Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

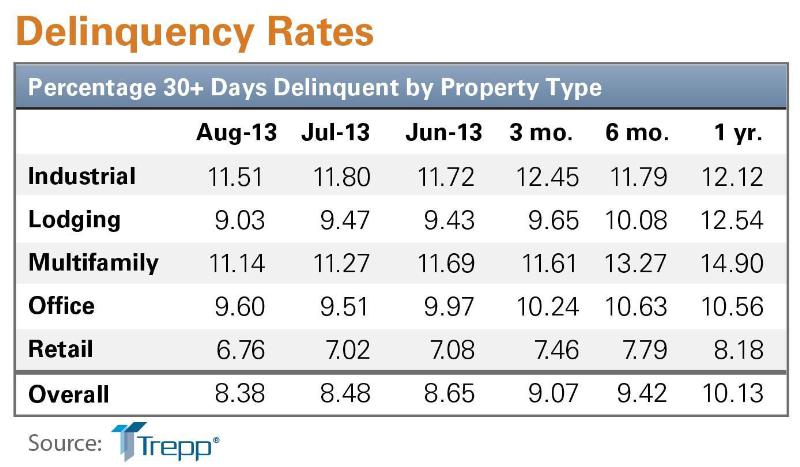

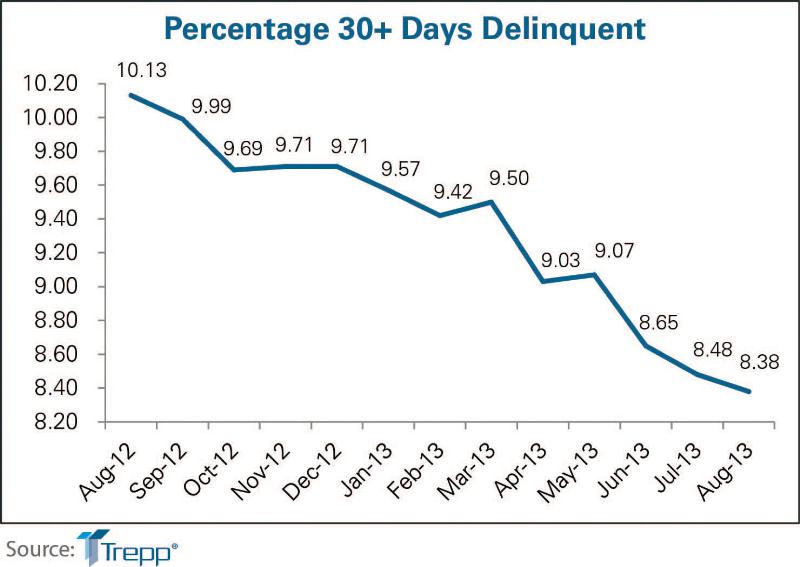

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| May 10, 2012

Chapter 7 When Modern Becomes Historic: Preserving the Modernist Building Envelope

This AIA CES Discovery course explores the special reconstruction questions posed by Modern-era buildings.

| May 10, 2012

Chapter 6 Energy Codes + Reconstructed Buildings: 2012 and Beyond

Our experts analyze the next generation of energy and green building codes and how they impact reconstruction.

| May 10, 2012

Chapter 5 LEED-EB and Green Globes CIEB: Rating Sustainable Reconstruction

Certification for existing buildings under these two rating programs has overtaken that for new construction.

| May 10, 2012

Chapter 4 Business Case for High-Performance Reconstructed Buildings

Five reconstruction projects in one city make a bottom-line case for reconstruction across the country.

| May 10, 2012

Chapter 3 How Building Technologies Contribute to Reconstruction Advances

Building Teams are employing a wide variety of components and systems in their reconstruction projects.

| May 10, 2012

Chapter 2 Exemplary High-Performance Reconstruction Projects

Several case studies show how to successfully renovate existing structures into high-performance buildings.

| May 9, 2012

Chapter 1 Reconstruction: ‘The 99% Solution’ for Energy Savings in Buildings

As a share of total construction activity reconstruction has been on the rise in the U.S. and Canada in the last few years, which creates a golden opportunity for extensive energy savings.

| May 9, 2012

International green building speaker to keynote Australia’s largest building systems trade show

Green building, sustainability consultant, green building book author Jerry Yudelson will be the keynote speaker at the Air-Conditioning, Refrigeration and Building Systems (ARBS) conference in Melbourne, Australia.

| May 9, 2012

Tishman delivers Revel six weeks early

Revel stands more than 730 feet tall, consists of over 6.3 milliont--sf of space, and is enclosed by 836,762-sf of glass.

| May 9, 2012

Stoddert Elementary School in DC wins first US DOE Green Ribbon School Award

Sustainable materials, operational efficiency, and student engagement create high-performance, healthy environment for life-long learning.