Total construction spending declined in September for the first time since February, as both residential and nonresidential construction slipped, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials urged the House of Representatives to promptly complete work on the bipartisan infrastructure bill that the Senate passed earlier this year, noting that spending on infrastructure in the first nine months of 2021 fell short of year-earlier levels.

“Spending on projects has been slowed by shortages of workers and materials, as well as extended or uncertain delivery times,” said Ken Simonson, the association’s chief economist. “And the extreme rise in materials costs is likely to mean some infrastructure projects will no longer be affordable without additional funding.”

Construction spending in September totaled $1.57 trillion at a seasonally adjusted annual rate, down 0.5% from August. Year-to-date spending in the first nine months of 2021 combined increased 7.1% from the total for January-September 2020. While both residential and nonresidential construction declined from August to September, the two categories have diverged relative to 2020 levels. Residential construction spending slipped 0.4% for the month but was 24.5% higher year-to-date. Combined private and public nonresidential construction spending decreased 0.6% in September and 5.8% year-to-date.

Most infrastructure categories posted significant year-to-date declines, Simonson pointed out. The largest public infrastructure segment, highway and street construction, was 1.3% lower than in January-September 2020. Spending on public transportation construction slumped 6.8% year-to-date. Investment in sewage and waste disposal structures was the sole exception, rising 4.3%, but public water supply projects dipped 0.9% and conservation and development construction plummeted 19.5%.

Other types of nonresidential spending also decreased year-to-date, Simonson added. Combined private and public spending on electric power and oil and gas projects declined 2.5%. Education construction slumped 10.1%. Commercial construction--comprising warehouse, retail, and farm structures--dipped 1.7%, as a 13.2% plunge in retail construction outweighed a 12.0% hike in warehouse structures. Office spending fell 9.2% and manufacturing construction inched down 0.2%.

Association officials said the almost ubiquitous downturn in infrastructure spending shows that enactment of the Bipartisan Infrastructure bill that already passed in the Senate is urgently needed. They said each day’s delay is putting the nation further behind in unclogging supply chains and enhancing competitiveness.

“This legislation advances the policy priorities that members of both parties have long said they want,” said Stephen E. Sandherr, the association’s chief executive officer. “It is disgraceful that both sides are still holding these projects hostage while sorting out other priorities. Construction workers, businesses, and the public deserve better.”

Related Stories

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

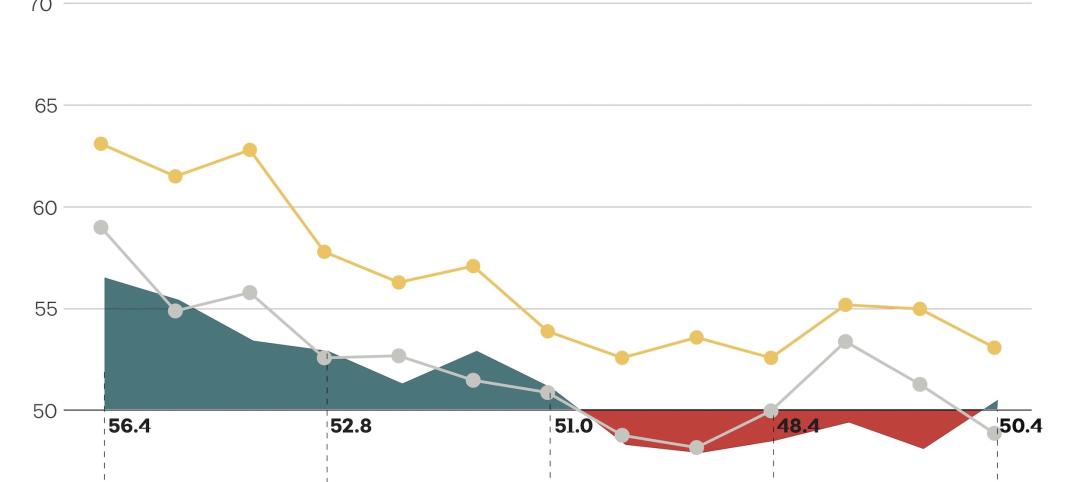

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

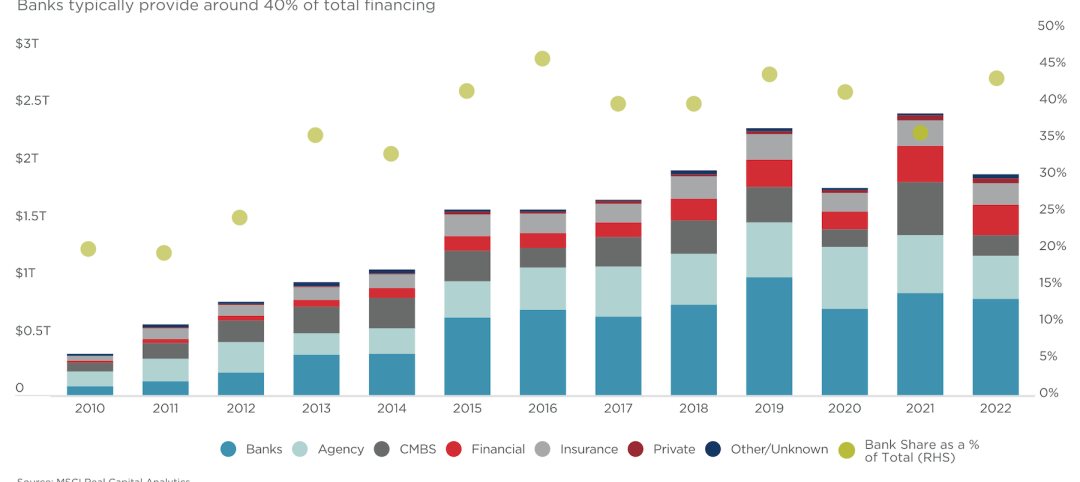

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.