Total construction spending ticked up from June to July, as gains in residential and public construction offset a dip in private nonresidential projects, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted, however, that challenges remain for the industry, particularly because of continuing problems with coronavirus flare-ups and supply-chain disruptions.

“Although nonresidential construction is no longer in free fall, many categories face continuing challenges,” said Ken Simonson, the association’s chief economist. “The rapid spread of the delta variant of COVID-19 is causing a pullback in re-openings and travel that may lead some owners to postpone new projects. Meanwhile, materials price increases, limited supplies of key materials, and long or uncertain delivery times are impeding the industry’s recovery.”

Construction spending in July totaled $1.57 trillion at a seasonally adjusted annual rate, an increase of 0.3% from June, and 9.0% higher than the pandemic-depressed rate in July 2020. Once again, residential construction saw monthly and year-over-year gains, while nonresidential construction spending posted mixed results. The residential construction segment climbed 0.5% for the month and 26.5% year-over-year. Combined private and public nonresidential construction spending inched up 0.1% compared to June but declined 4.2% compared to July 2020.

Private nonresidential construction spending fell 0.2% from June to July and 3.6% since July 2020. The largest private nonresidential category, power construction, decreased by 0.7% from June to July and 0.9% year-over-year. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—was essentially unchanged for the second month in a row but higher than in July 2020 by 4.6%. Manufacturing construction spending was also nearly unchanged for the month and up 1.8% from a year earlier. Office construction decreased 0.1% compared to June and 6.1% year-over-year.

Public construction spending increased 0.7% for the month but was 5.1% lower year-over-year. Among the largest segments, highway and street construction gained 1.9% compared to June but dipped 0.1% over 12 months. Public educational construction fell 0.5% in July and 6.4% year-over-year. Spending on transportation facilities was up 0.3% from June but fell 4.2% from July 2020.

Association officials said the spending figures highlight some of the challenges the industry is facing amid a resurgent coronavirus and ongoing supply chain problems. They added that the association will release more details on how demand for new projects and workforce supply are being impacted by the coronavirus during a virtual media event at noon on Thursday, September 2nd with Autodesk.

“We are starting to get a more complete picture of how the resurgent coronavirus and policy responses to it are impacting the construction industry,” said Stephen E. Sandherr, the association’s chief executive officer. “The industry will not be out of the woods without new federal infrastructure investments and support for workforce development.”

