The construction industry lost 3,000 jobs between July and August as ongoing declines in nonresidential segments offset a pickup among residential building and remodeling firms, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said their newly released survey shows many contractors are eager to hire but are encountering a lack of qualified applicants and supply-chain delays that are holding back nonresidential employment gains.

“Today’s figures show that nonresidential building and infrastructure contractors are having a hard time recovering from the impact of the pandemic on demand for structures,” said Ken Simonson, the association’s chief economist. “At the same time, our survey finds many contractors have job openings but are experiencing a lack of qualified applicants, shortages of materials and long delivery delays.”

Construction employment in August totaled 7,416,000, a drop of 3,000 from July. Employment among nonresidential firms—comprising heavy and civil engineering construction firms, along with nonresidential building and specialty trade contractors—shrank for the fifth month in a row, by 20,300. In contrast, homebuilders and residential specialty trade contractors added 17,400 workers, the fourth-straight gain.

Despite the job losses for nonresidential construction firms, the association’s annual workforce survey, conducted with Autodesk, found many of its members—nonresidential and multifamily contractors—have unfilled job openings. Ninety percent of the more than 2,100 firms that responded had openings for hourly craft workers, while 62% had openings for salaried employees. Overwhelming percentages of firms with openings reported having a hard time filling positions, including 89% of the companies seeking craft workers and 86% of those looking for salaried employees.

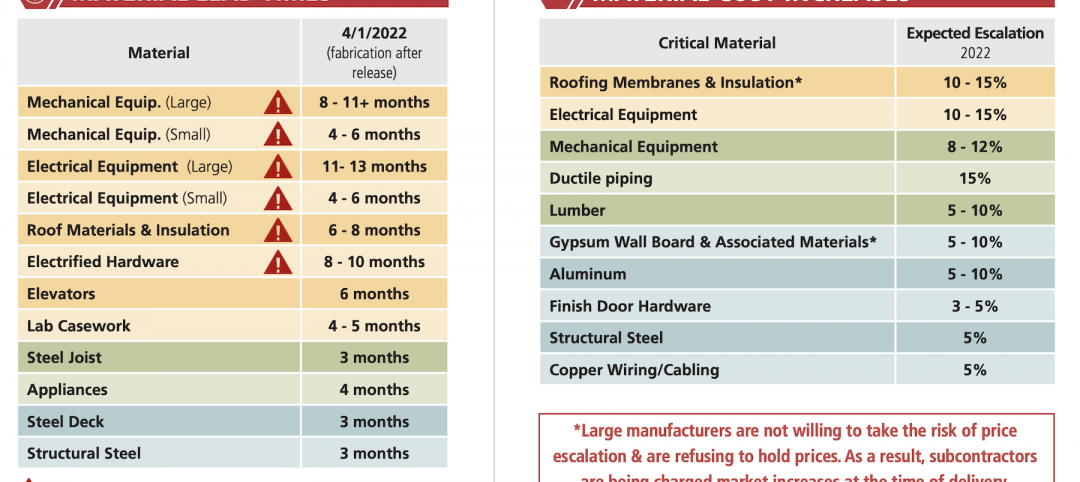

Contractors are facing multiple challenges. Seventy-two percent of survey respondents reported that available job candidates were not qualified. Three-quarters of the firms reported projects were delayed due to longer lead times or shortages of materials, while 57% reported delivery delays.

Association officials called on officials in Washington to address both immediate and long-term needs for the construction industry. They urged lawmakers to finish work on the Senate-passed infrastructure bill and provide more funding for career and technical education programs that will attract and prepare more people for high-paying careers in construction.

“Contractors are eager to hire more workers but they need Washington officials to make sure there is enough funding for vitally needed infrastructure to justify hiring,” said Stephen E. Sandherr, the association’s chief executive officer. “In addition, more federal money should be going into preparing workers to execute these projects.”

Click here for the association’s survey results.

Related Stories

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

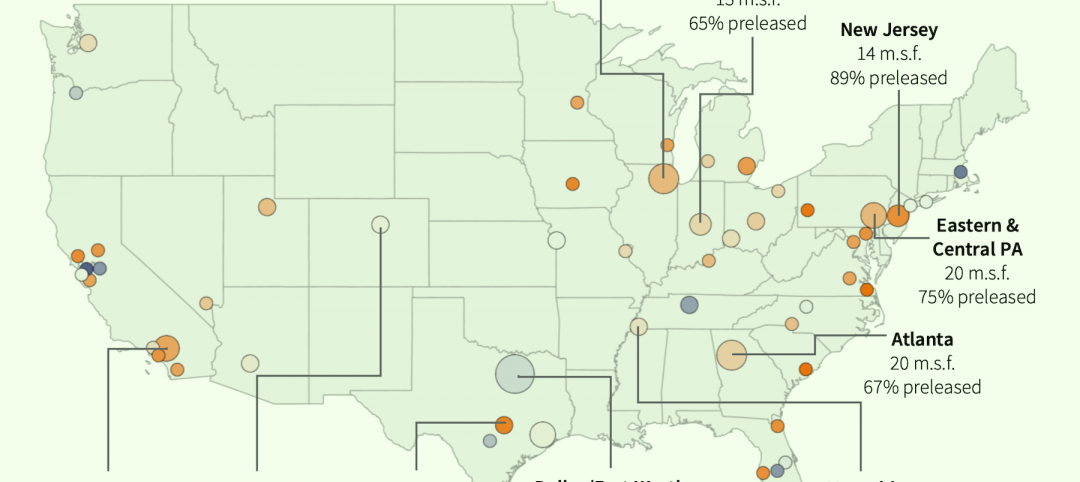

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.