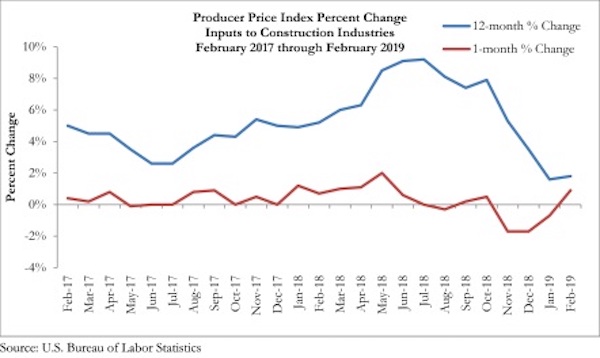

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction input prices rose 0.9% monthly in February and 1.8% in the past 12 months. Inputs to nonresidential construction were up 1% on a monthly basis and 2.7% on a yearly basis. This is the first time that input prices have risen on a monthly basis since October 2018, when prices increased by 0.5%.

Of the 11 construction subcategories, seven experienced price declines for the month, with the largest decreases in natural gas (-25.8%) and unprocessed energy materials (-10.7%). The largest monthly increases in prices were seen in softwood lumber (+4.8%) and crude petroleum (+2.6%).

“While the monthly increase in materials prices was quite substantial, it makes more sense to focus on the year-over-year statistics,” said ABC Chief Economist Anirban Basu. Several factors were at work when materials prices were expanding very rapidly, including a synchronized global expansion and the initial effects of tariffs on items such as steel, aluminum and softwood lumber. At the time, year-over-year increases in materials prices were routinely in the double digits in percentage terms.

“Today, the annualized increase in materials prices is less than 2%, despite the data characterizing February,” said Basu. Some of this is explained by the dip in oil prices during the past year, which is due in part to a softening global economy and a significant increase in U.S. oil production. However, other key construction materials prices also have declined during the last 12 months, including natural gas, nonferrous wire and cable and softwood lumber.

“With the global economy continuing to weaken, it is unlikely that materials prices will surge in the near term, despite a still very active U.S. nonresidential construction sector,” said Basu. “It is quite conceivable that much of the monthly increase in materials prices registered in February was associated with unusually severe winter weather in much of the nation. Difficulties involving transportation, for instance, have a tendency to push purchase prices higher. The implication is that the monthly increase registered in February will probably not be repeated in March and April.”

Related Stories

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

Designers | Dec 25, 2023

Redefining the workplace is a central theme in Gensler’s latest Design Report

The firm identifies eight mega trends that mostly stress human connections.

Contractors | Dec 12, 2023

The average U.S. contractor has 8.5 months worth of construction work in the pipeline, as of November 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.