“While the COVID-19 pandemic taught new lessons about the quick and safe delivery of critical vaccines, the global shock is only now being understood.” That’s the opening observation of the 98-page 2022 Life Sciences Report, published by the AC firm CRB and based on responses from nearly 500 industry leaders, which explores this industry sector’s R&D and growth strategies.

This is CRB’s third Horizons report, and its first to include Europe, where many of the industry’s leading organizations are paving the way through innovation, groundbreaking research, and new and dynamic ways of speeding therapies to patients.

CRB is seeing a rapidly maturing industry that’s in pursuit of more diversification. “The days of single-product specialization are receding,” the report states, as companies large and small are utilizing a wide array of tools to expand their pipeline and address diverse indications.

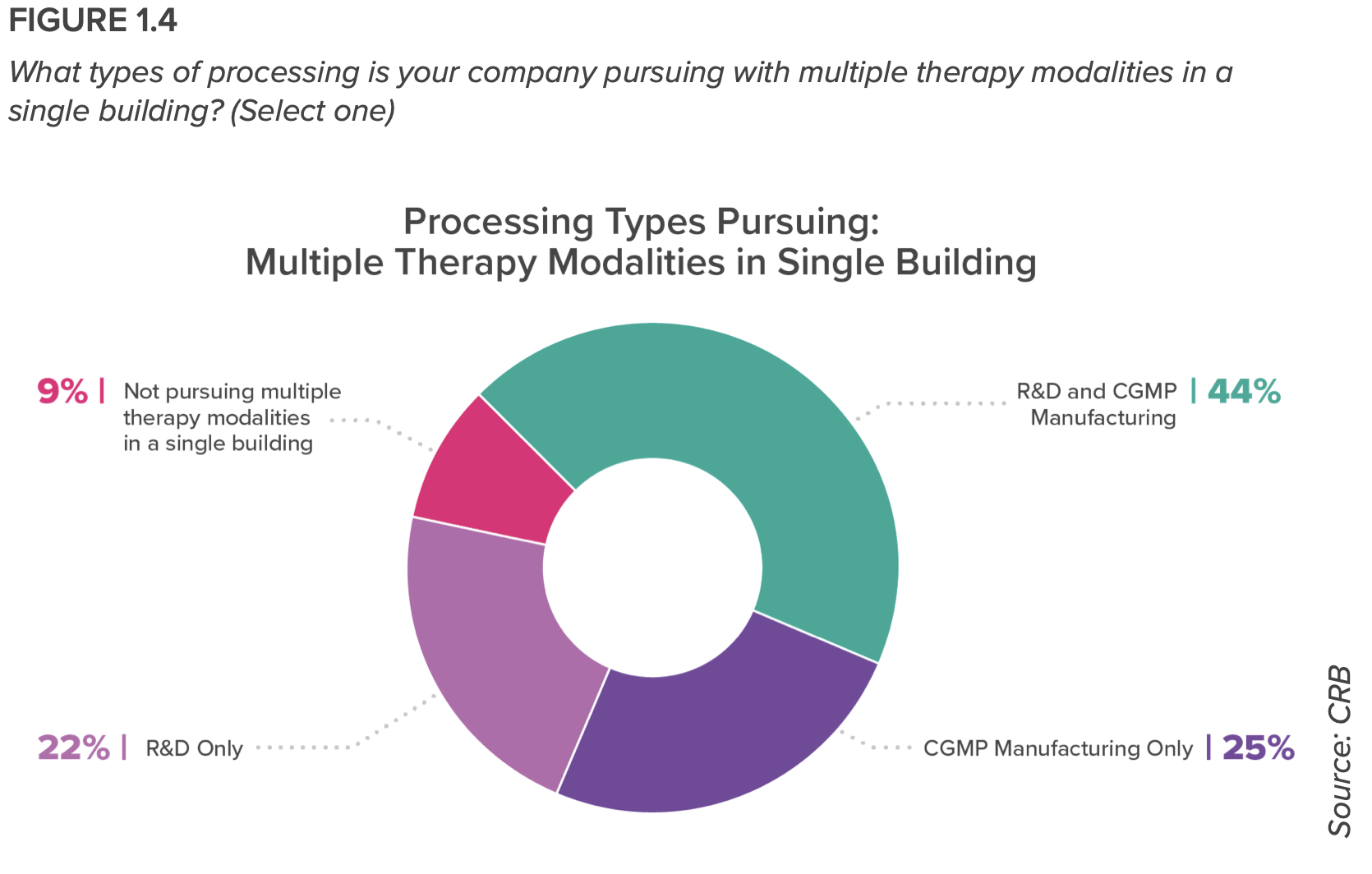

Nearly all respondents (90%) are developing and manufacturing multiple therapy modalities in a single building, or plan to do so in the future. And more than half of the respondents plans to rely on contract development and manufacturing organizations (CDMOs) over the next three years. “We’re seeing a rise in hybrid models—that is, owners who are offering their in-house manufacturing expertise for hire,” the report states.

As such, the nature of in-demand talent is changing, as companies mature towards more automated, AI-driven manufacturing models, with the traditional C-suite expanding to include roles previously unseen in this industry, such as “Chief Data Officer.”

Cell therapies emerge as dynamic submarket

Cell therapies emerge as dynamic submarket

CRB divides its report into eight chapters, each with contextualized perspectives. Those chapters found that:

