The American Institute of Architects has issued its triennial Survey Report of Firm Characteristics, “The Business of Architecture,” which documents the devastation that the economic recession brought down on the U.S. construction industry, specifically the architecture profession. It’s not a pretty picture.

As if you were unaware, the years 2008 to 2011 wrought havoc on the finances of architecture firms. Jobs at architecture firms actually grew 18% from 2003 to 2007 and continued to grow through mid-2008, but then the bottom fell out and more than 28% of positions at architecture firms vanished. From 2007 to 2011, payrolls in the overall construction sector declined by more than 2.1 million, nearly 28%, thanks largely to the tanking of the residential market.

Total construction spending (including homebuilding and public works projects like roads and bridges, along with commercial, industrial, and institutional buildings) dropped more than 20%, from $1 trillion in 2008 to below $800 billion in 2011. During the same period, gross revenues at architecture firms took an even bigger hit, plummeting more than 40%, from $44 billion in 2008 to $26 billion in 2011.

The $787 billion infusion from the American Recovery and Reinvestment Act, the great bulk of which went to “shovel-ready” infrastructure projects like highways, propped up the heavy construction sector for awhile, but very little stimulus money benefited architecture firms.

One way architecture firms tried to fight back during the recession was to expand their services. Even though virtually all firms had to lay off staff, more firms reported that they were offering new services, notably sustainable design, planning, interior design, and space planning.

Thirty-six percent of design firms also categorized themselves as “multidisciplinary”—a full 10 percentage points over the previous decade. The AIA report does not provide any data on how successful firms were in implementing these new service lines, or whether being more multidisciplinary improved the bottom line.

The most telling finding of “The Business of Architecture” is how much the profession of architecture is split between the haves and the have-nots and how much it remains a cottage industry. More than one in four architects (26%) are sole practitioners; four of five architecture firms (81%) have less than 10 employees. Firms of 1-9 employees account for 28% of architects, but bring in only 21% of billings.

From the reverse perspective, firms of 10 or more employees account for just 19% of all architecture firms, but employ 72% of all U.S. architects—and account for 79% of all billings.

More to the point, the giant firms—those with 50 or more employees—account for 37% of staff and 43% of billings, even though they represent only 3% of all firms. Large firms (50 or more employees) also produce nearly double the net revenue per employee of small firms—$136,000–138,000 per employee at the giants, vs. $70,000 for sole practitioners and $74,000 for firms with 2-4 employees.

The AIA report does not provide data on profitability, so it is possible that some small firms are more nimble and entrepreneurial and can manage their overhead costs better than large firms. Midsize firms (20-49 employees) also seem to be quite competitive, producing net revenues of $132,000 per employee.

But that 2-to-1 ratio in billings probably argues against too many of the Davids knocking out the Goliaths in head-to-head competition. +

More from Author

Rob Cassidy | Mar 30, 2020

Your turn: Has COVID-19 spelled the death knell for open-plan offices?

COVID-19 has designers worrying if open-plan offices are safe for workers.

Rob Cassidy | Mar 25, 2020

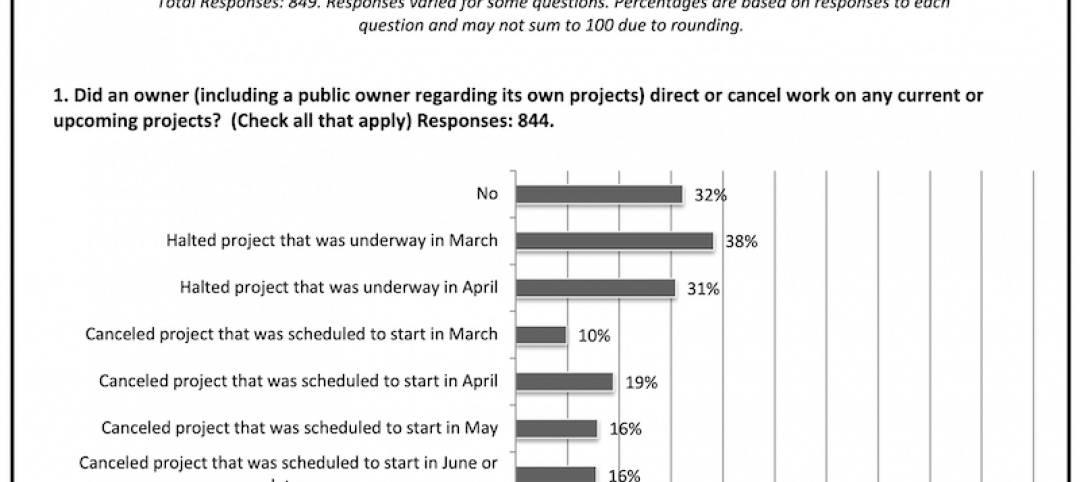

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Coronavirus pandemic's impact on U.S. construction, notably the multifamily sector - 04-30-20 update

Rob Cassidy | Nov 20, 2019

Word of the Year: "climate emergency," says the Oxford English Dictionary

The Oxford Word of the Year 2019 is climate emergency.

