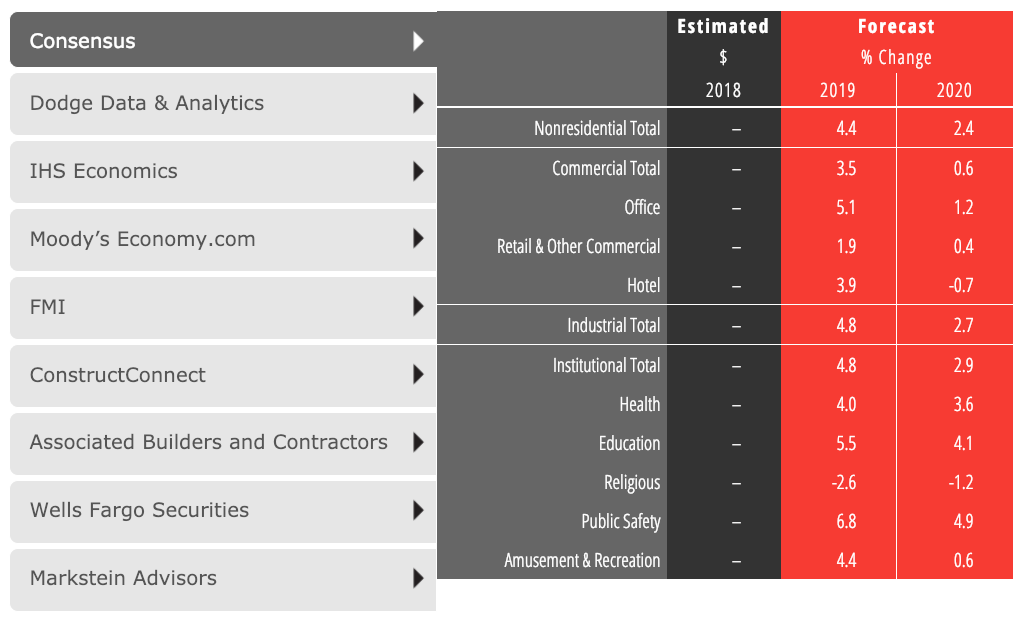

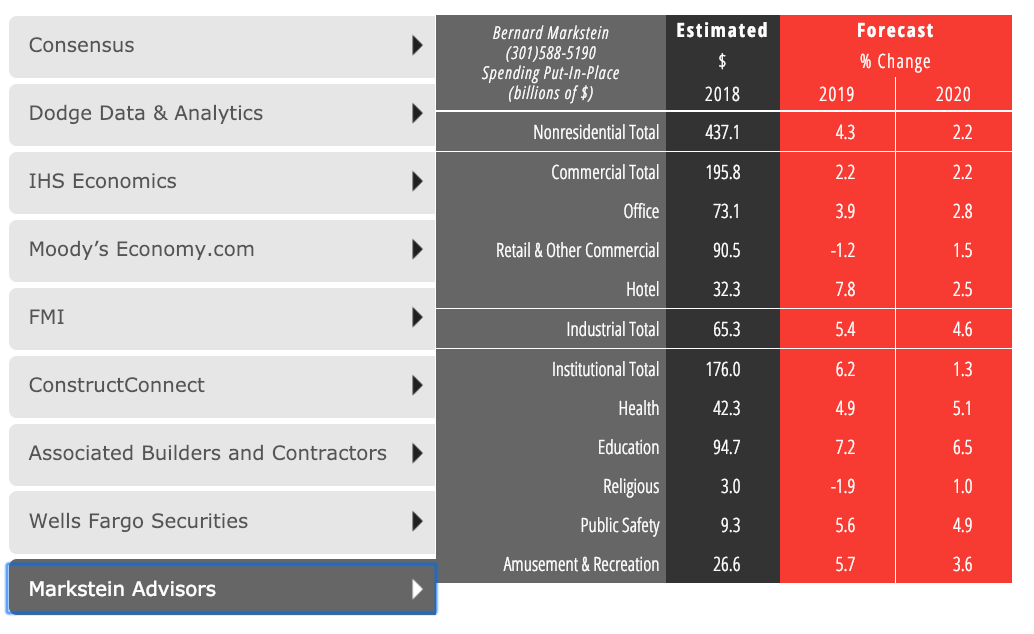

Nonresidential construction spending on buildings is projected to grow by 4.4% through 2019, according to a new consensus forecast from The American Institute of Architects (AIA).

Healthy gains in the industrial and institutional building sectors have bolstered growth projections for 2019. However, the AIA Consensus Construction Forecast Panel—consisting of leading economic forecasters—is suggesting that a broader economic downturn may be materializing over the next 12-24 months. See what each panelist forecasts for 2019 below, and using this interactive chart.

“Though the economy has been performing very well recently, trends in business confidence scores are red flags that suggest a slowdown is likely for 2020,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “These signals may be temporary responses to negative short-term conditions, but historically they have preceded a more widespread downturn.”