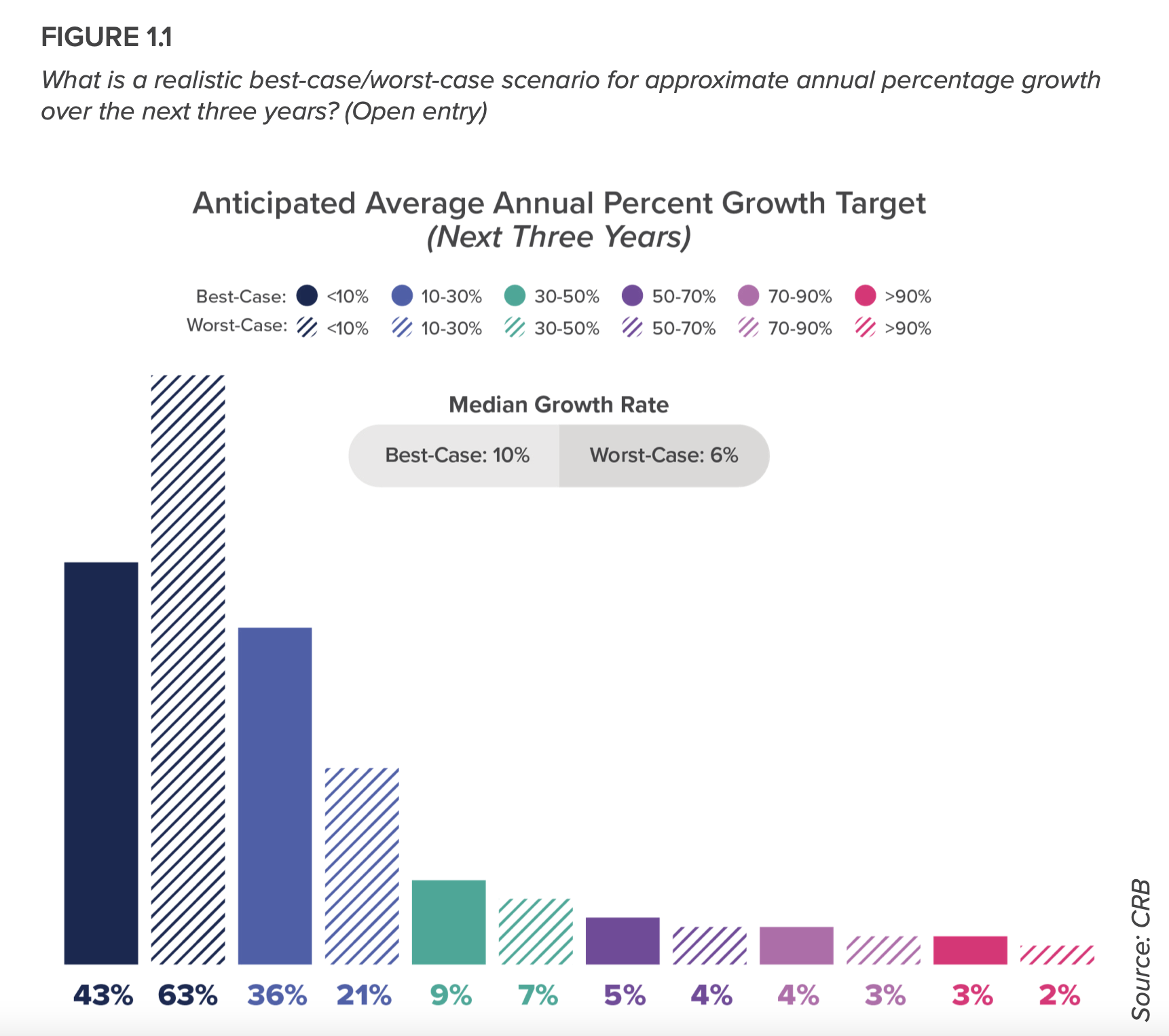

- Since the pandemic, companies have adopted an optimistic but more cautious approach to ongoing research and discovery. That means carefully weighing risks and rewards of capital spending and pipeline expansion while continuously pushing for new and exciting discoveries.

- Ribonucleic acid (RNA) technologies have catapulted into the spotlight because of COVID. In addition to preventing infectious diseases, these technologies—using non-coding and coding RNA—can be harnessed to treat other conditions, like cancer. When compared to other biologics, RNA technologies have the potential to increase speed to market, lower costs, and reduce regulatory requirements.

