The construction industry continues to tackle the challenges of rising construction materials costs, a skilled labor shortage and overall lack of productivity improvements, offering an expansive opportunity for disruption. According to the newly released JLL research report, “The State of Construction Technology,” Silicon Valley investors are stepping in to seize that opportunity. Venture capital funds are funneling unprecedented levels of cash into Construction Technology startups’ pockets.

In the first half of 2018, venture capital firms invested $1.05 billion in global construction tech startups, setting a record high. The 2018 investment volume is already up nearly 30 percent over the 2017 total, with six months still remaining in the year. To date, the Construction Technology sector has found three Unicorns—startups valued at more than $1 billion—in Katerra, Procore and Uptake.

“The construction sector is on the verge of major disruption as tech start-ups tackle head-on the industry’s biggest pressure points,” says Todd Burns, President, Project and Development Services, JLL. “These startups can provide technology that helps deliver projects faster, cheaper and with fewer resources than ever before, effectively addressing the existing challenges in the industry.”

Emerging technology is opening a significant opportunity for venture capitalists and construction executives. JLL recognized this opportunity early, and last year brought on two Silicon Valley veterans to launch JLL Spark, a global business that identifies and delivers new technology-driven real estate service offerings, including a $100 million global venture fund.

JLL’s research uncovered three primary focus areas of construction tech startups:

1. Collaboration software. Considering that dozens of professionals can be working on a given construction project at the same time, leveraging cloud-based software to optimize the workflow could profoundly improve collaboration and impact the bottom line. Front-runners such as Procore Technologies, PlanGrid, Clarizen and Flux Factory are utilizing cloud capabilities, mobile platforms and dedicated design software to enable collaboration.

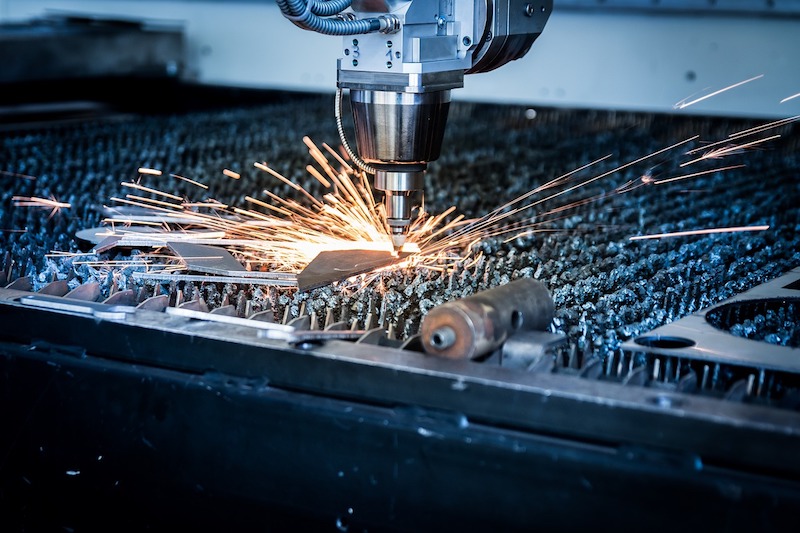

2. Offsite construction. As skilled construction labor becomes harder to find and general competition for construction inputs heats up, offsite construction startups are championing a different approach to how buildings are built: building component manufacturing. Offsite manufacturing and delivery of finalized components to the construction site equals shorter assembly time and more centralized production to help offset the labor pinch and rising costs. Industry leaders include Katerra, Blu Homes and Project Frog.

3. Big data and artificial intelligence (AI). From materials delivery to equipment maintenance, predictive data and automation tools can collect data on nearly every aspect of a construction project, resulting in data pools at risk of going to waste. Armed with big data and AI software, construction teams can make more informed business decisions to save time and money by extending the life of expensive equipment, reducing worksite risk and automating simple business processes. Top startups in this area include Uptake Technologies, Flux Factory and SmartEquip.

