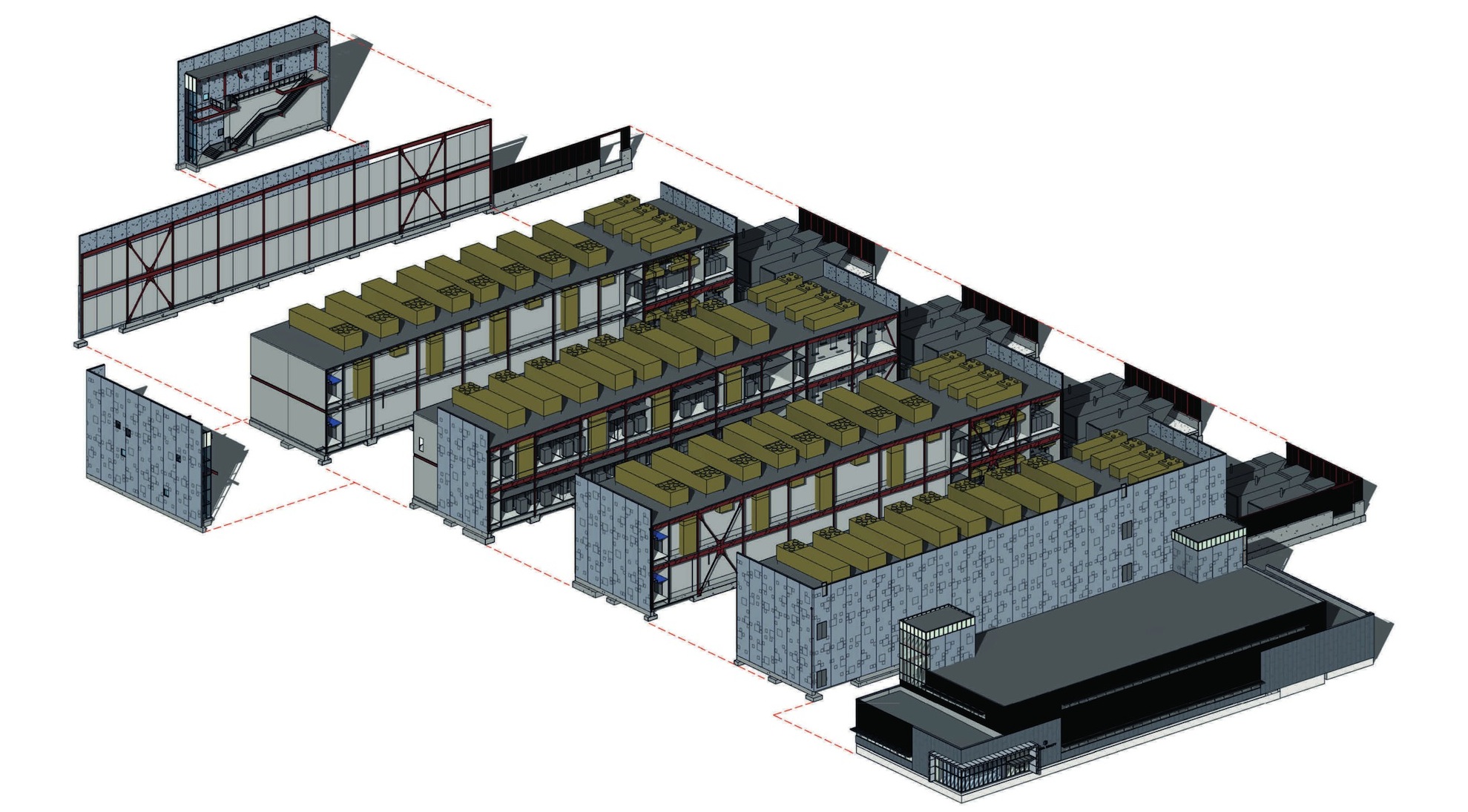

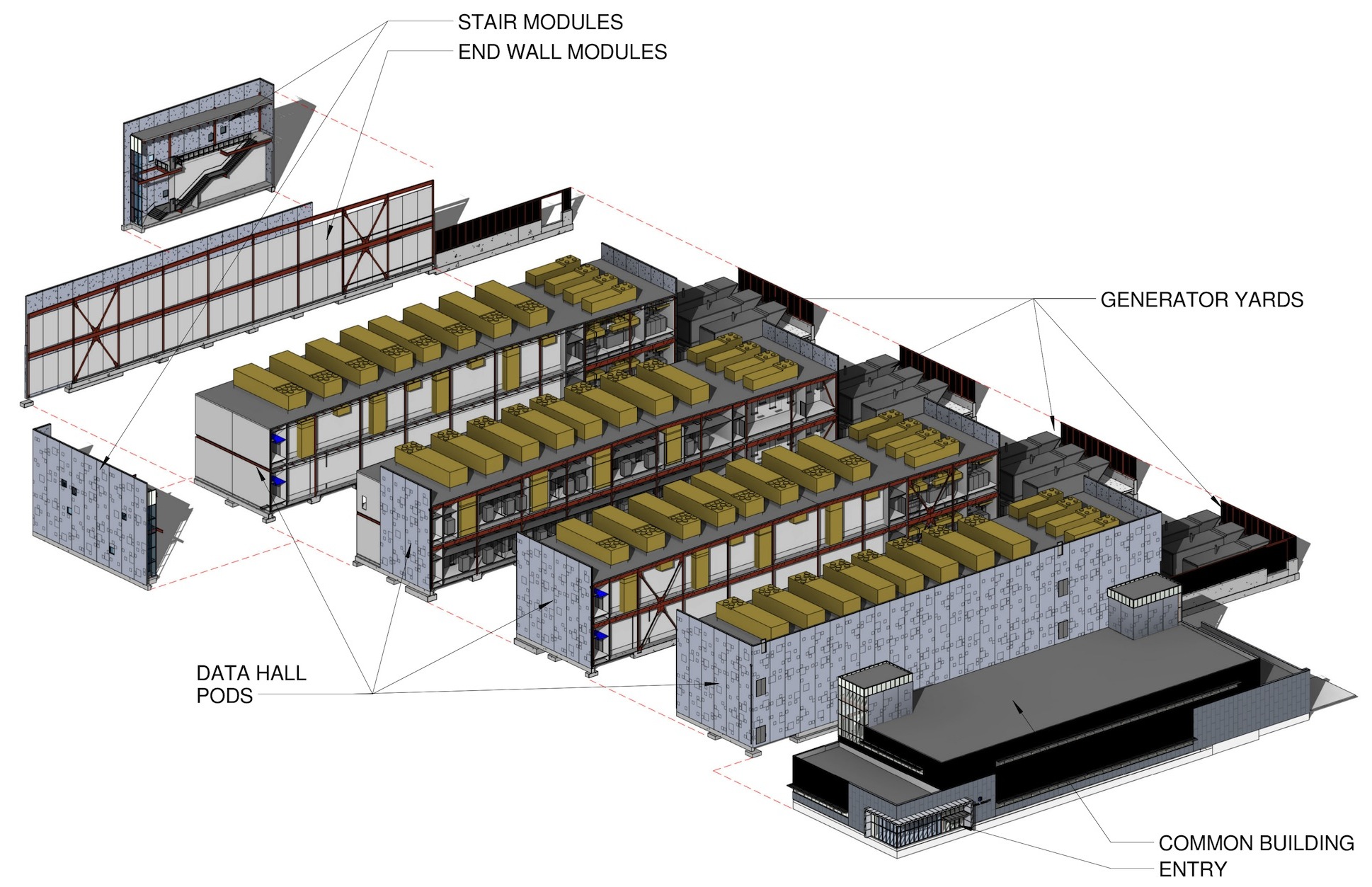

Rendering depicts a two-story, four-pod prototype assembly with an attached common building

