In designing and building apartment and condominium projects, parking determines everything from site suitability to the building’s footprint to revenue optimization.

Throughout my career, I’ve had to turn down sites from a development perspective because we couldn’t make the parking work. Parking often dictates building layouts and sometimes even the number of units we can put into the building. For those of us in the multifamily sector, we want to create spaces for people to live, play, and grow, not just projects centered around giving people a place to store their cars.

Over the years, my colleagues and I at The Bradley Projects have developed strategies for site evaluation and alternative methods for maximizing parking and overall return on investment. The following are strategies for parking that we have found serve the site, the residents, and the owner/developer.

KNOWLEDGE AND THOROUGHNESS: STILL THE KEY FACTORS IN SITE ASSESSMENTS

First, there is no “thinking around” a site’s topography related to parking design strategies. As developers ourselves, we occasionally have to pass on a site solely because it doesn’t allow for optimal parking.

Take the matter of subterranean conditions, which can vary significantly across the U.S. In coastal areas, underground parking becomes difficult due to soil conditions and drainage, whereas in Nashville, where we are based, everything is on bedrock. That makes excavation time-consuming and expensive and carries certain liabilities due to the need for explosives to blast the rock. So it is important to identify the unique site-specific conditions before moving on to the rest of the site analysis.

STARTING POINTS FOR EVALUATING PARKING

We typically begin by looking at the geometries of the site, any irregularities, possible ingress and egress points, traffic flow and patterns, and assorted other unique features—all of which is part of our contextual analysis. We study layouts, which are a factor of dimensions, rhythms, and building codes.

Over the years, we have assembled a knowledge base of parking analyses from every project we’ve ever done, based on our work with numerous traffic engineers and parking consultants. Using this knowledge base we can be very efficient in evaluating a site. Specialized software technology can sometimes be helpful, but we often still rely on conventional evaluation methods due to cost and budget to get the job done.

We’ve also found that technology doesn’t quite go that last step to optimize the layout. We have been experimenting with software from several new tech companies, beta testing their products that promise to use in-depth algorithms to essentially compute the most efficient layout from the onset of the study.

We have found that, while these tools can produce results very quickly, the results have been much the same as what we would have developed without the program. We’ve also found the algorithm-based software can lay out the spaces mathematically but has not yet been able to finesse the geometries the way the human brain can. There are just times where a motorcycle space or two can fill in a strange area, or you can move trash collection somewhere else, or a transformer to another location—all solutions that surface through human collaboration, brainstorming, and experience.

THREE APPROACHES TO PARKING IN APARTMENT AND CONDOMINIUM PROJECTS

Once we have completed an initial analysis, we’re ready to consider what building typology makes sense. Usually, that falls into three categories: tuck under, cantilever, and over excavation.

Tuck under is usually the least expensive method for tight areas but only works well off alley-loaded sites. For our Fairfax Flats project, we managed to fit parking for 19 units into a tiny urban infill lot with this tactic.

In neighborhood-based urban areas with alley-loaded access, the tuck under approach can work well if the site allows the structure to address the main street and neighborhood while hiding and directing the cars to the alley.

Cantilever. In multifamily projects, cantilevers can break up the typical “box” multifamily development that is running rampant in so many cities and give architects a chance for a more progressive statement. They also provide an ideal way to work covered parking into the project. While more expensive than a tuck under, the cantilever approach can provide more parking spaces.

A site with an alley is still preferable for the cantilever technique, although, in tight spatial scenarios, we’ve done this off of a busy city street.

Over excavation is usually the most expensive option. In many urban areas this approach allows parking to be pushed to the extreme edges of the property, then covered by the building or by setback/outdoor space, depending on the zoning requirements.

Over excavation is expensive due to the excavation costs, shoring requirements at property lines, and the extra effort needed to build space underground. This approach lends itself to creating plaza-like spaces over the concrete “lid” of the parking area.

Some more enlightened cities have begun to incentivize developers to create this type of ground-level outdoor space to integrate new multifamily communities into the urban fabric and pedestrian realm. Such spaces also can increase retail or residential rents if they are seen as marketable. But it’s still a question of thoughtful and intentional design.

Over excavation can work just about anywhere there is enough room to get a car ramp down and parking allocated.

CHOOSING THE RIGHT PARKING STYLE

Ultimately, the cost-effectiveness equation is more complex than dollars in and dollars out. So many of our projects would never have penciled out without pushing hard on efficiencies and getting creative with how we solve for the highest level of efficiency while addressing all of the various types of users and circulation patterns.

Sometimes the cheapest option isn’t the best. I’ve seen the ROI on a multifamily development increase 20-25% just by rethinking how we handle the parking scenario. It was not because the parking solution saved construction dollars, but because it allowed 20-25% more units, or more retail space, or both.

It’s becoming much more critical to think about and be honest about how much parking your project needs. Cities across the map are lowering their parking requirements. People are becoming less car reliant. In the Nashville region, we are seeing an average 25% decrease in required parking in most areas of our urban areas—even down to zero required parking in areas on multimodal corridors. Nashville’s civic leadership is very wisely and progressively pushing much of the parking requirements back on developers and the market to resolve the parking situation instead of adopting an antiquated, one-size-fits-all policy.

THE FUTURE OF PARKING

Despite the reduced reliance on cars, we’re nowhere near a zero parking world, but the trend is undoubtedly moving toward less and less parking, more EV charging areas, and more drop-off/valet areas.

I’m excited to see the possibility of our cities becoming more populated with autonomous vehicles that can be developed for much safer conditions for riders and pedestrians.

ABOUT THE AUTHOR

Jared Bradley, AIA, NCARB, is Founder and President of The Bradley Projects, an architecture, construction, and development company headquartered in Nashville, Tenn.

Related Stories

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

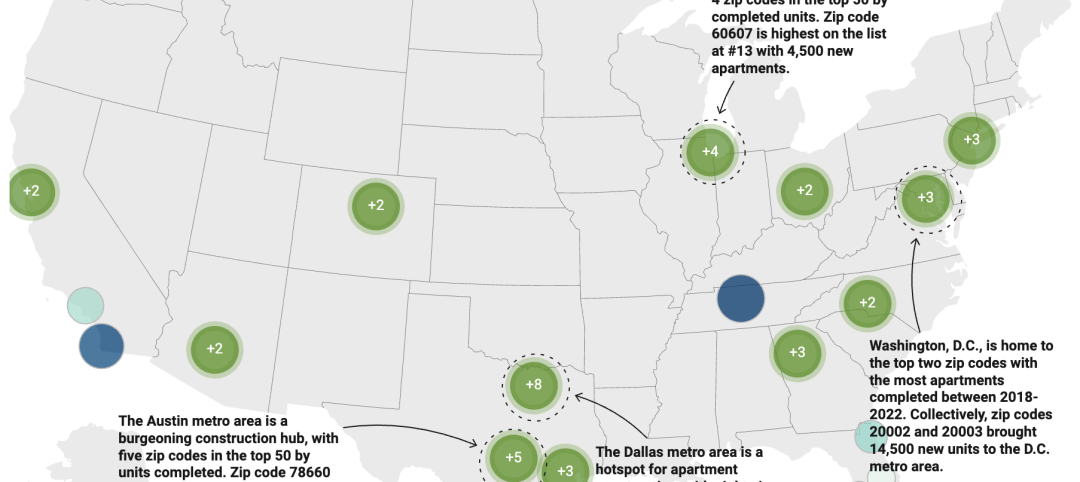

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.