Total construction spending ticked up from June to July, as gains in residential and public construction offset a dip in private nonresidential projects, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted, however, that challenges remain for the industry, particularly because of continuing problems with coronavirus flare-ups and supply-chain disruptions.

“Although nonresidential construction is no longer in free fall, many categories face continuing challenges,” said Ken Simonson, the association’s chief economist. “The rapid spread of the delta variant of COVID-19 is causing a pullback in re-openings and travel that may lead some owners to postpone new projects. Meanwhile, materials price increases, limited supplies of key materials, and long or uncertain delivery times are impeding the industry’s recovery.”

Construction spending in July totaled $1.57 trillion at a seasonally adjusted annual rate, an increase of 0.3% from June, and 9.0% higher than the pandemic-depressed rate in July 2020. Once again, residential construction saw monthly and year-over-year gains, while nonresidential construction spending posted mixed results. The residential construction segment climbed 0.5% for the month and 26.5% year-over-year. Combined private and public nonresidential construction spending inched up 0.1% compared to June but declined 4.2% compared to July 2020.

Private nonresidential construction spending fell 0.2% from June to July and 3.6% since July 2020. The largest private nonresidential category, power construction, decreased by 0.7% from June to July and 0.9% year-over-year. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—was essentially unchanged for the second month in a row but higher than in July 2020 by 4.6%. Manufacturing construction spending was also nearly unchanged for the month and up 1.8% from a year earlier. Office construction decreased 0.1% compared to June and 6.1% year-over-year.

Public construction spending increased 0.7% for the month but was 5.1% lower year-over-year. Among the largest segments, highway and street construction gained 1.9% compared to June but dipped 0.1% over 12 months. Public educational construction fell 0.5% in July and 6.4% year-over-year. Spending on transportation facilities was up 0.3% from June but fell 4.2% from July 2020.

Association officials said the spending figures highlight some of the challenges the industry is facing amid a resurgent coronavirus and ongoing supply chain problems. They added that the association will release more details on how demand for new projects and workforce supply are being impacted by the coronavirus during a virtual media event at noon on Thursday, September 2nd with Autodesk.

“We are starting to get a more complete picture of how the resurgent coronavirus and policy responses to it are impacting the construction industry,” said Stephen E. Sandherr, the association’s chief executive officer. “The industry will not be out of the woods without new federal infrastructure investments and support for workforce development.”

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

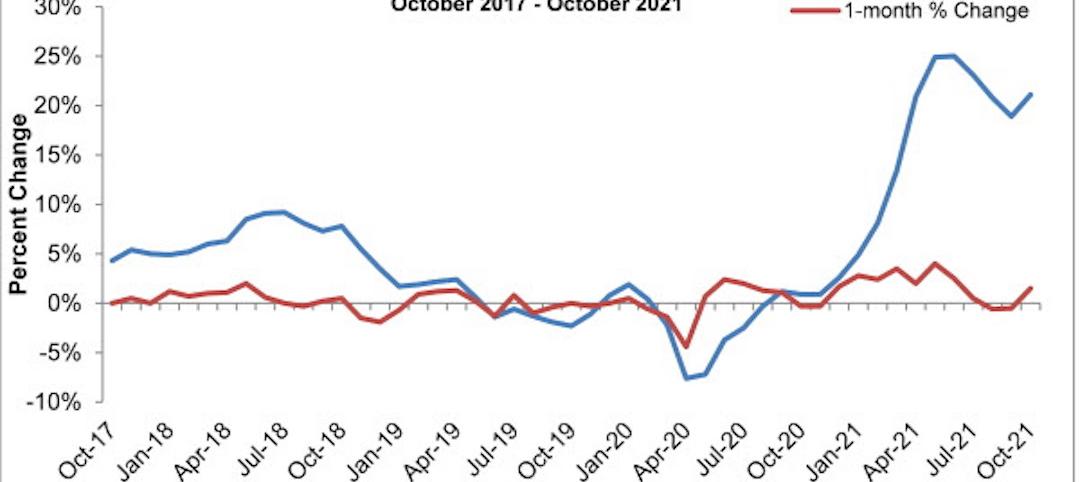

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

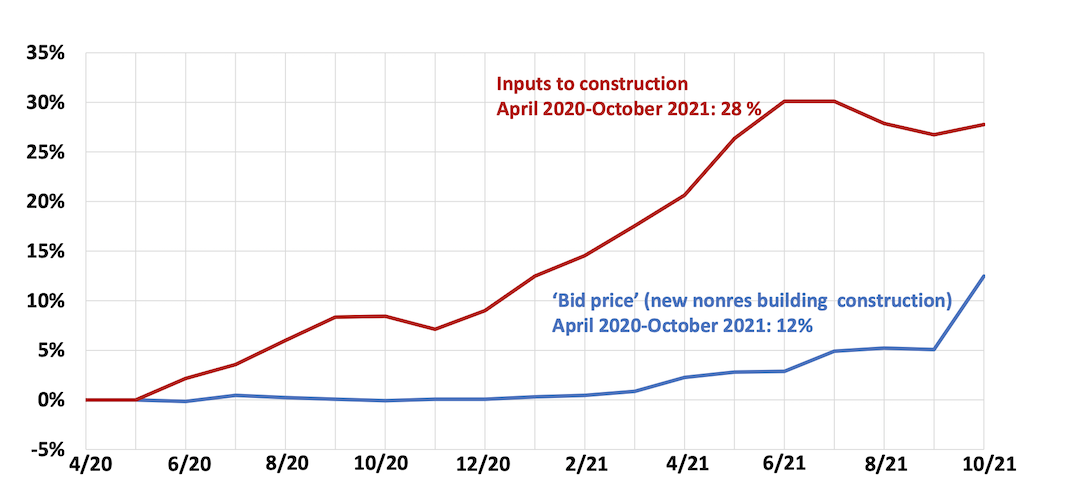

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.