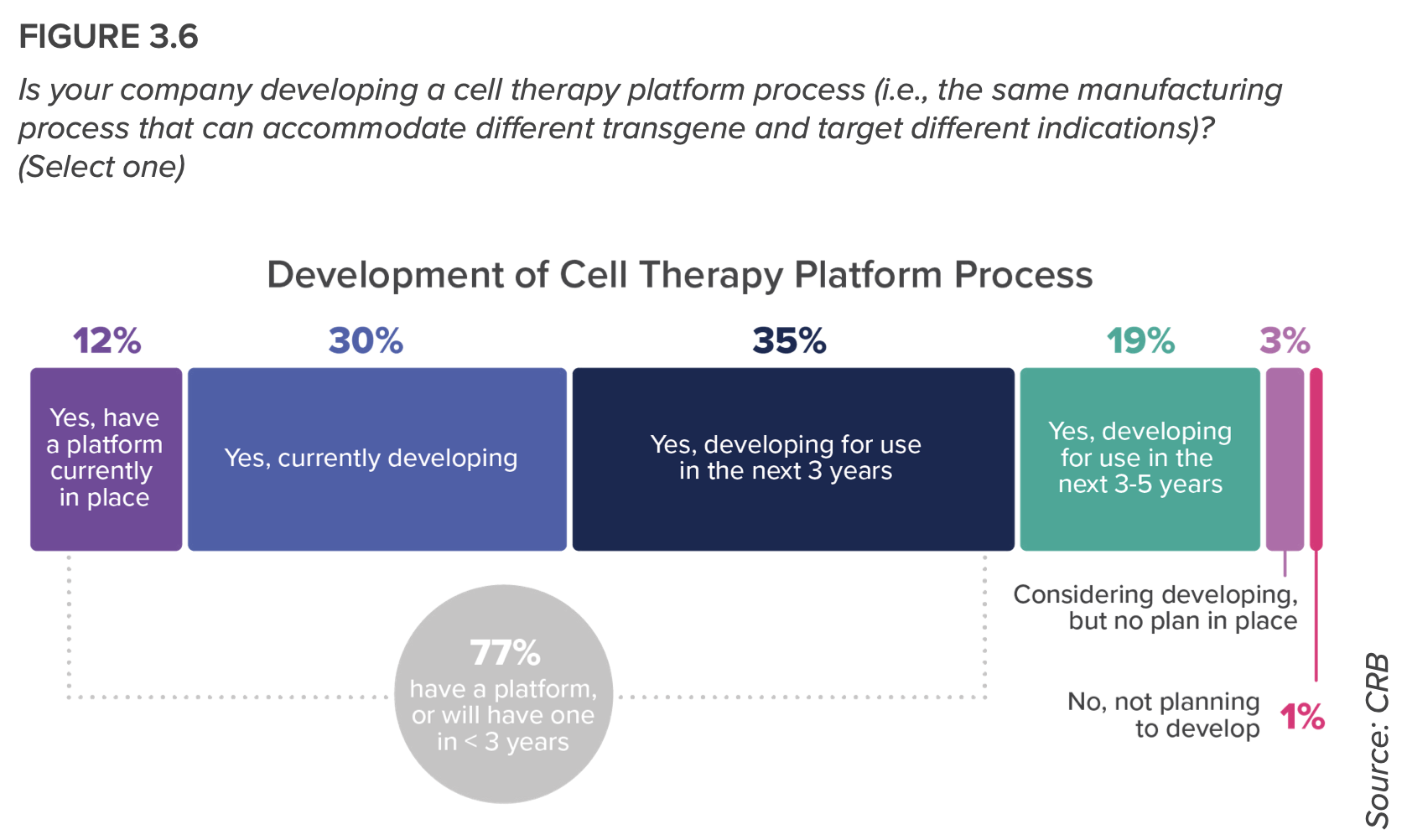

- More than 300 of this report’s respondents have cell therapies in their pipelines, creating one of the most dynamic—and challenging—submarkets. Researchers are leveraging standardized platforms to maximize the versatility and scalability of their processes, to where decentralized manufacturing will change the future of autologous production—“a future that will see cell therapies mature from our last line of defense to an accessible and expected level of patient care,” the report predicts.

- Change is also accelerating for gene therapies. Most respondents said they plan to leap from the small-scale batches necessary for early clinical trials to much larger manufacturing volumes within just three years. Suspension cell cultures, sterile filtration, stable cell lines, and in-house plasmids manufacturing are attracting an enormous volume of R&D activity among both owners and contract manufacturing organizations (CMOs), as this race toward the commercial market heats up.

Modular design will facilitate expansion

- Last year was a milestone year for therapeutic proteins, and not only because the U.S. Food and Drug Administration (FDA) approved the 100th antibody therapy on the market. The field of therapeutic proteins has come a long way—especially in the last few years wherein trends, technologies, and perceptions in the industry saw significant changes. Developers are strategizing for the future.

