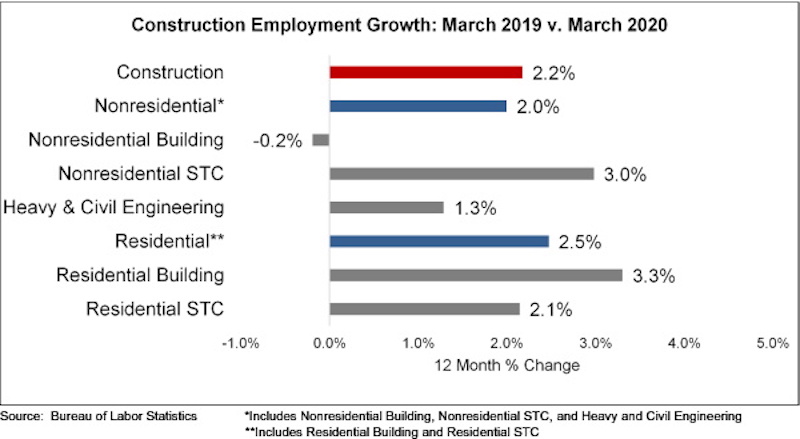

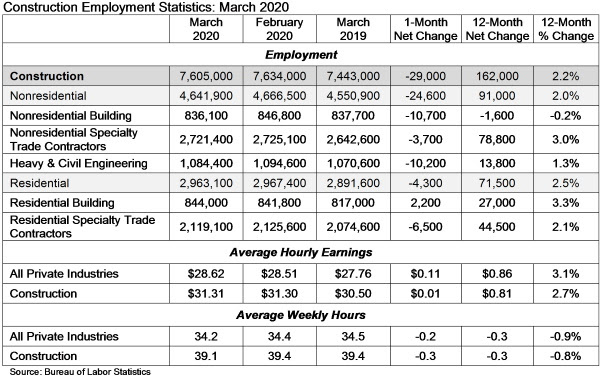

Construction industry employment declined by 29,000 in March, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Nonresidential construction employment declined by 24,600 in March.

All three nonresidential segments registered job losses, with the largest decrease experienced in nonresidential building (-10,700) followed closely by heavy and civil engineering (-10,200). Nonresidential specialty trade lost 3,700 jobs on net.

The construction unemployment rate was 6.9% in March, up 1.7 percentage points from the same time one year ago. Unemployment across all industries rose from 3.5% in February to 4.4% last month, a direct result of the global pandemic.

“So ends the lengthiest expansion in American economic history,” said ABC Chief Economist Anirban Basu. “The expansion was associated with dramatic asset price increases, multi-decade lows in unemployment, persistently low costs of capital and a thriving U.S. nonresidential construction sector. While the March jobs report is horrific, ending a 113-month streak of employment gains, it is clear that employment reports in future months are likely to be even worse.

“What remains unclear is the extent to which estimated construction employment declines are due to mandated suspension of projects in Massachusetts, Pennsylvania, California and elsewhere, and how much of this is due to the emergence of recessionary forces,” said Basu. “Generally, nonresidential construction is one of the last segments of the economy to enter recession as contractors continue to work down their collective backlog, which stood at 8.9 months in ABC’s Construction Backlog Indicator. The need for social distancing renders that statistic less pertinent, meaning that nonresidential construction is susceptible to large-scale job losses immediately.

“While the recently passed stimulus package is massive and helps support the payments side of the economy, economic recovery will remain elusive until the COVID-19-engendered crisis is behind us,” said Basu. “While that is obvious, many people are still looking to compare the current crisis to other episodes in American history, including the Great Recession. As a practical matter, this period defies comparison, and must be understood on its own. Based on what is known, the downturn will be vicious. The good news is that this crisis may finally induce policymakers to fashion and implement a long-awaited infrastructure stimulus package.”

Related Stories

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.