Construction employment declined in 99 out of 358 metro areas from March 2019 to last month as the coronavirus pandemic triggered the first shutdown orders and project cancellations, according to an analysis released by the Associated General Contractors of America today. Association officials urged federal and state officials to boost investments in infrastructure to help put more people to work amid rising unemployment levels.

“These new figures foreshadow even larger declines in construction employment throughout the country as the pandemic’s economic damage grows more severe,” said Ken Simonson, the association’s chief economist. “Unfortunately, the data for April and later months are sure to be much worse. In our latest survey, more than one-third of firms report they had furloughed or terminated workers—a direct result of growing cancellations.”

The largest percentage decline in construction employment between March 2019 and last month occurred in Laredo, Texas, which lost 19% or 800 jobs, followed by Lake Charles, La., which lost 18% (4,600 construction jobs). Lake Charles had the largest numerical decrease, followed by New York City, which lost 3,500 construction jobs (2%).

Construction employment increased over the year in 205 metro areas and was flat in 54. The largest percentage increases in construction employment occurred in Lewiston, Idaho-Wash. (23%, 300 jobs), followed by Walla Walla, Wash. (22%, 22 jobs). The largest numerical gain occurred in Dallas-Plano-Irving, Texas (10,200 jobs, 7%).

Association officials noted that new infrastructure investments would help offset some of the sudden and dramatic declines to demand for construction that have taken place since the start of the coronavirus pandemic. They noted, for example, that 68% of construction firms report in the association’s April 20-23 survey that they have had projects cancelled or delayed during the past two months.

“New infrastructure funding will put more people back to work in high-paying construction jobs in communities throughout the nation,” said Stephen E. Sandherr, the association’s chief executive officer. “New infrastructure funding will also give a needed boost to manufacturing and service sector firms that supply construction employers, all of which have been hard-hit by the coronavirus and the related economic shutdowns.”

View AGC’s coronavirus resources and survey. View comparative data here. View the metro employment data, rankings, highs and lows and top 10.

Related Stories

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

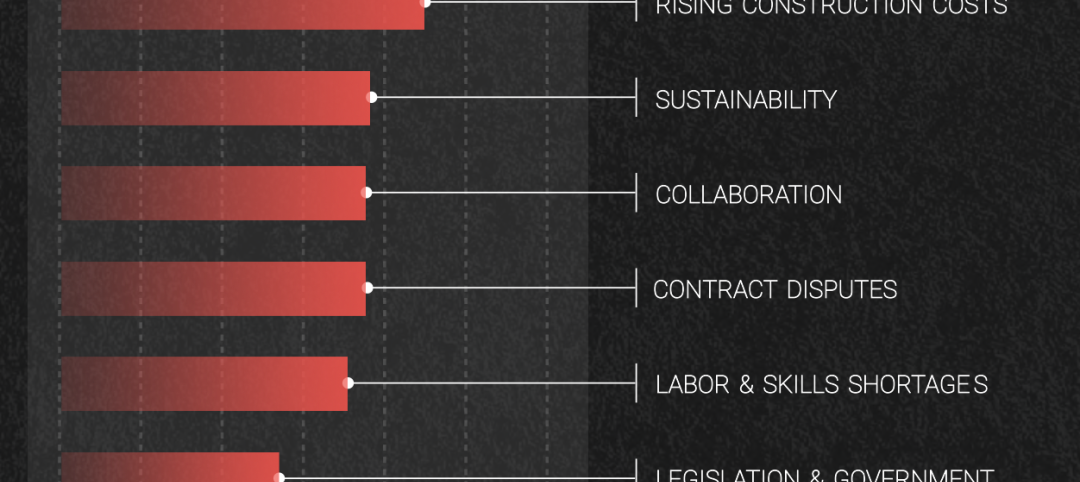

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.