Slower growth in the general economy, brought on by seemingly mounting national and international vulnerabilities, is putting downward pressure on the construction industry, whose sectors expanded last year by 20% or more but are moderating to single-digit growth levels.

That’s the viewpoint of the American Institute of Architects’ semiannual Consensus Construction Forecast Panel, which expects building construction spending to increase by just under 6%, its growth rate through the first half of the year, through 2017.

To view an interactive chart comparing the forecasts from the seven market watchers on the Panel, click here.

AIA puts out its Consensus to project business conditions for the coming 12 to 18 months. Kermit Baker, Hon. AIA, the Institute’s chief economist, notes that several factors—job growth, consumer confidence, low interest and inflation rates, and a trending single-family housing market—offer positive economic signs.

Good reception is also coming from AIA’s Architectural Buildings Index, a historically reliable indicator of future spending in the nonresidential sector. The latest data indicate that architectural firms are increasing their backlog of project activity.

Still, there is a growing list of issues “that threatens to unhinge this economic expansion, both national and international,” Baker writes.

These include:

•A weak manufacturing sector, which has declined 13 of the past 17 months dating back to the beginning of 2015.

•Sagging international economies that could diminish U.S. exports. China, Brazil, and Russia “continue to face difficulties,” observes Baker. And the U.K.’s recent split from the European Union could instigate more restrictive trade policies. On the other hand, a stronger U.S. dollar provides incentives for increasing imports.

•The upcoming presidential election, and the “unusually high” level of uncertainty regarding post-election policies.

Baker cites a recent Urban Land-generated consensus forecast of real estate trends that suggests “we are in the latter stages of this current real estate cycle,” where vacancy rates are expected to increase, and rent increases to slow, for multifamily housing and hotel rooms through 2017 and 2018.

Spending on hotel construction is on pace to increase by a still-healthy 7.6% in 2017, but down from 17.9% in 2016, according to AIA’s consensus forecast. Office space spending will grow by 14.7% this year, but only by 7.5% next.

The institutional side is expected rise by 6.7% this year and next. Healthcare facilities spending should increase to 5% next year, from 2.3% in 2016. Public Safety is expected to recover from a 3.7% decline to a 3.3% gain next year. Spending on Education construction, one of the industry’s big tickets, should see a slight downtick in growth, to 6.3% in 2017 from 6.5% this year.

Related Stories

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

AEC Tech | Feb 13, 2020

Exclusive research: Download the final report for BD+C's Giants 300 Technology and Innovation Study

This survey of 130 of the nation's largest architecture, engineering, and construction firms tracks the state of AEC technology adoption and innovation initiatives at the AEC Giants.

Office Buildings | Feb 11, 2020

Forget Class A: The opportunity is with Class B and C office properties

There’s money to be made in rehabbing Class B and Class C office buildings, according to a new ULI report.

Industry Research | Dec 13, 2019

Attention building design experts: BD+C editors need your input for our 2020 Color Trends Survey

The 2020 Color Trends research project will assess leading and emerging trends and drivers related to the use of color on commercial, institutional, and multifamily building projects.

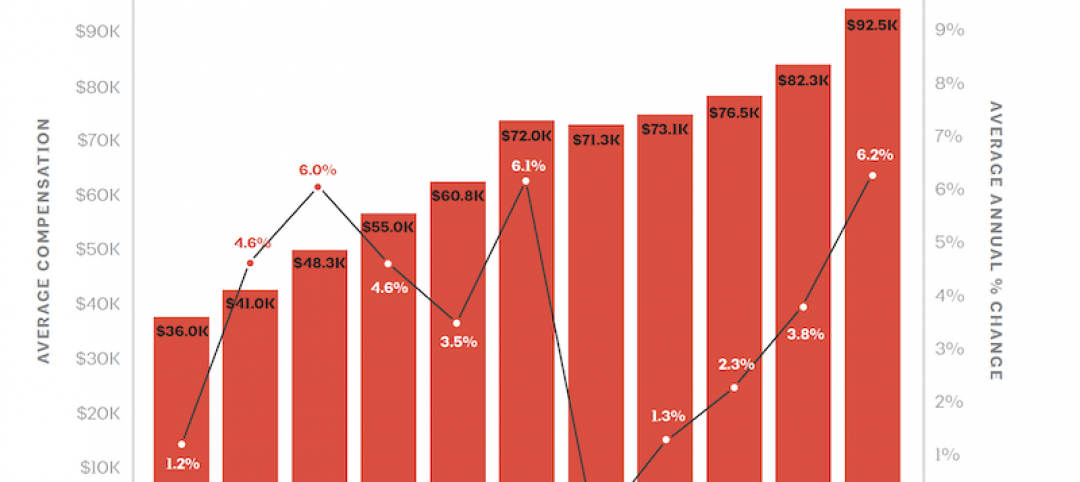

Architects | Sep 11, 2019

Buoyed by construction activity, architect compensation continues to see healthy gains

The latest AIA report breaks down its survey data by 44 positions and 28 metros.

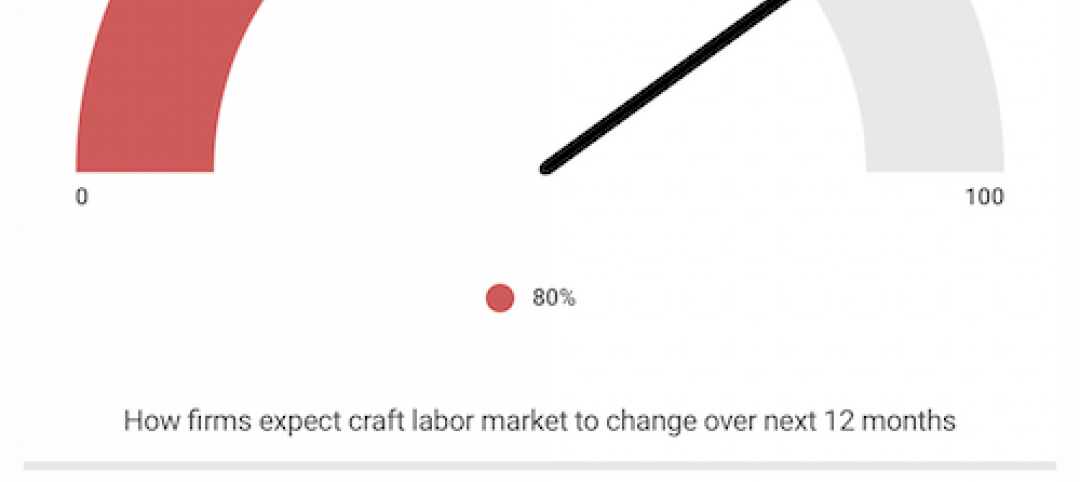

Industry Research | Aug 29, 2019

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Codes and Standards | Aug 29, 2019

Industry leaders ask for government help as trades shortage worsens

AGC asks for more funding for education and increased immigration to fill gaps.

Multifamily Housing | Aug 19, 2019

Top 10 outdoor amenities in multifamily housing for 2019

Top 10 results in the “Outdoor Amenities” category in our Multifamily Design+Construction Amenities Survey 2019.

Multifamily Housing | Aug 12, 2019

Multifamily Amenities 2019: Rethinking the $30,000 cup of coffee

What amenities are “must-have” rather than “nice to have” for the local market? Which amenities will attract the renters or buyers you’re targeting? The 2019 Multifamily Amenities Survey measured 113 amenity choices.