Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

Multifamily Housing | Aug 9, 2017

Multifamily developers, designers cater to occupants’ need for mobility

Bike storage facilities and “bicycle kitchens” are among the most popular mobility amenities in multifamily developments, according to a new survey by Multifamily Design + Construction magazine.

Giants 400 | Aug 9, 2017

Innovation at 72 design firms

The following is a list of advancements architecture and A/E firms underwent in 2016, as reported in Building Design+Construction's 2017 Giants 300 Report.

Contractors | Aug 7, 2017

A Wisconsin contractor takes a personal approach to getting employees to achieve their full potential

Miron Construction’s “Dream Project” helps remove obstacles to self actualization.

Contractors | Aug 4, 2017

4 ways to prepare for a negotiation

Practice, practice, practice, and understanding both sides of the deliberation are critical to success in any negotiation.

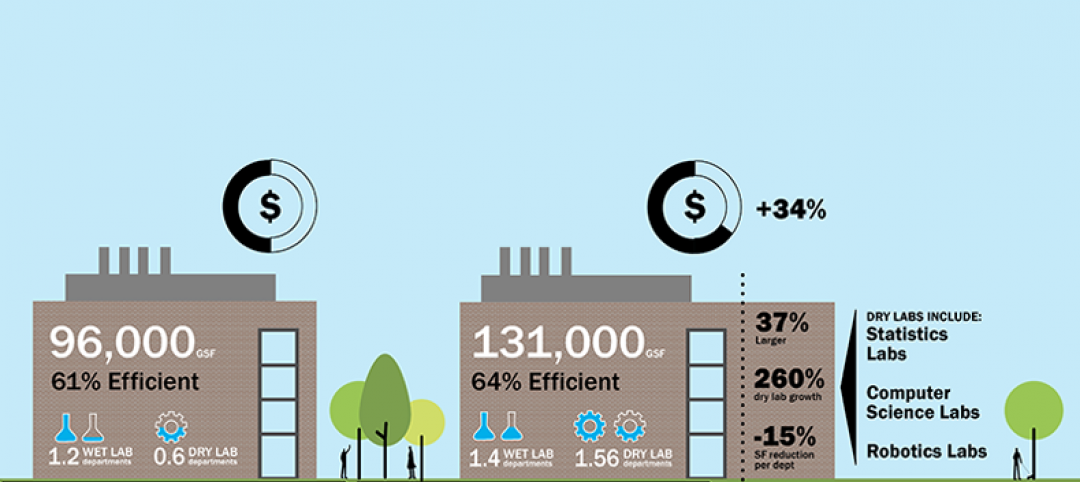

Laboratories | Aug 3, 2017

Today’s university lab building by the numbers

A three-month study of science facilities conducted by Shepley Bulfinch reveals key findings related to space allocation, size, and cost.

Lighting | Aug 2, 2017

Dynamic white lighting mimics daylighting

By varying an LED luminaire’s color temperature, it is possible to mimic daylighting, to some extent, and the natural circadian rhythms that accompany it, writes DLR Group’s Sean Avery.

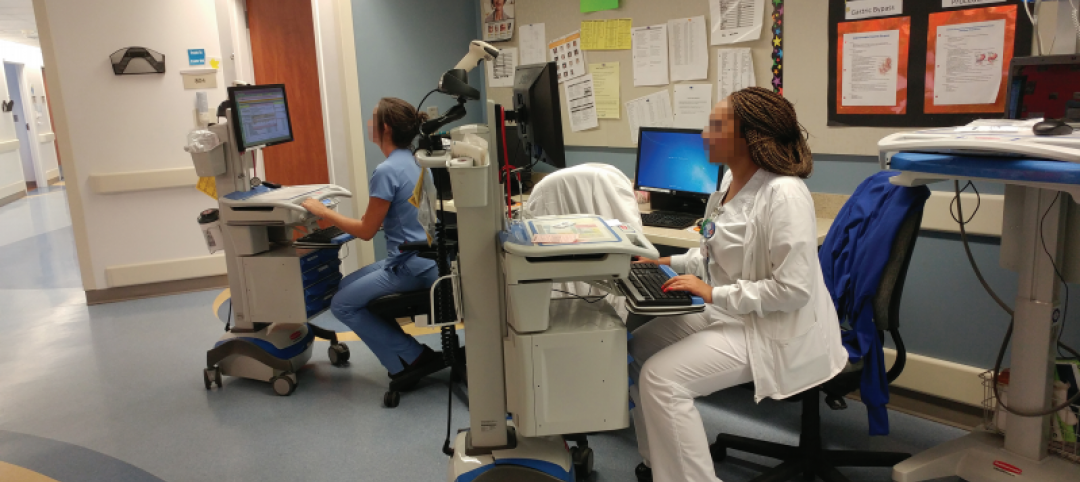

Healthcare Facilities | Aug 2, 2017

8 healthcare design lessons from shadowing a nurse

From the surprising number of “hunting and gathering” trips to the need for quiet spaces for phone calls, interior designer Carolyn Fleetwood Blake shares her takeaways from a day shadowing a nurse.

High-rise Construction | Aug 1, 2017

Construction on the world’s skinniest tower halts due to ballooning costs

The planned 82-story tower has stalled after completing just 20 stories.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.