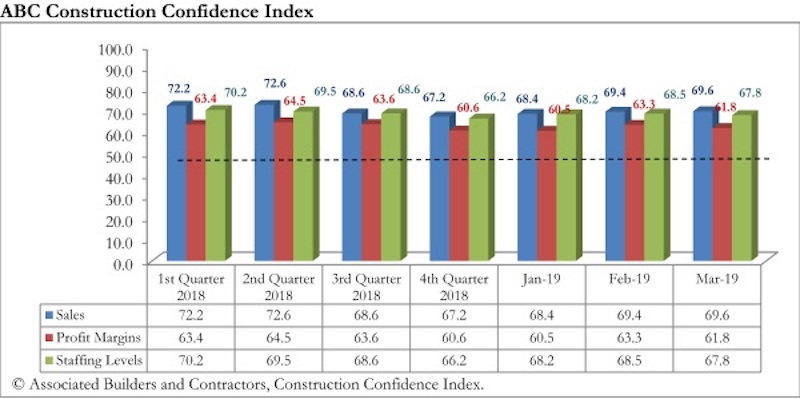

Construction industry leaders remained upbeat with respect to nonresidential construction prospects in March 2019, according to the latest Construction Confidence Index released today by Associated Builders and Contractors.

All three principal components measured by the survey—sales, profit margins and staffing levels— remained well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity. While contractors are slightly less upbeat regarding profit margins and staffing levels than in February, more than 70% of contractors expect to increase staffing levels over the next six months, a reflection of continued elevated demand for construction services. Despite rising wage pressures, more than 56% of survey respondents anticipate rising profit margins, an indication that users of construction services remain willing to pay more to get projects delivered.

- The CCI for sales expectations increased from 69.4 to 69.6 in March.

- The CCI for profit margin expectations fell from 63.3 to 61.8.

- The CCI for staffing levels fell from 68.5 to 67.8.

“Last year, the U.S. economy grew 2.9%, and it expanded an additional 3.2% during the first quarter of 2019,” said ABC Chief Economist Anirban Basu. “All of this is consistent with the notion that demand for nonresidential construction services will remain elevated for the foreseeable future. The CCI findings are also consistent with ABC’s latest Construction Backlog Indicator report, which revealed that many contractors have a growing number of projects in their pipeline.

“A major source of influence on the data is the reemergence of public construction spending,” said Basu. “With nearly 10 years of economic expansion complete, many state and local governments are experiencing their best fiscal health in years, resulting in more funds to invest in roads, transit systems, schools, fire stations and police stations. The combination of spending growth in certain private construction categories and rising infrastructure outlays will keep the average American nonresidential contractor scrambling to retain and recruit workers, especially in the context of a national rate of unemployment effectively at a 50-year low.

“It should be noted that the most recent CCI survey was completed prior to the turmoil associated with the trade dispute between the United States and China, which may impact contractor confidence,” said Basu. “While global investors have exhibited concern, most construction activity involves U.S.-based enterprises providing services to U.S.-based customers, minimizing unease. That said, the imposition of tariffs has the potential to raise costs of equipment and other inputs, which could at least conceivably impact profit margins. Moreover, market turmoil can truncate the availability of financing to prospective construction projects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

ABC Construction Confidence Index, March 2019

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

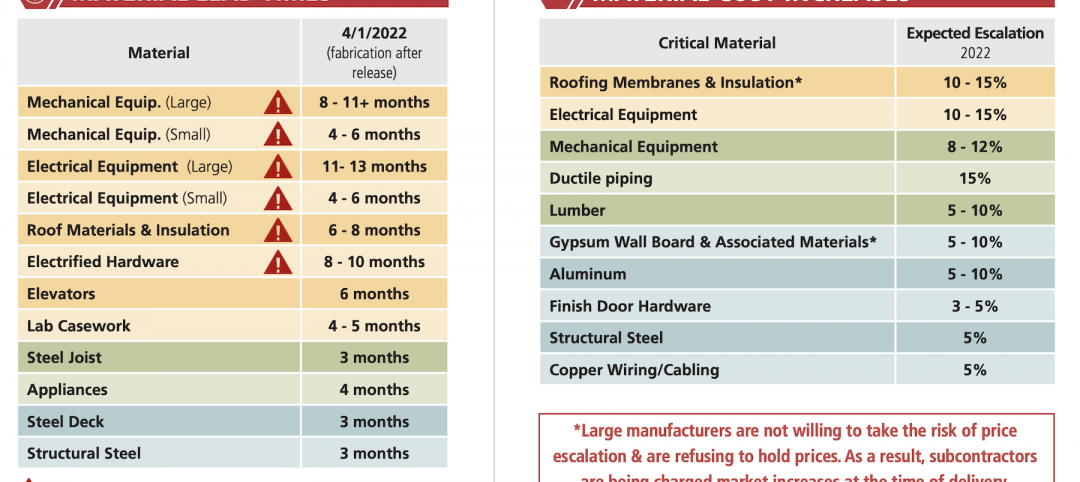

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

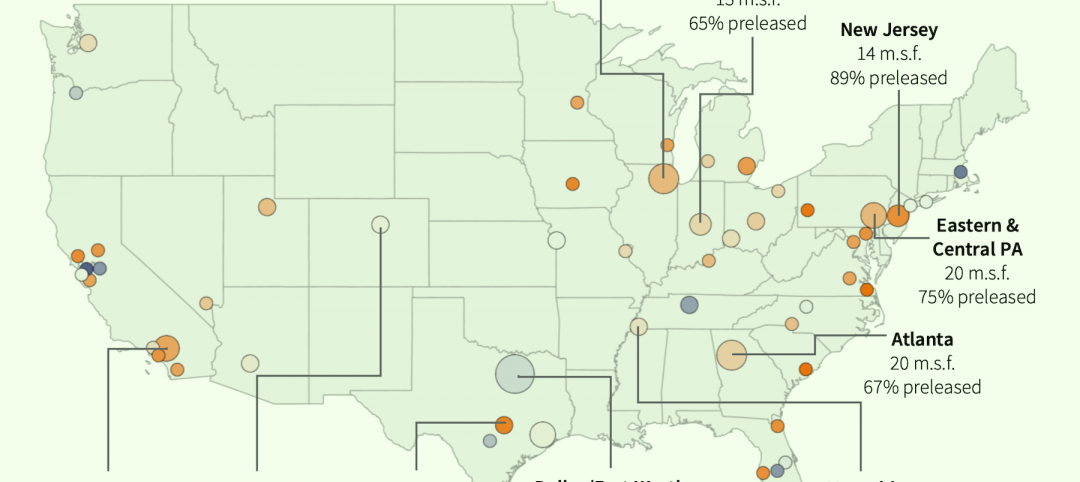

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment