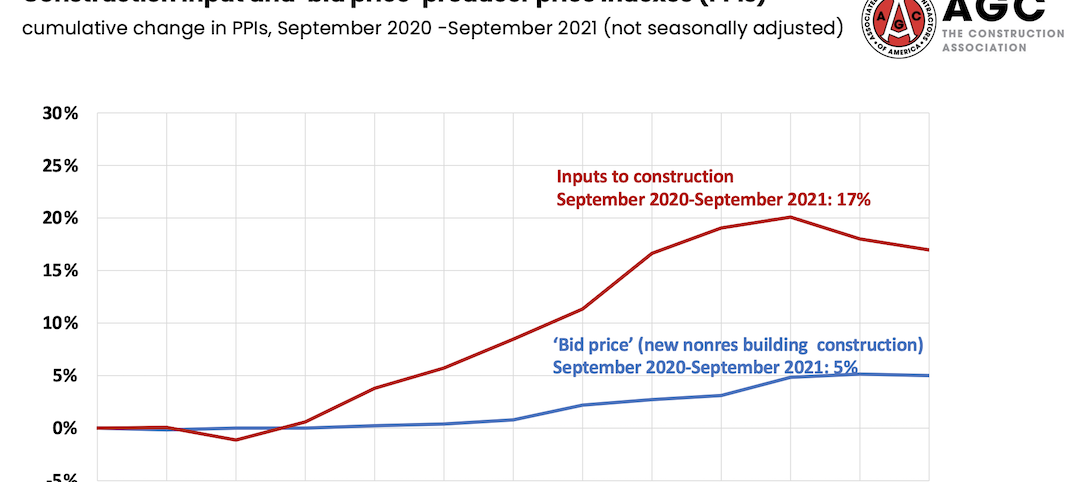

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

No decline in construction costs in sight

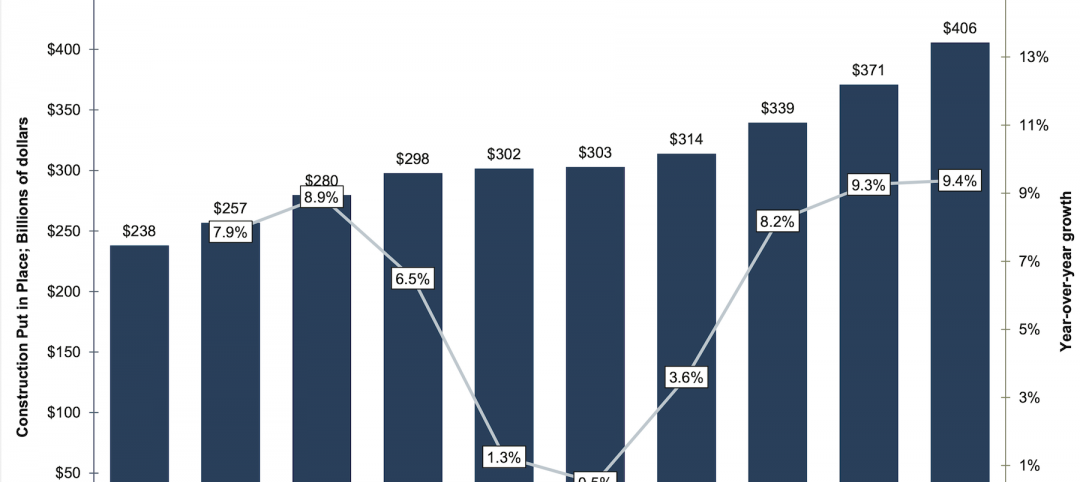

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

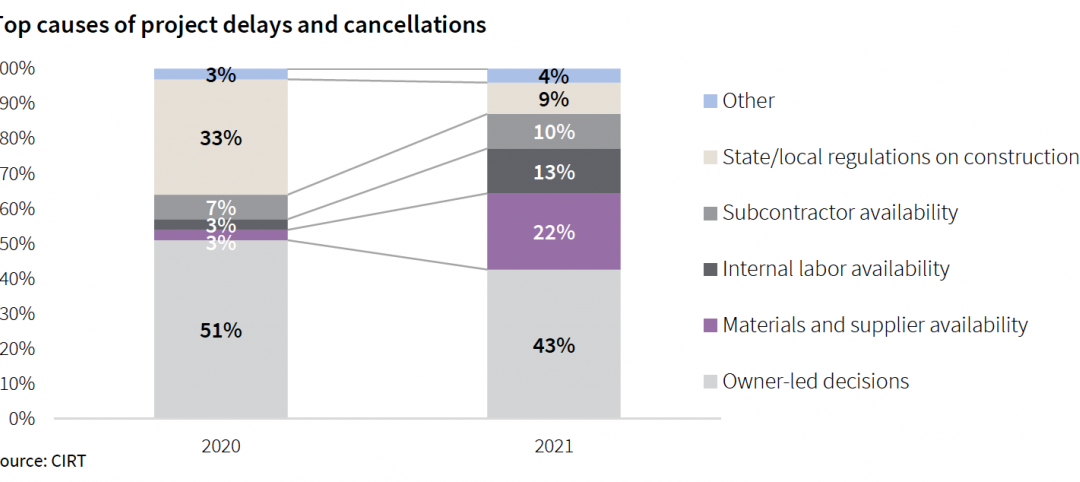

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

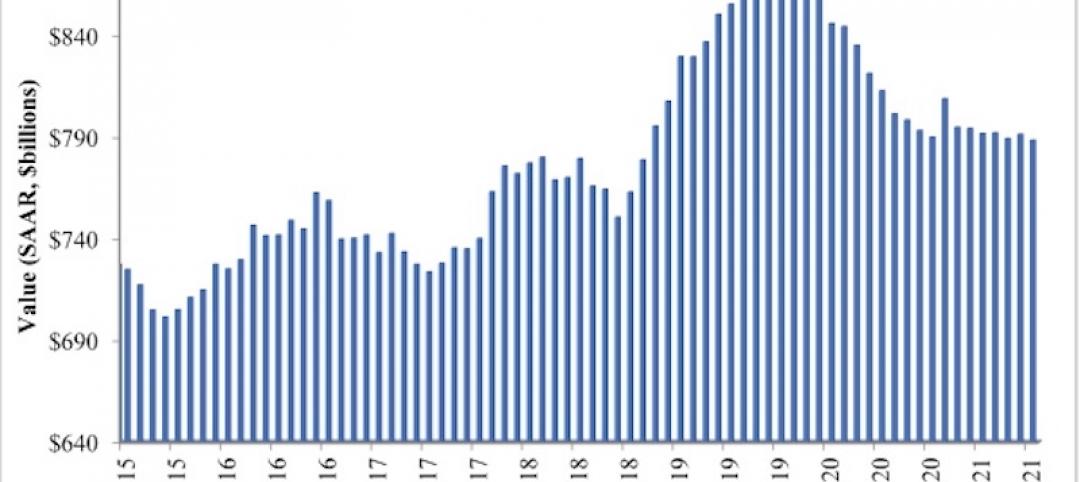

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.