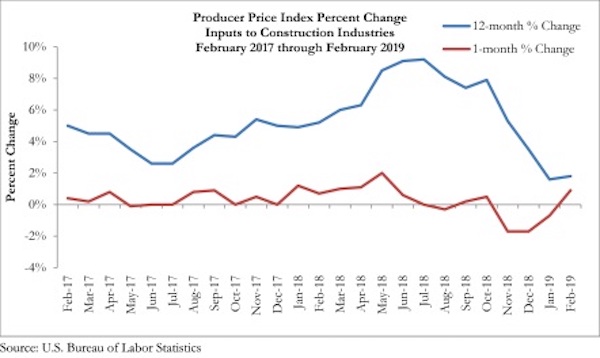

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction input prices rose 0.9% monthly in February and 1.8% in the past 12 months. Inputs to nonresidential construction were up 1% on a monthly basis and 2.7% on a yearly basis. This is the first time that input prices have risen on a monthly basis since October 2018, when prices increased by 0.5%.

Of the 11 construction subcategories, seven experienced price declines for the month, with the largest decreases in natural gas (-25.8%) and unprocessed energy materials (-10.7%). The largest monthly increases in prices were seen in softwood lumber (+4.8%) and crude petroleum (+2.6%).

“While the monthly increase in materials prices was quite substantial, it makes more sense to focus on the year-over-year statistics,” said ABC Chief Economist Anirban Basu. Several factors were at work when materials prices were expanding very rapidly, including a synchronized global expansion and the initial effects of tariffs on items such as steel, aluminum and softwood lumber. At the time, year-over-year increases in materials prices were routinely in the double digits in percentage terms.

“Today, the annualized increase in materials prices is less than 2%, despite the data characterizing February,” said Basu. Some of this is explained by the dip in oil prices during the past year, which is due in part to a softening global economy and a significant increase in U.S. oil production. However, other key construction materials prices also have declined during the last 12 months, including natural gas, nonferrous wire and cable and softwood lumber.

“With the global economy continuing to weaken, it is unlikely that materials prices will surge in the near term, despite a still very active U.S. nonresidential construction sector,” said Basu. “It is quite conceivable that much of the monthly increase in materials prices registered in February was associated with unusually severe winter weather in much of the nation. Difficulties involving transportation, for instance, have a tendency to push purchase prices higher. The implication is that the monthly increase registered in February will probably not be repeated in March and April.”

Related Stories

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.