Total construction spending increased in November compared to levels in October and a year earlier, as gains in private residential and nonresidential projects outweighed decreases in public outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments were down in part because Congress has failed to provide funding so far for the Bipartisan Infrastructure bill enacted last year.

“Private nonresidential spending appears to be on a solid upswing, with five consecutive months of growth, but public outlays for construction remain erratic,” said Ken Simonson, the association’s chief economist. “The public side isn’t likely to post steady gains until funds from the new infrastructure law become available and turn into actual projects.”

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate, 0.4% above the October rate and 9.3% higher than in November 2020. Year-to-date spending in the first 11 months of 2021 combined increased 7.9% from the total for January-November 2020.

Private construction spending rose 0.6% in November from the October total and 12.5% from November 2020. In contrast, public construction spending slipped 0.2% for the month and 0.9% year-over-year.

There were gains in both residential and nonresidential private construction. Spending on new single- and multifamily residential projects, along with additions and renovations to existing houses, increased 0.9% for the month and 16.3% from a year earlier. Private nonresidential spending edged up 0.1% from October and 6.7% from November 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 7.5% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--dipped 0.1% in November but jumped 15.1% year-over-year. Manufacturing construction increased for the 11th month in a row, by 0.9%, putting the total 22.4% above the year-earlier level.

The largest public categories posted mixed results. Highway and street construction slid 0.8% from October but rose 0.2% compared to November 2020. Educational construction climbed 0.3% for the month but declined 6.3% year-over-year. Transportation spending fell 0.5% in November but rose 0.7% from the year-earlier total.

Association officials said that public construction spending likely suffered from the fact Congress has not yet allocated the additional funds that were authorized in the Bipartisan Infrastructure bill that the President signed into law last year. As a result, the economic benefits from that measure will be delayed for at least a few months until Congress passes a new spending bill.

“Construction demand is definitely being impacted by Congress’ failure to include the funding increases it promised as part of the Bipartisan Infrastructure bill,” said Stephen E. Sandherr, the association’s chief executive officer.