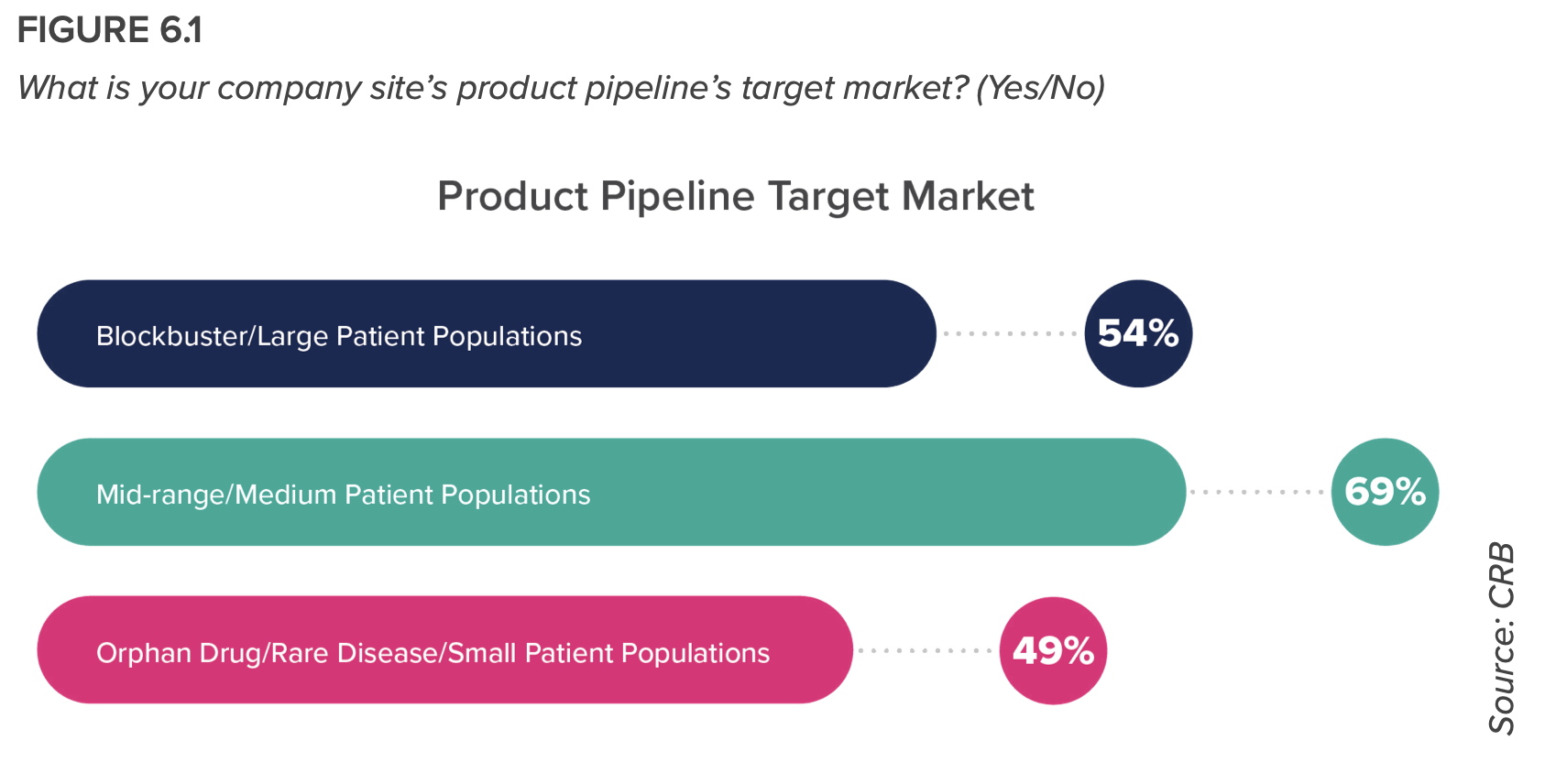

- The tailwinds from COVID-19 treatment innovation have unleashed a new era for drug product manufacturing: one that is looking beyond rare disease markets and smaller patient populations to search for the next blockbuster drug; one that is engaging with drug product formulations that are becoming increasingly more complex; and one that readily embraces automation and online/inline monitoring technologies even at the clinical production operations level.

- CRB’s experts are seeing an “encouraging evolution” in the journey to implementing all aspects of Pharma 4.0—shorthand for efficiencies through process visibility, faster decision making, and real-time system optimization—including smart end-user devices, advanced robotics, and digital twins. “We can see that in the abundance of recent acquisitions that have brought AI innovators into established life science companies,” the report states. But respondents remain sanguine about how to get there, knowing that budget constraints, organizational reluctance, and a lack of skilled labor might hold them back.