Rob Cassidy | Nov 8, 2019

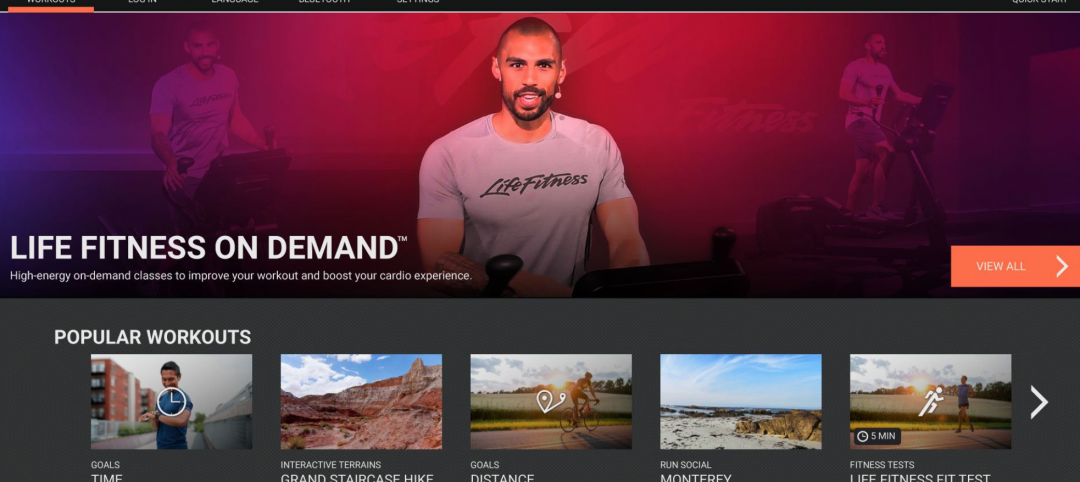

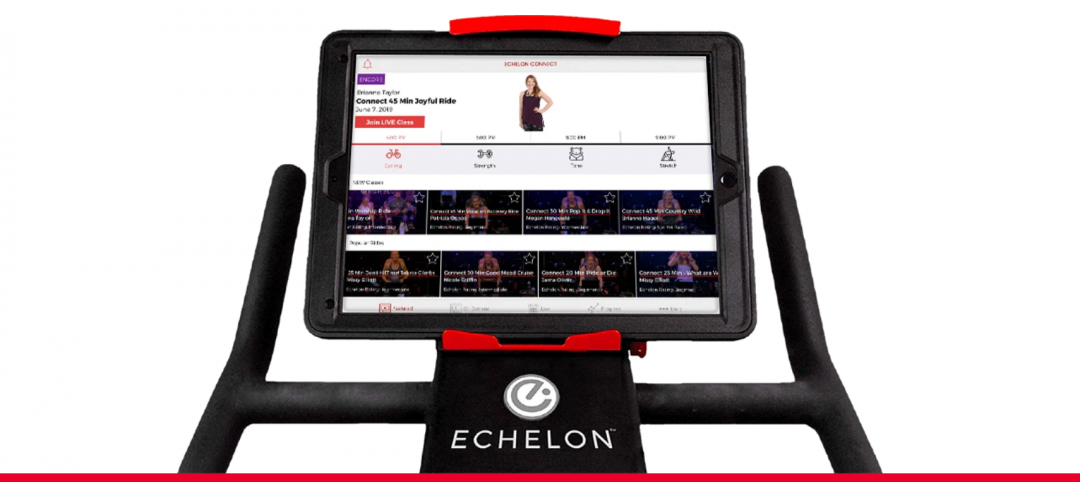

The Peloton Wars, Part III - More alternatives for apartment building owners

ProForm Studio Bike Pro review.

Rob Cassidy | Nov 1, 2019

Do car-free downtown zones work? Oslo, yes; Chicago, no

Two recent reports (October 2019) explore whether car-free downtowns really work, based on experience in Oslo, Norway, and Chicago.

Rob Cassidy | Oct 9, 2019

Multifamily developers vs. Peloton: Round 2... Fight!

Readers and experts offer alternatives to Peloton bicycles for their apartment and condo projects.

Rob Cassidy | Sep 4, 2019

Peloton to multifamily communities: Drop dead

Peloton will no longer sell its bikes to apartment communities.