Related Stories

Industry Research | Apr 25, 2023

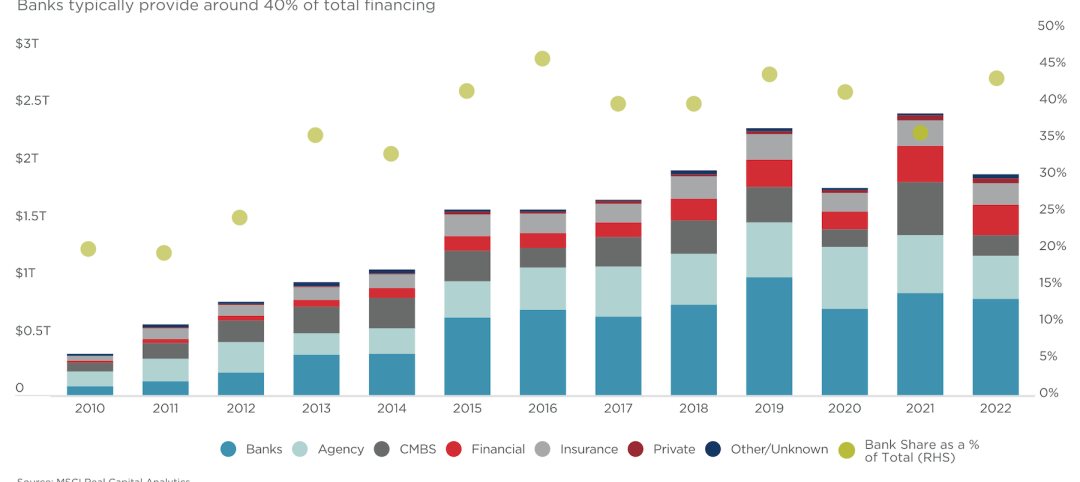

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

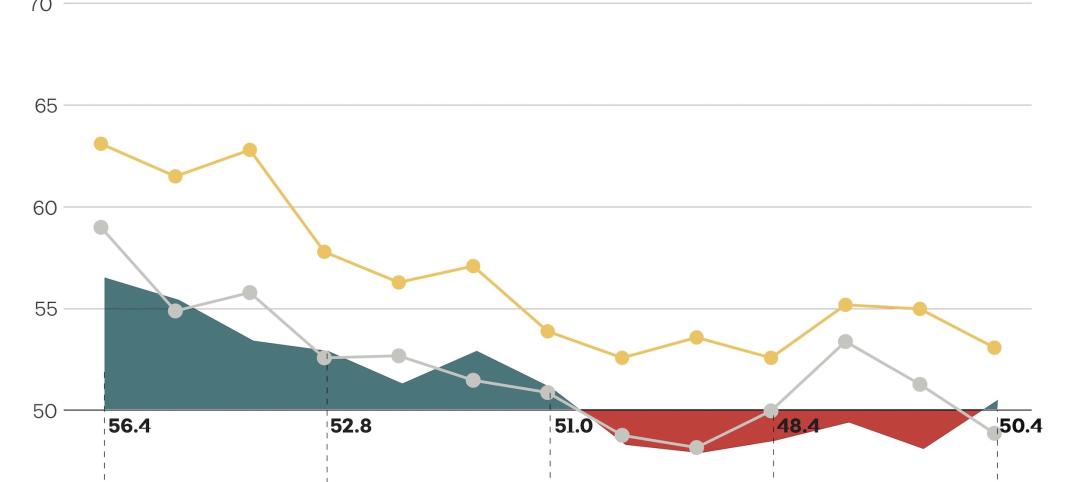

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

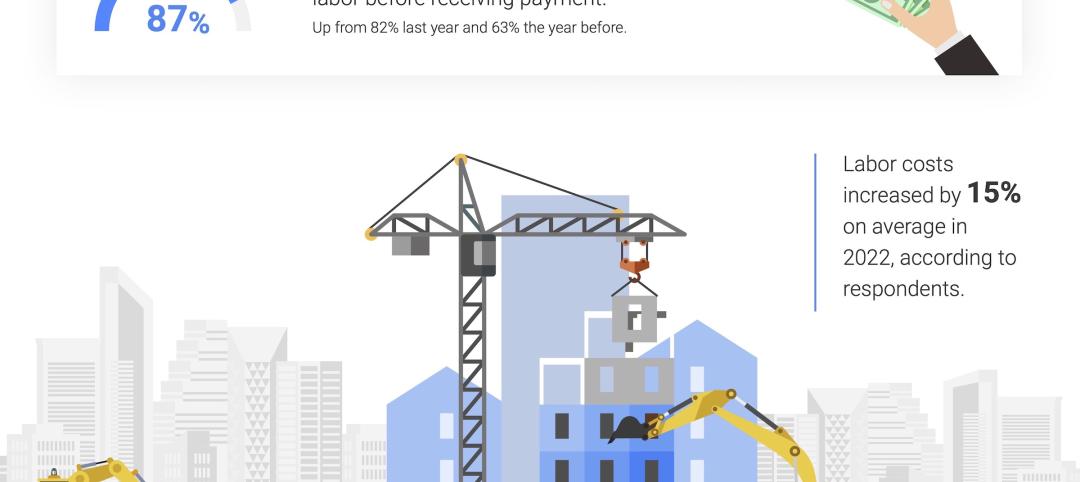

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

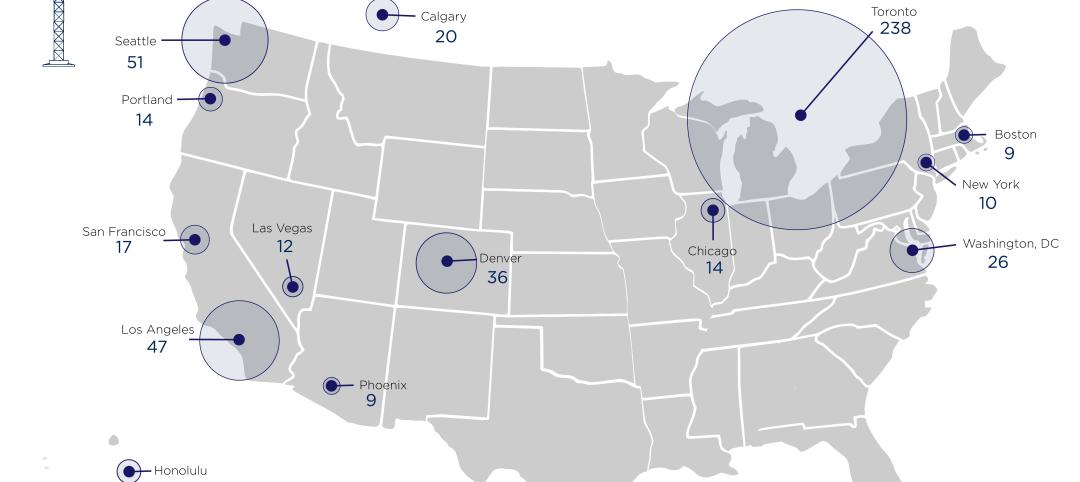

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.