The coronavirus has harmed the construction industry, prompting project delays and cancellations, layoffs and furloughs, yet it remains difficult for a majority of firms to find craft workers to hire, according to the results of a workforce survey conducted by the Associated General Contractors of America and Autodesk. The survey paints a picture of an industry in need of immediate recovery measures and longer-term workforce development support, association officials added.

“Few firms have survived unscathed from the pandemic amid widespread project delays and cancellations,” said Ken Simonson, the association’s chief economist. “Ironically, even as the pandemic undermines demand for construction services, it is reinforcing conditions that have historically made it hard for many firms to find qualified craft workers to hire.”

Sixty percent of responding firms report having at least one future project postponed or canceled because of the coronavirus, while 33% report having projects that were already underway halted because of the pandemic. The share of firms reporting canceled projects has nearly doubled since the survey AGC conducted in June, when 32% of respondents reported cancellations.

The coronavirus has also undermined the sector’s productivity levels as firms across the country change the way they operate to protect workers and the public from the disease. Forty-four percent of responding firms report that it has taken longer to complete projects and 32% say it has cost more to complete ongoing projects because of the coronavirus. As a result, 40% report they have adopted new hardware or software to alleviate labor shortages they have experienced.

“The results of the AGC and Autodesk workforce study reveal that the construction industry is still grappling with the changes and consequences of the coronavirus pandemic,” said Allison Scott, director of construction thought leadership and customer marketing at Autodesk. “The long-term effects of the current crisis have yet to play out, and firms that double down on innovation efforts, whether an increased focus on lean construction, workforce training or technology that facilitates remote collaboration will be well poised for enduring resilience.”

The coronavirus has also negatively affected many firms’ confidence in future demand for projects. Only 42% of firms report their volume of business has returned to year-ago levels or is expected to do so in the next six months, compared to 52% who held this view in AGC’s June survey. Another 37% expect returning to normal levels of business will take more than six months, while the remainder don’t know.

While the pandemic has led to project delays and cancellations nationwide, contractor expectations of recovery do vary by region. Forty-five percent of respondents in the Northeast expect it will take more than six months for their firm’s volume of business to return to normal, compared to only 34% of respondents in the West, 35% in the South, and 41% in the Midwest.

There are also some differences by project type and revenue size. For instance, highway and transportation contractors report the greatest difficulty in filling hourly craft positions, with nearly three out of four (73%) reporting an unfilled craft position on June 30. About two-thirds (69%) of utility infrastructure and federal and heavy construction firms had unfilled craft positions then, along with 58% of building construction firms.

Small firms were less likely to have experienced cancellations of upcoming projects. Fifty-six percent of firms with revenues of $50 million or less report a project has been postponed or canceled, compared with 71% of midsized firms (revenue between $50.1 million and $500 million) and 69% of large firms (revenue exceeding $500 million).

Roughly a third of responding firms furloughed or terminated employees as a result of the pandemic and shutdowns ordered by government officials or project owners. Most of those firms have asked at least some laid-off workers to return to work. But 44% of firms that recalled employees report that some have refused to return, citing a preference for unemployment benefits, virus concerns, or family responsibilities, among other reasons.

The pandemic has also made it difficult for many firms to fill open positions, especially for hourly craft jobs. A majority (52%) of respondents report having a hard time filling some or all hourly craft positions, especially openings for laborers, carpenters and equipment operators. Sixty percent of firms had at least one unfilled hourly craft position as of June 30. In addition, 28% of respondents report difficulty filling salaried positions—in particular, project managers and supervisors.

In addition to turning to diverse technologies to alleviate labor shortages, 38% of firms report having increased base pay rates to attract and retain workers. In contrast, only 3% of firms have reduced pay, in spite of the downturn in business.

Construction firms also identified a series of measures that Washington officials could take to help the industry. Fifty-five percent of responding firms, for example, said they were looking to Congress to increase funding for all forms of public infrastructure and facilities. Fifty-three percent of firms want Congress and the Trump administration to enact liability reforms to shield companies who are protecting workers from the coronavirus from needless lawsuits. And 41% want Congress to address unemployment benefits that serve as artificial barriers to returning people to work.

Association officials unveiled new plans to encourage more people to pursue high-paying careers in construction to ease hiring challenges and find a way to attract recently unemployed people into the construction industry. Among other steps, the association is launching a new “Construction is Essential” campaign to highlight the many benefits of construction careers.

“There is a lot that Washington officials can do to help boost demand for construction projects and get more people back to work rebuilding the economy,” said Stephen E. Sandherr, the association’s chief executive officer, noting the association was pushing Congress and the administration to enact new recovery measures. “The challenge is that the coronavirus has put many contractors in the position of looking for work and workers at the same time.”

The association and Autodesk conducted the Workforce Survey between August 4 and 26. Over 2000 firms completed the survey from a broad cross-section of the construction industry, including union and open shop firms of all sizes. The 2020 Workforce Survey is the association’s eighth annual workforce-related survey.

Click here for survey materials including national, regional and state fact sheets, survey analysis and event remarks.

Related Stories

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

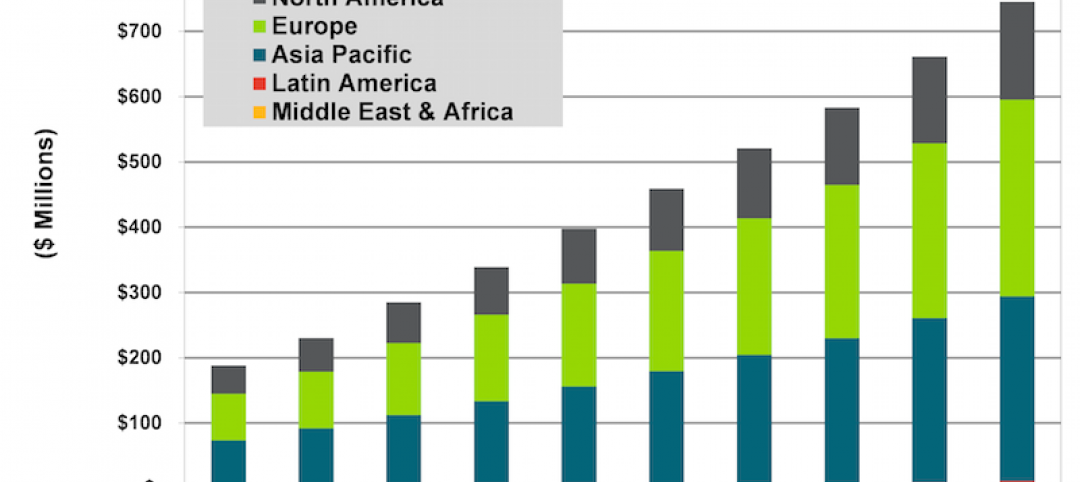

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.