Construction employment increased from May to June in 31 states and the District of Columbia, but the gains may have stalled, according to an analysis by the Associated General Contractors of America of government employment data released today and a compilation of weekly jobsite hours by construction technology firm Procore. Association officials urged officials in Washington to promptly enact funding for infrastructure projects and plug looming state and local budget deficits to head off a new round of job losses.

“The widespread job gains in June follow even more universal increases in May,” said Ken Simonson, the association’s chief economist. “But the government’s employment snapshot was based on payrolls during the week of June 12. More recent data collected by Procore on hours worked on jobsites suggests employment topped out around mid-June and may have begun to decline.”

Simonson observed that users of Procore’s software record the number of hours worked each week on their construction job sites. Procore reported that jobsite hours reached a peak of 15.1 million during the week of June 7-13. Since then, preliminary totals have slipped, to 15.0 million during the week of June 14-20 and 14.6 million during the week of June 21-27.

Procore has been mapping total jobsite hours in each state since the week of March 1, around the time of the initial restrictions on businesses in some states. Jobsite hours have increased in most states as shutdown orders were relaxed and the weather grew more favorable for construction in many locations. Nevertheless, in 12 states Procore users logged fewer jobsite hours in late June than in early March, Simonson noted.

New York added the most construction jobs from May to June (42,000 jobs or 14.2%). Massachusetts had the largest percentage increase (16.3%, 19,700 construction jobs). Construction employment declined from May to June in 18 states and was unchanged in Alaska. Louisiana lost the most construction jobs (-3,900 jobs, -3.1%). Nevada had the highest percentage loss (-3.5%, -3,500 jobs).

From June 2019 to June 2020, construction employment increased in 15 states, decreased in 34 states and D.C., and held steady in Wyoming. Utah added the most construction jobs over the year (10,200 jobs, 9.4%). South Dakota had the largest percentage increase (13.7%, 3,200 jobs). Both states set all-time highs, in records dating to 1990. New York lost the most construction jobs over the year (68,300 jobs, -16.8%). The largest percentage decline occurred in Vermont (-29.4%, -4,500 jobs).

Association officials warned that recent flare-ups of coronavirus across most states mean there will soon be more project cancellations, forcing contractors to lay off workers again. They urged Congress and the Trump administration to promptly enact new infrastructure funding measures and backfill the massive budget gaps that have opened in state and local government budgets, so that public construction does not decline precipitously.

“Only the federal government has the means to keep infrastructure and other needed public construction on track,” said Stephen E. Sandherr, the association’s chief executive officer. “It would be tragic to miss the opportunity to support the economy, keep thousands of construction employees at work, and invest in much-needed upgrades to roads, transportation facilities, water and sewer systems.”

View the state employment data, 12-mo, 1-mo rankings, map and high and lows. Click here for Procore’s data.

Related Stories

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

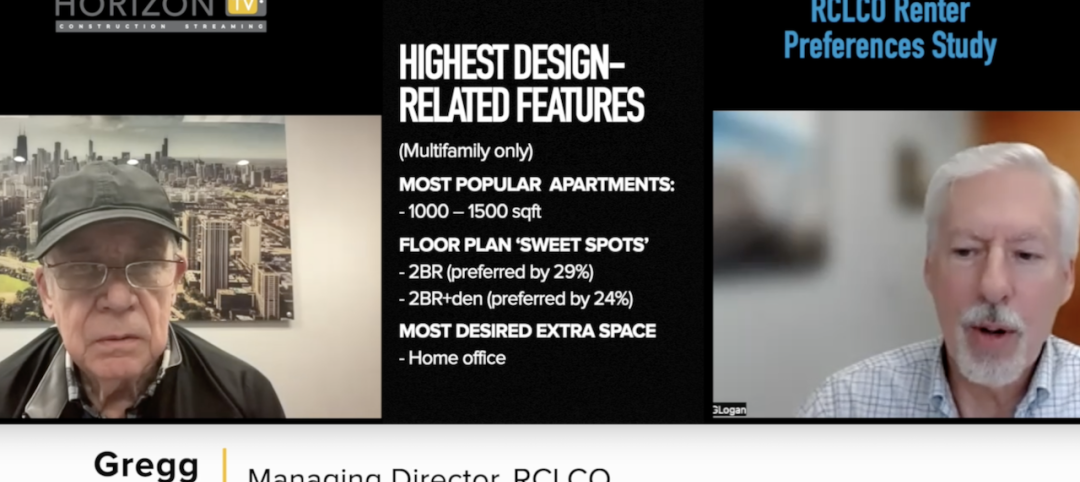

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

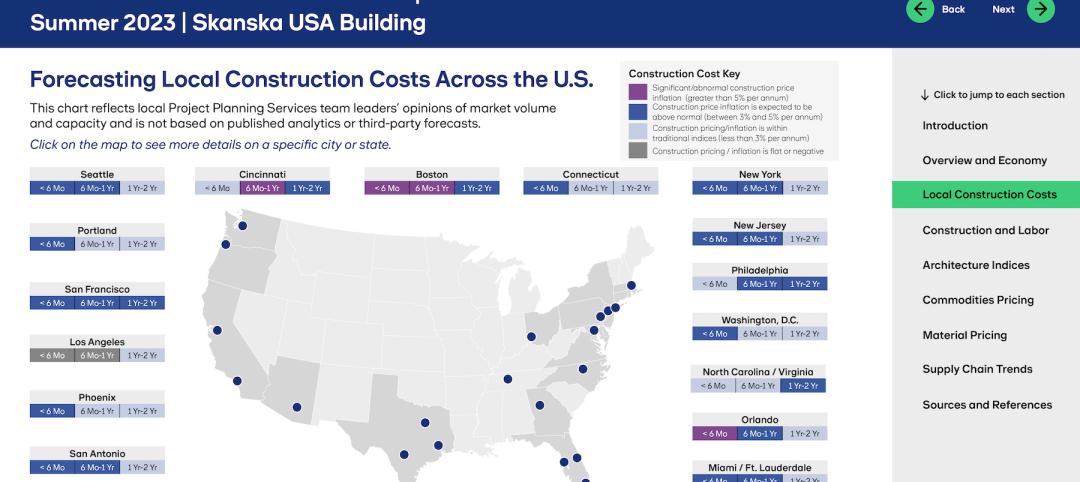

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.