Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

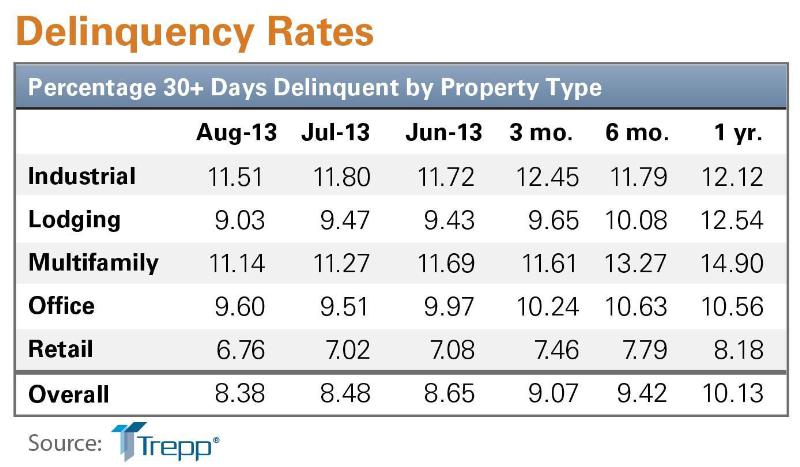

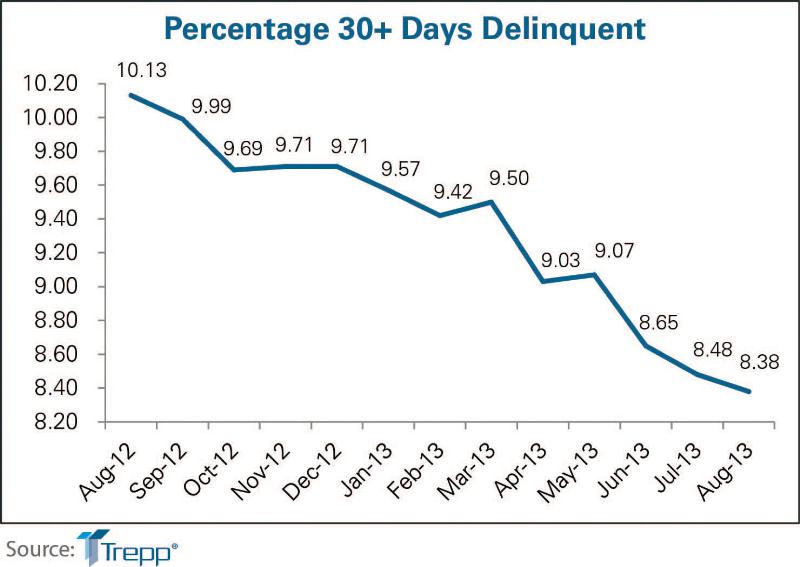

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Apr 3, 2012

Meyer receives RCMA's Martin A. Davis Industry Leadership Award

The Martin A. Davis Industry Leadership Award is presented annually to an individual, selected by his or her peers, who has exemplified outstanding service and made significant contributions to the roof coatings industry.

| Apr 3, 2012

Johns Manville publishes 2011 Sustainability Report

Report covers JM’s long-time sustainability focus and progress towards goals.

| Apr 3, 2012

Educational facilities see long-term benefits of fiber cement cladding

Illumination Series panels made for a trouble-free, quick installation at a cost-effective price. The design for Red Hawk Elementary School stems from the desire to create a vibrant place for kids to learn. In an effort to achieve this design, RB+B Architects selected Nichiha USA to provide a durable yet modern, contemporary exterior finish.

| Apr 2, 2012

TGP launches new fire-rated glazing website

Website offers online continuing education courses registered with the American Institute of Architects (AIA), BIM 3D models, and rapid-response quoting, among other support tools.

| Apr 2, 2012

Gilbane honored for sustainability efforts in Indianapolis

Emmitt J. Bean Federal Center project team for their role in advancing sustainability in the city.

| Apr 2, 2012

Mitsubishi unveils ultra-high-speed elevator for Shanghai skyscraper

The operation of the elevator is scheduled to begin in 2014.

| Apr 2, 2012

Sachse Construction helps complete Salt Lake City’s City Creek Center

Sachse was hired to complete store build-outs at City Creek Center.

| Apr 2, 2012

Culver joins Sasaki as managing director

Culver will work closely with Sasaki firm leaders on issues of strategy, marketing, and business development.

| Apr 2, 2012

EB-5 investment funds new Miramar, Fla. business complex

Riviera Point Holdings breaks ground on $17 million office center.

| Mar 30, 2012

New windows and doors revitalize older buildings

With their improved aesthetics, energy efficiency, and durability, replacement windows and doors can add significant value to a renovation project.