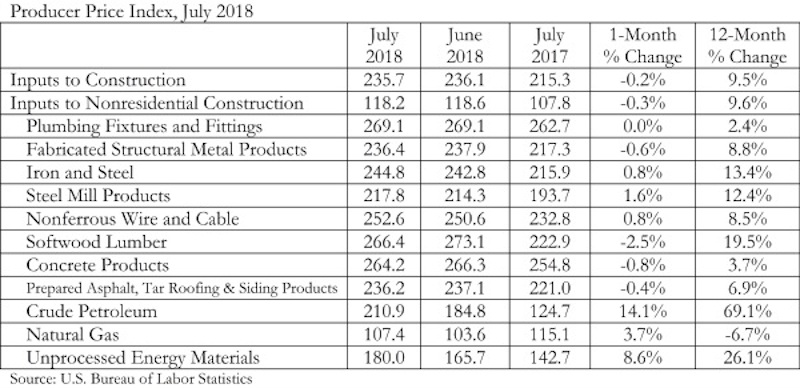

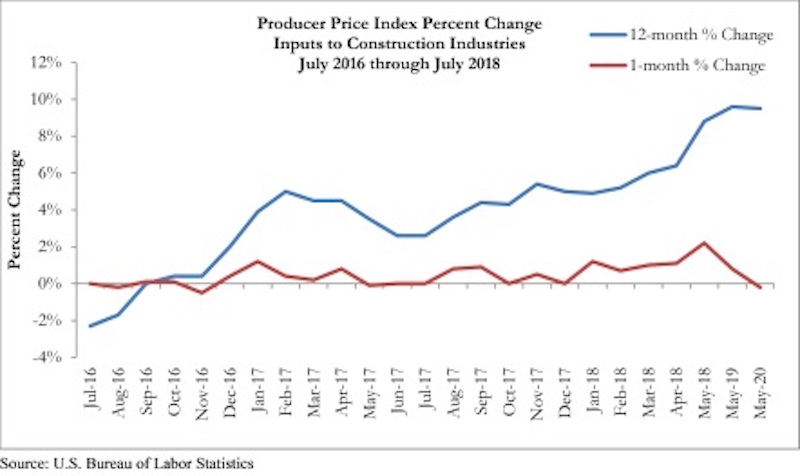

Prices for inputs to construction fell 0.2% in July but are 9.5% higher than a year ago, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today. Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year. Softwood lumber prices are up 19.5% from July 2017, while iron and steel prices are up 13.4%.

“The monthly decline in construction input prices registered in July represents a departure from the recent trend,” said ABC Chief Economist Anirban Basu. “As is often the case, the question for the economist is how much weight to place on the most recent data point.

“In this instance, placing significant weight on July's PPI release would be equivalent to suggesting that the surge in materials prices has ended,” said Basu. “Putting less weight on the most recent bit of data means that July represents a statistical aberration, and that prices will rise in ways similar to the period preceding July.

“Given the ongoing strength of the U.S. construction sector and ongoing trade tussles, it would be difficult to conclude that the rise in materials prices is over,” said Basu. “It may be the case, however, that the pace of increase in materials prices is set to slow as suppliers ramp up production of key inputs in the wake of higher prices and as the U.S. dollar remains strong. In any case, it is far too early for estimators, chief financial officers and others to conclude that the construction input inflation cycle is over.”

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.