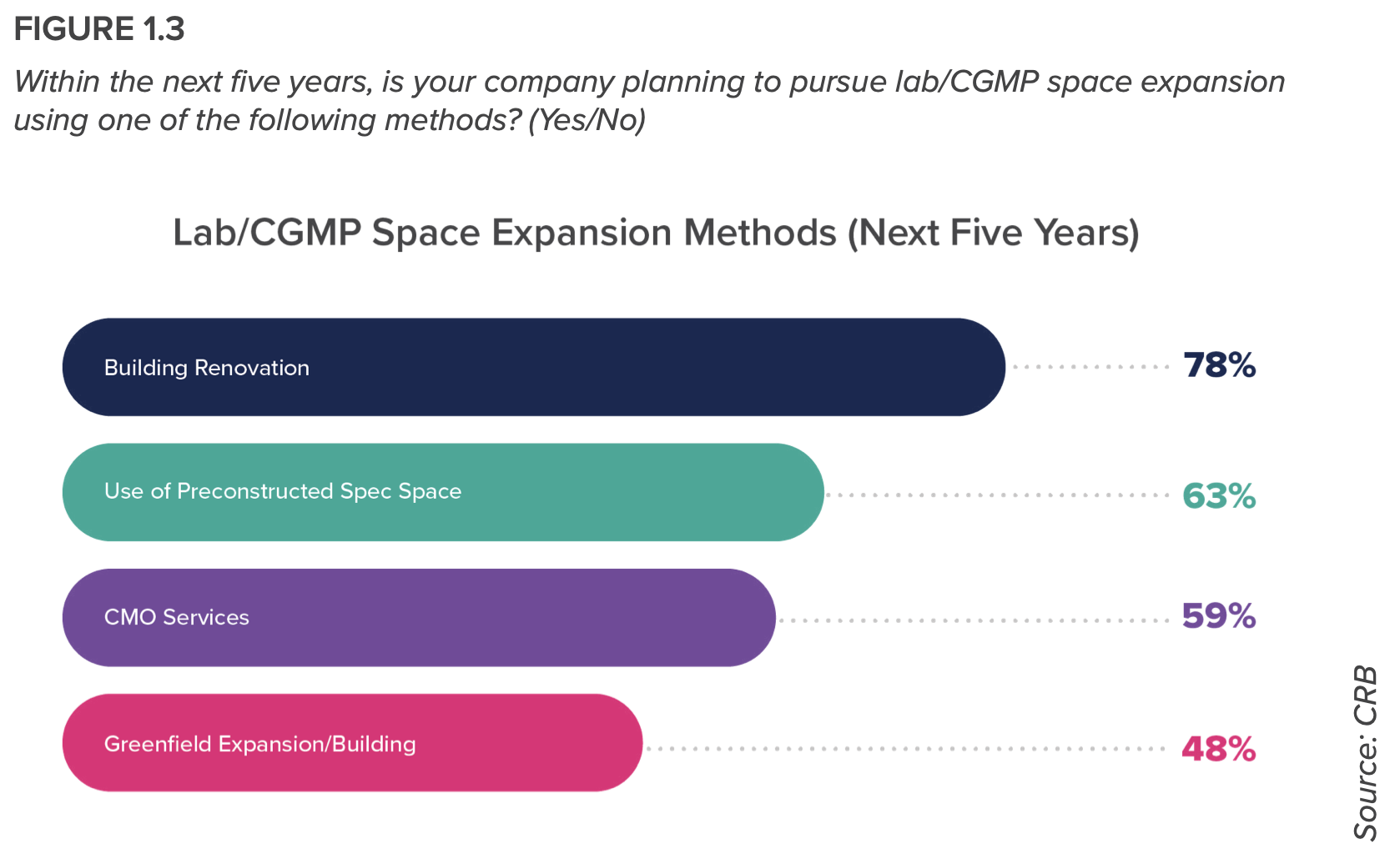

- Most respondents plan to expand over the next five years, with some indicating an intent to establish a footprint in other countries. Optimizing capital and operations expenditure in these expansion efforts means standardizing operations between sites, expediting regulatory approvals, and remaining agile to demand for new modalities and technologies. Hence, CRB concludes, a case for modular design.

