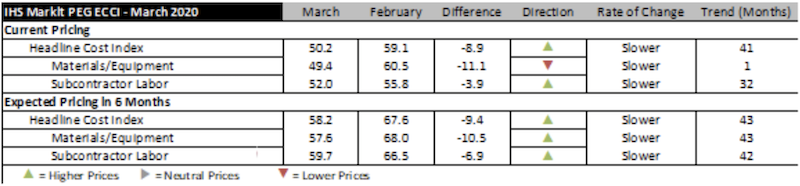

Construction costs increased once again in March, according to IHS Markit (NYSE: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 50.2, a figure barely above the neutral mark. The last time the headline index registered an almost flat pricing was in November 2016. After 40 months, the materials and equipment index came in at 49.4, indicating falling prices. The sub-contractor labor index showed continued price increases, with an index reading of 52.0.

Survey respondents reported falling prices for five out of the 12 components within the materials and equipment sub-index. These included ocean freight (Asia to U.S. and Europe to U.S.), fabricated structural steel, carbon steel pipe, copper-based wire and cable. Prices for five categories rose while prices for two categories (alloy steel pipe and exchangers) remained the same. Index figures for all categories dropped relative to February, indicating that a greater proportion of the respondents are observing lower prices. The sharpest drops were reported for ocean freight.

“Ocean freight has taken a notable hit with the onset of coronavirus,” said Deni Koenhemsi, senior economist with IHS Markit. “As China tried to contain COVID-19, industrial production contracted substantially, and the transportation of goods nearly came to a halt. In the first two months of 2020, U.S. imports from Asia dropped 6.2 percent year-over-year, and imports from China were down 15.5 percent. Although the number of blank sailings is beginning to taper off-meaning we will see higher imports from China to United States-the rapid spread of the virus in Europe and North America could cause the downward trend to continue.”

The sub-index for current subcontractor labor costs came in at 52.0 for March. For the United States, labor cost remained flat in the Northeast, Midwest and West, but increased in the South. For Canada, the labor cost index was flat in western Canada but rose for eastern Canada.

The six-month headline expectations for future construction costs index reflected increasing prices for the 43rd consecutive month, registering 58.2, a sharp decline from February’s reading of 67.6. The six-month materials and equipment expectations index came in at 57.6 this month, down from 68.0 last month. Prices for all materials, equipment and freight are expected to rise with the exception of carbon steel pipe and exchangers, which are expected to see flat pricing. Expectations for sub-contractor labor slipped to 59.7 in March. All regions of the U.S. are expected to see higher labor costs; labor costs in Canada are expected to stay flat.

In the survey comments, respondents noted lower demand conditions due to the coronavirus.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

Related Stories

Market Data | Oct 31, 2016

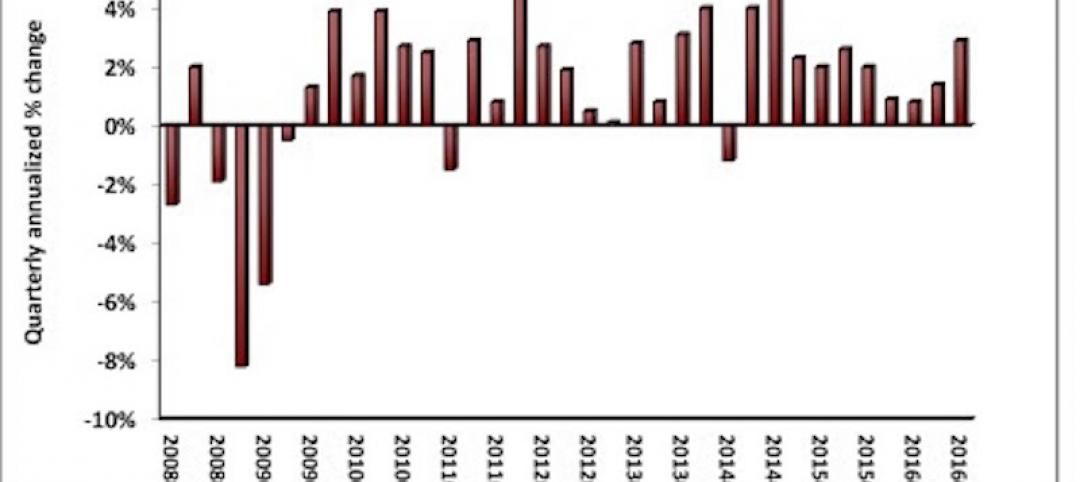

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.