The once steady 10% growth rate in healthcare construction spending has slowed, but hasn't entirely stopped.

Spending is currently 1.7% higher than the same time last year when construction materials costs were 8% higher. The 2.5% monthly jobsite spending decline since last fall is consistent with the decline in materials costs. A 7% decline is expected in the next six months, consistent with the year-to-date drop in the value of healthcare construction starts, which includes a 66% plunge in June.

The June drop is partly random but also reflects concern by healthcare project managers about how the outcome of the current healthcare debate in Congress will affect their operations. Specifically, they are concerned about reimbursement rates from federally operated or regulated insurance plans. With no final plan ready for a vote in early August, expect the cautious spending to continue through the summer.

|

| Healthcare construction spending is currently 1.7% higher than the same time last year, led by hospital work, which is 14% higher than a year ago. |

All options being considered in Washington envision expanded healthcare services that would require additional facility capacity by 2011—but financing for the expanded services remains fuzzy. Half the added cost appears to be vague promises of $40 billion plus annual fee cuts by hospitals and drug companies. Significant growth in healthcare construction will not resume until the healthcare financing arrangements are final and judged to be realistic.

Hospital construction spending is currently 14% higher than a year ago, while spending for other healthcare facilities, including specialized office buildings and residential care facilities, is off 25% from last year. The developers of these buildings react to a recession much as developers of commercial buildings do: They pull back when they see falling rental and occupancy rates. By this time next year, expect spending for medical office buildings and possible residential care facilities to be expanding again in a growing economy while spending for hospitals is expected to still be stuck at current levels.

Related Stories

Healthcare Facilities | Apr 14, 2022

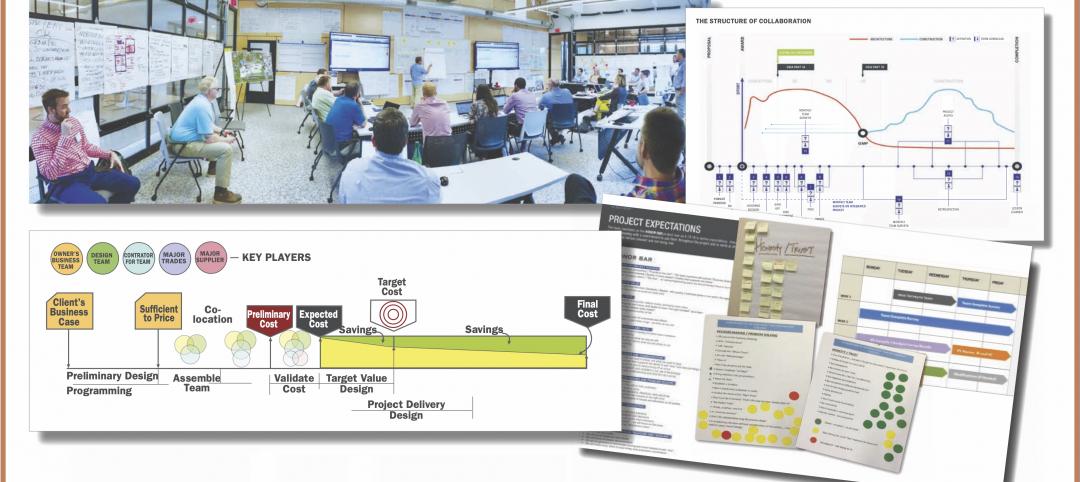

Healthcare construction veteran creates next-level IPD process for hospital projects

Can integrated project delivery work without incentives for building team members? Denton Wilson thinks so.

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Laboratories | Apr 7, 2022

North Carolina's latest play for biotech real estate development

The Tar Heel State is among a growing number of markets rolling out the welcome mat for lab spaces.

Healthcare Facilities | Apr 7, 2022

Visibility breeds traffic in healthcare design

Ryan Companies has completed several healthcare projects that gain exposure by being near retail stores or office buildings.

Healthcare Facilities | Mar 25, 2022

Health group converts bank building to drive-thru clinic

Edward-Elmhurst Health and JTS Architects had to get creative when turning an American Chartered Bank into a drive-thru clinic for outpatient testing and vaccinations.

Projects | Mar 21, 2022

BIG-designed Danish Neuroscience Center will combine groundbreaking science and treatment

A first-of-its-kind facility, a new Danish Neuroscience Center in Aarhus, Denmark designed by BIG, will combine psychiatry and neuroscience under one roof.

Projects | Mar 18, 2022

Toronto suburb to build the largest hospital in Canada

A new hospital in Ontario will nearly triple the care capacity of its existing facility—becoming the largest hospital in Canada.

Projects | Mar 15, 2022

Old Sears store will become one of the largest orthopaedics outpatient facilities in the Northeast

A former Sears store in Rochester, N.Y., will be transformed into one of the largest orthopaedics outpatient facilities in the Northeast.

Projects | Mar 10, 2022

Optometrist office takes new approach to ‘doc-in-a-box’ design

In recent decades, franchises have taken over the optometry services and optical sales market. This trend has spawned a commodity-type approach to design of office and retail sales space.

Industry Research | Mar 2, 2022

31 percent of telehealth visits result in a physical office visit

With little choice but to adopt virtual care options due to pandemic restrictions and interactions, telehealth adoption soared as patients sought convenience and more efficient care options.