Related Stories

Market Data | Mar 29, 2017

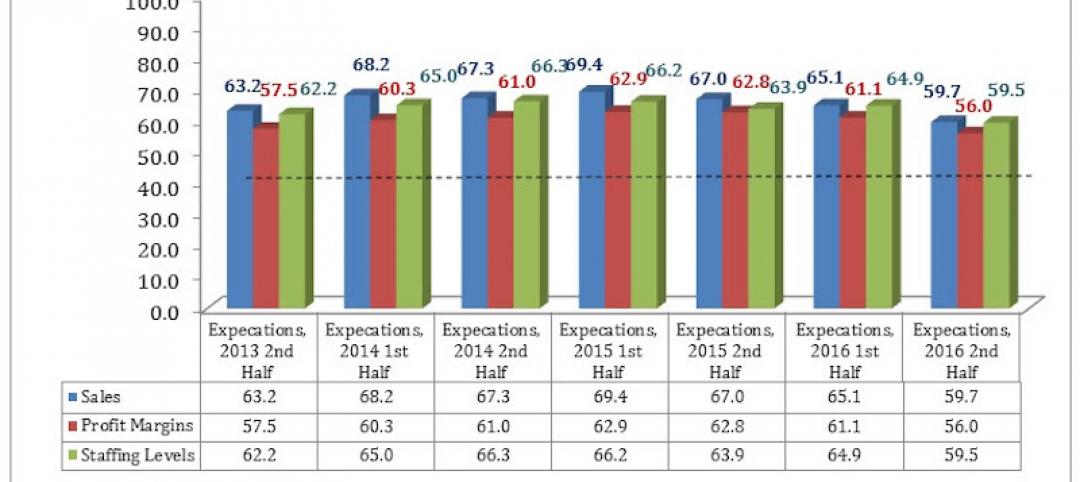

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

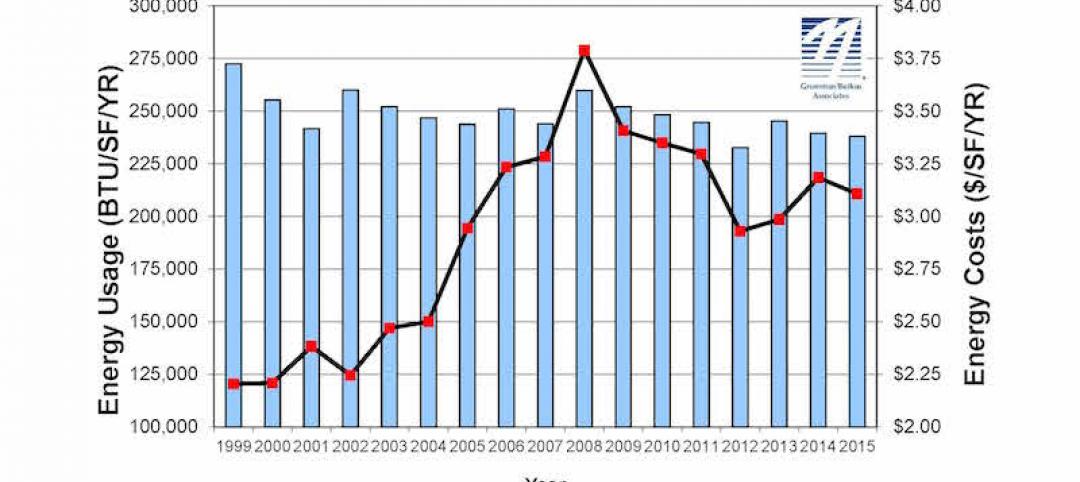

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

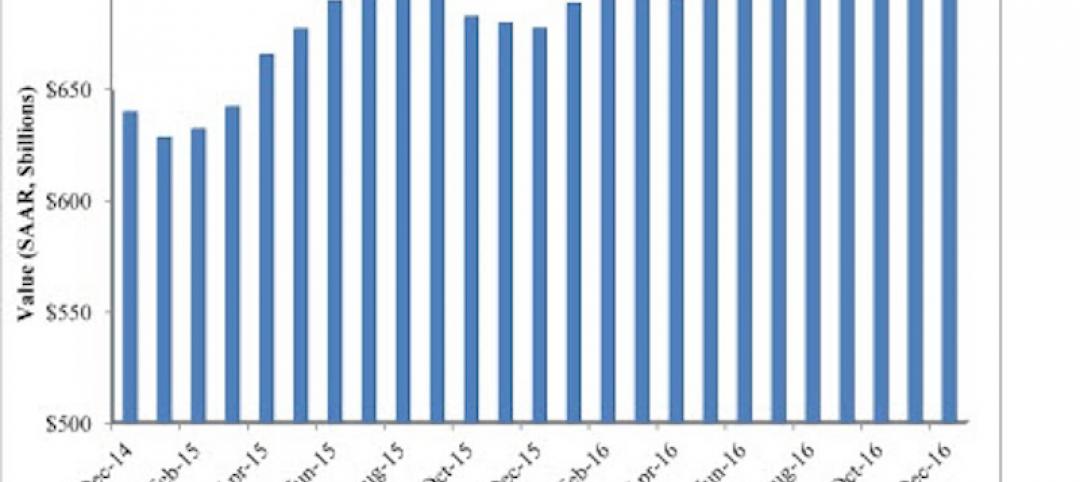

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.