Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

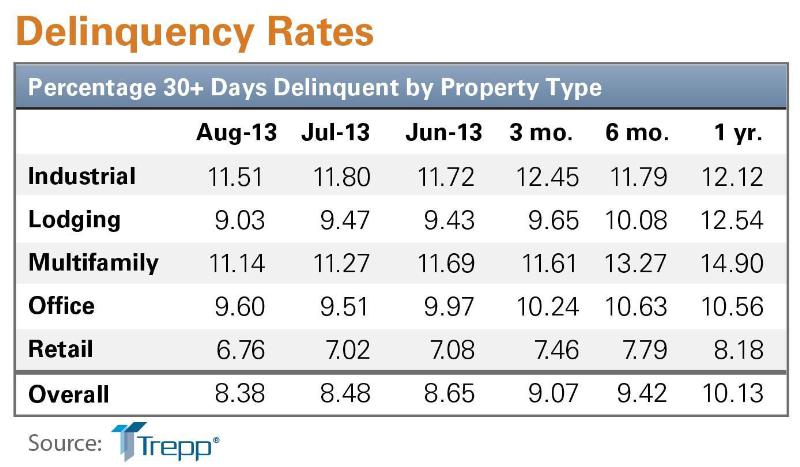

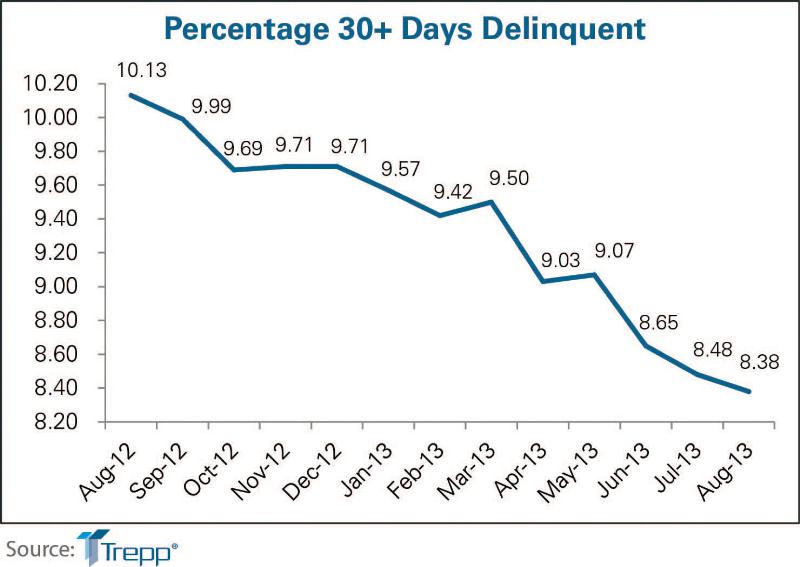

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Apr 12, 2012

Solar PV carport, electrical charging stations unveiled in California

Project contractor Oltman Construction noted that the carport provides shaded area for 940 car stalls and generates 2 MW DC of electric power.

| Apr 11, 2012

Shawmut appoints Tripp as business development director

Tripp joined Shawmut in 1998 and previously held the positions of assistant superintendent, superintendent, and national construction manager.

| Apr 11, 2012

Corgan & SOM awarded contract to design SSA National Support Center

The new SSA campus is expected to meet all Federal energy and water conservation goals while achieving LEED Gold Certification from the United States Green Building Council.

| Apr 11, 2012

C.W. Driver completes Rec Center on CSUN campus

The state-of-the-art fitness center supports university’s goal to encourage student recruitment and retention.

| Apr 10, 2012

JE Dunn completes two medical office buildings at St. Anthony’s Lakewood, Colo. campus

Designed by Davis Partnership Architects, P.C., Medical Plaza 1 and 2 are four-story structures totaling 96,804-sf and 101,581-sf respectively.

| Apr 10, 2012

THINK [about architecture] Scholarship enters 15th year

Students are invited to submit two-minute creative videos that illustrate how they interact with their school's design and what the space makes possible.

| Apr 10, 2012

Structured Development & Bucksbaum close on new retail site in Chicago

The site is the location of New City, a mixed-use development that will feature 370,000-sf of retail space and 280 residential rental units.

| Apr 10, 2012

Moriarty & Associates selected as GC for Miami’s BrickellHouse Condo

Construction of the 46-story development is schedule to get underway this summer and be completed in 2014.

| Apr 6, 2012

Flat tower green building concept the un-skycraper

A team of French designers unveil the “Flat Tower” design, a second place winner in the 2011 eVolo skyscraper competition.