Related Stories

Laboratories | Sep 12, 2017

New York City is positioning itself as a life sciences hub

A new Transwestern report highlights favorable market and regulatory changes.

Laboratories | Aug 3, 2017

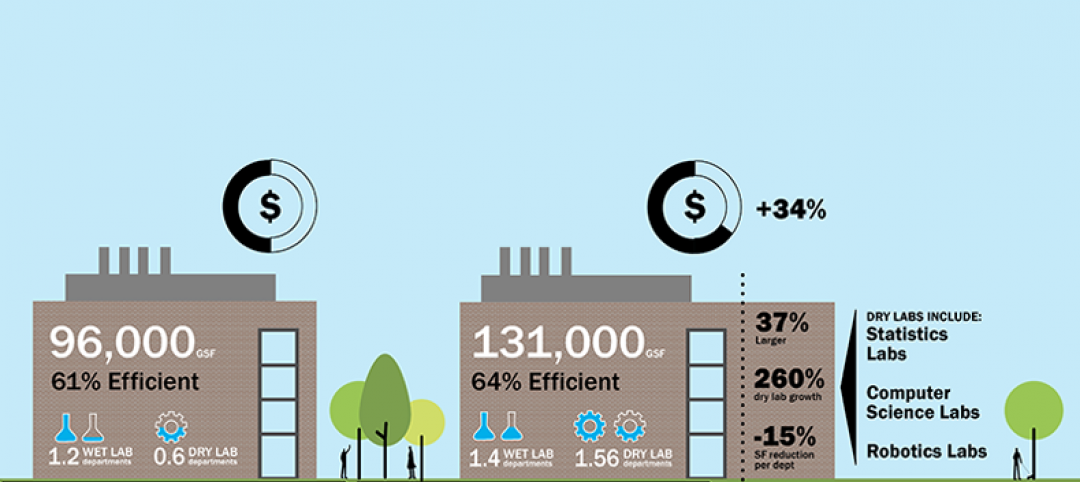

Today’s university lab building by the numbers

A three-month study of science facilities conducted by Shepley Bulfinch reveals key findings related to space allocation, size, and cost.

Laboratories | Jul 18, 2017

Pfizer breaks ground on new R&D campus in St. Louis suburb

The facility will consolidate the company’s local workforce, and provide flexible work and research spaces.

Building Team Awards | Jun 12, 2017

The right prescription: University of North Dakota School of Medicine & Health Sciences

Silver Award: North Dakota builds a new medical/health sciences school to train and retain more physicians.

Laboratories | Apr 13, 2017

How to design transformative scientific spaces? Put people first

While most labs are designed to achieve that basic functionality, a transformational lab environment prioritizes a science organization’s most valuable assets: its people.

Laboratories | Sep 26, 2016

Construction has finished on the world’s largest forensic anthropology lab, designed by SmithGroupJJR

The lab’s main purpose will be to help in the investigation, recovery, and accounting of Americans lost in past wars.

Laboratories | Aug 8, 2016

The lab of the future: smaller, flexible, tech-enabled, business focused

A new CBRE report emphasizes the importance of collaboration and standardization in lab design.

Laboratories | Jun 16, 2016

How HOK achieved design consensus for London's Francis Crick Institute

The 980,000-sf, $931 million facility is the result of a unique financing mechanism that brought together three of the U.K.’s heaviest funders of biomedical research—the Medical Research Council, Cancer Research UK, and the Wellcome Trust—and three leading universities—University College London, Imperial College London, and King’s College London.