Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Analysis of the data by Cushman & Wakefield shows population growth in all areas since the 2020 census, with the exception of urban cores that have had declining numbers. In 2022, however, the rate of decline in urban counties slowed significantly, buoyed by the resumption of international migration following the Covid pandemic.

The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, outpacing the metro area with the second largest population gains, Houston, by nearly 50,000 people. The New York metro region saw its population shrink by about 139,000.

Since the 2020 Census, Austin, Texas and Raleigh, N.C., rank as the two fastest growing metros on a percentage basis among major markets.

Here are Cushman & Wakefield's five takeaways from its recent analysis of the census, as authored by Sam Tenenbaum, Head of Multifamily Insights:

- Further-flung counties, those in Exurbs and Emerging suburbs, saw their population grow the fastest, with the former growing by 1.9% and the latter by 1.5%. These areas continue to accelerate population gains.

- All districts saw population gains with the exception of Urban Cores. However, with international migration making a big rebound in 2022, those counties saw the biggest change in population, stemming the tide of major population declines experienced from 2020-2021.

- Urban cores saw 70% of international migration among major U.S. counties in 2022 but high costs pushed more residents out, with domestic migration outflows of more than 1.1 million people.

- Mirroring the urban core rebound, Gateway markets largely saw the largest turnaround in population growth with New York, San Francisco, King County (Seattle) and Miami representing the biggest change in population growth from 2021 to 2022. New York and San Francisco still saw net population losses, but they were much limited than 2021.

- The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, dwarfing No. 2 Houston by nearly 50,000 people. On the other hand, the New York metro division saw its population shrink by about 139,000. Since the 2020 Census, Austin, TX and Raleigh, NC rank as the two fastest growing metros on a percentage basis among major markets.

Related Stories

Industry Research | Mar 9, 2023

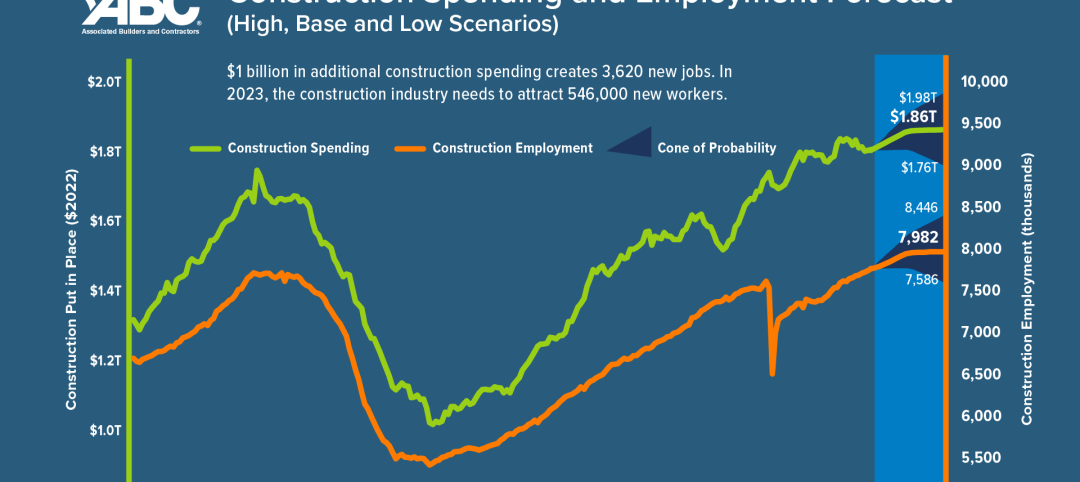

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Industry Research | Mar 2, 2023

Watch: Findings from Gensler's latest workplace survey of 2,000 office workers

Gensler's Janet Pogue McLaurin discusses the findings in the firm's 2022 Workplace Survey, based on responses from more than 2,000 workers in 10 industry sectors.

Architects | Feb 24, 2023

7 takeaways from HKS’s yearlong study on brain health in the workplace

Managing distractions, avoiding multitasking, and cognitive training are key to staff wellbeing and productivity, according to a yearlong study of HKS employees in partnership with the University of Texas at Dallas’ Center for BrainHealth.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

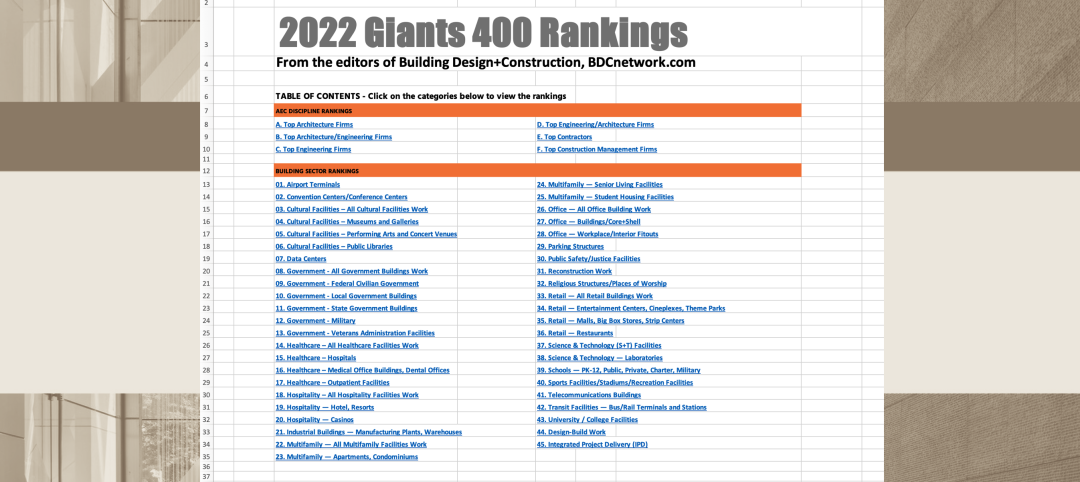

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.