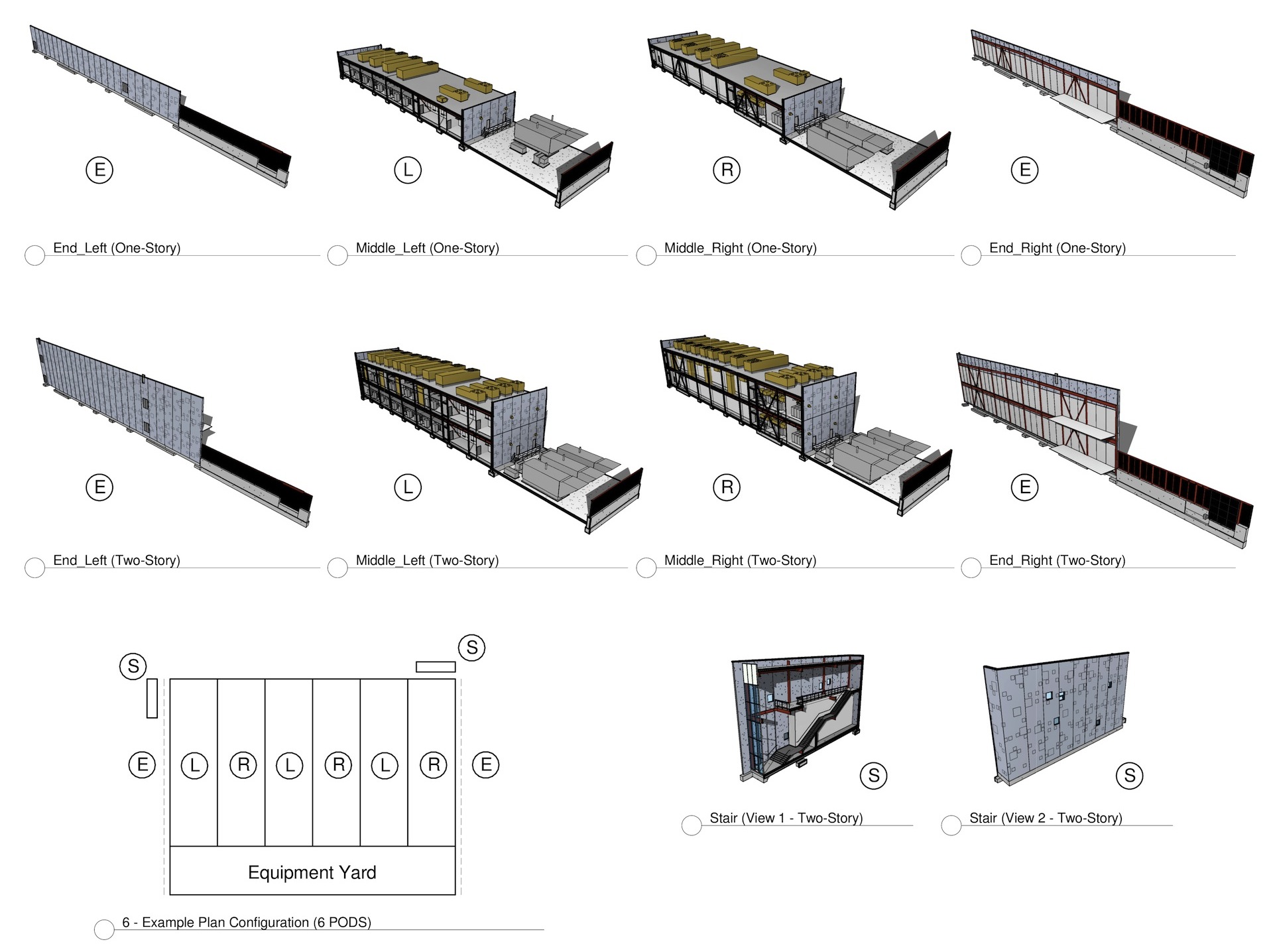

Individual components of one-story and two-story pod configurations

Related Stories

Women in Design+Construction | Jan 25, 2024

40 Under 40 Class of 2023 winner Kimberly Dowdell inaugurated as AIA 2024 President

The American Institute of Architects (AIA) has announced the inauguration of Kimberly Dowdell, AIA, NOMAC, NCARB, LEED AP BD+C, Principal and Director of Strategic Relationships at HOK and BD+C 40 Under 40 superstar, as its 100th president.

Senior Living Design | Jan 24, 2024

Former Walgreens becomes affordable senior living community

Evergreen Real Estate Group has announced the completion of Bellwood Senior Apartments. The 80-unit senior living community at 542 25th Ave. in Bellwood, Ill., provides independent living options for low-income seniors.

AEC Tech | Jan 24, 2024

4 ways AEC firms can benefit from digital transformation

While going digital might seem like a playground solely for industry giants, the truth is that any company can benefit from the power of technology.

Giants 400 | Jan 23, 2024

Top 60 Parking Structure Architecture Firms for 2023

Choate Parking Consultants, Page Southerland Page, Gensler, AO, and Elkus Manfredi Architects top BD+C's ranking of the nation's largest parking structure architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Giants 400 | Jan 23, 2024

Top 110 Medical Office Building Architecture Firms for 2023

SmithGroup, CannonDesign, E4H Environments for Health Architecture, and Perkins Eastman top BD+C's ranking of the nation's largest medical office building architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 22, 2024

Top 100 Outpatient Facility Architecture Firms for 2023

HDR, CannonDesign, Stantec, Perkins&Will, and ZGF top BD+C's ranking of the nation's largest outpatient facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes design revenue for work related to outpatient medical buildings, including cancer centers, heart centers, urgent care facilities, and other medical centers.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Transit Facilities | Jan 22, 2024

Top 40 Transit Facility Architecture Firms for 2023

Perkins&Will, HDR, Gensler, Skidmore, Owings & Merrill, and HNTB top BD+C's ranking of the nation's largest transit facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes design revenue for work related to bus terminals, rail terminals, and transit stations.

Hotel Facilities | Jan 22, 2024

U.S. hotel construction is booming, with a record-high 5,964 projects in the pipeline

The hotel construction pipeline hit record project counts at Q4, with the addition of 260 projects and 21,287 rooms over last quarter, according to Lodging Econometrics.