Since 2009, investors have closed 478 Construction Technology funding deals totaling $4.34 billion, underscoring the continued volume of construction projects and the recent urgency to innovate and offset industry costs. The huge bump in Construction Technology investment in 2018 is hopeful proof of an impending surge of technology and hardware marvels, promising to optimize the industry.

Related Stories

| Aug 11, 2010

SAFTI FIRST hires Tim Nass as National Sales Manager

SAFTI FIRST, a leading USA manufacturer of fire rated glazing and framing systems, is pleased to announce the addition of Tim Nass as National Sales Manager. In his new role, Tim will be working closely with architects and contract glaziers in selecting the appropriate and most economical fire rated glazing solution for their project. He will also be coordinating SAFTI FIRST’s extensive network of architectural representatives throughout the United States.

| Aug 11, 2010

NCARB welcomes new board of directors

The National Council of Architectural Registration Boards (NCARB) introduces its Board of Directors for FY10, who were installed during the culmination of the Council’s 90th Annual Meeting and Conference in Chicago.

| Aug 11, 2010

Nonprofit healthcare providers turn to real estate for liquidity and to preserve capital, says Jones Lang LaSalle report

Long considered to be stable investments immune to recession, hospitals and other healthcare facilities are now feeling the effects of a cash-strapped economy as decreased charitable contributions are forcing nonprofit hospitals to pare back and seek new financing sources, according to Jones Lang LaSalle’s 2009 Healthcare Real Estate Financing Outlook.

| Aug 11, 2010

New CertainTeed Gypsum drywall compound reduces airborne dust by more than 70%

CertainTeed Gypsum launches two new revolutionary drywall compounds that significantly reduce the amount of dust traditionally associated with finishing gypsum walls and ceilings. The products—Dust Away Reduced Airborne Dust Drywall Compound and Renovation Mud—join CertainTeed’s Easi-Fil and ProRoc brands of finishing products currently available throughout Canada.

| Aug 11, 2010

Suffolk Construction Company acquires William A. Berry & Son

Suffolk Construction Company, New England’s largest construction company announced today that they have acquired William A. Berry & Son (Berry), the second largest construction company in the region. The two companies, both with deep New England roots and successful track-records, combined will have more than 1,200 employees and projected revenues of $2 billion.

| Aug 11, 2010

Polshek Partnership unveils design for University of North Texas business building

New York-based architect Polshek Partnership today unveiled its design scheme for the $70 million Business Leadership Building at the University of North Texas in Denton. Designed to provide UNT’s 5,400-plus business majors the highest level of academic instruction and professional training, the 180,000-sf facility will include an open atrium, an internet café, and numerous study and tutoring rooms—all designed to help develop a spirit of collaboration and team-oriented focus.

| Aug 11, 2010

University of Florida aiming for nation’s first LEED Platinum parking garage

If all goes as planned, the University of Florida’s new $20 million Southwest Parking Garage Complex in Gainesville will soon become the first parking facility in the country to earn LEED Platinum status. Designed by the Boca Raton office of PGAL to meet criteria for the highest LEED certification category, the garage complex includes a six-level, 313,000-sf parking garage (927 spaces) and an attached, 10,000-sf, two-story transportation and parking services office building.

| Aug 11, 2010

Aslaug Haraldsdottir, Ph.D. receives highest honor from the Society of Women Engineers

The Society of Women Engineers (SWE) is pleased to announce Aslaug Haraldsdottir, Ph.D. as the recipient of the 2009 SWE Achievement Award for accomplishments in Air Traffic Management, communication, navigation and surveillance system design, greatly influencing the future worldwide Air Traffic Management systems.

| Aug 11, 2010

Nonresidential construction will be down 14% in 2009; 17% in 2010, according to FMI report

FMI released its Construction Outlook: Second Quarter 2009 Report, and the outlook isn't good for the nonresidential market. FMI forecasts the market to decline 14% this year, followed by a 17% slide in 2010. FMI says that while the economy is showing some signs of improvement, it is just the beginning of the downfall for nonresidential construction.