OVERALL CONSENSUS

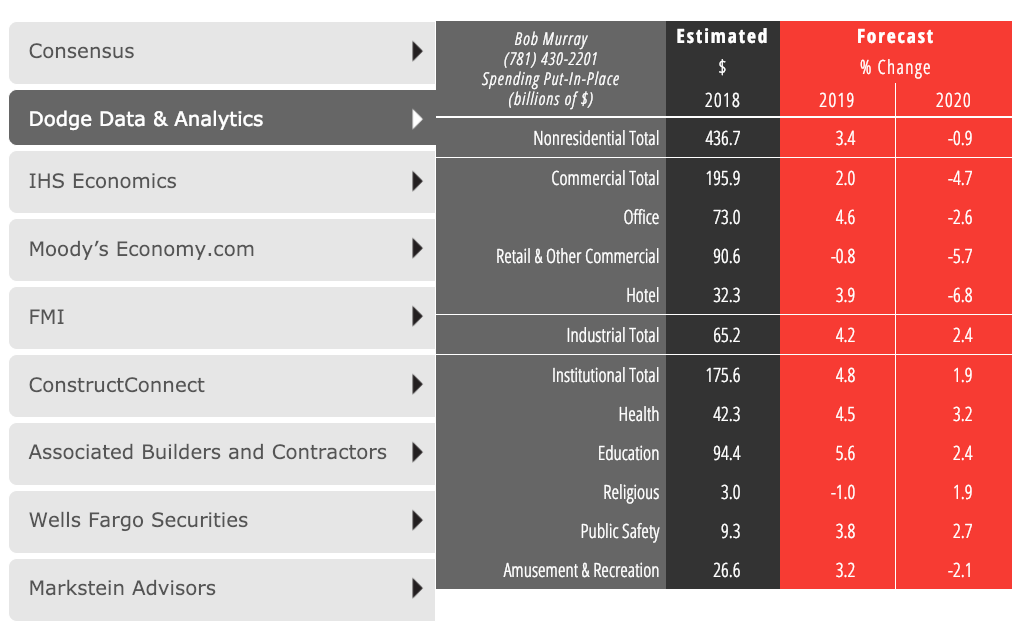

DODGE DATA & ANALYTCS

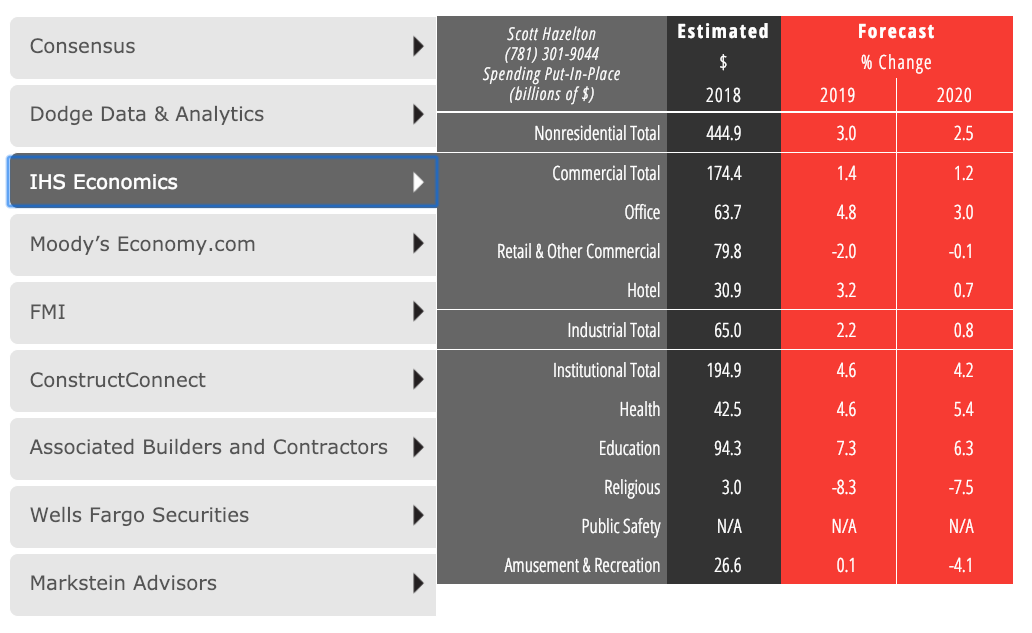

IHS ECONOMICS

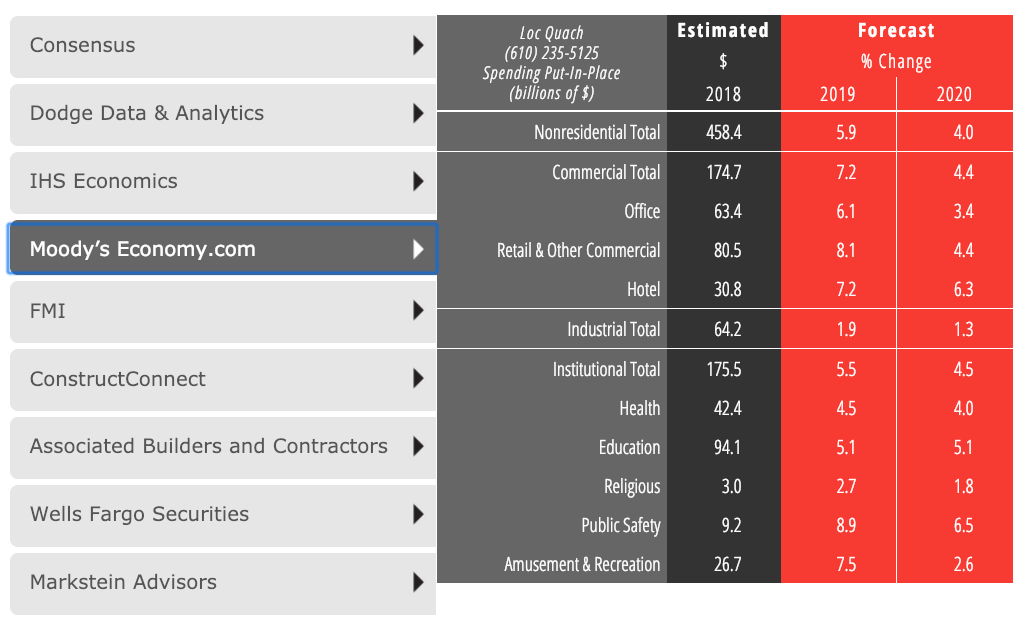

MOODY'S ECONOMY.COM

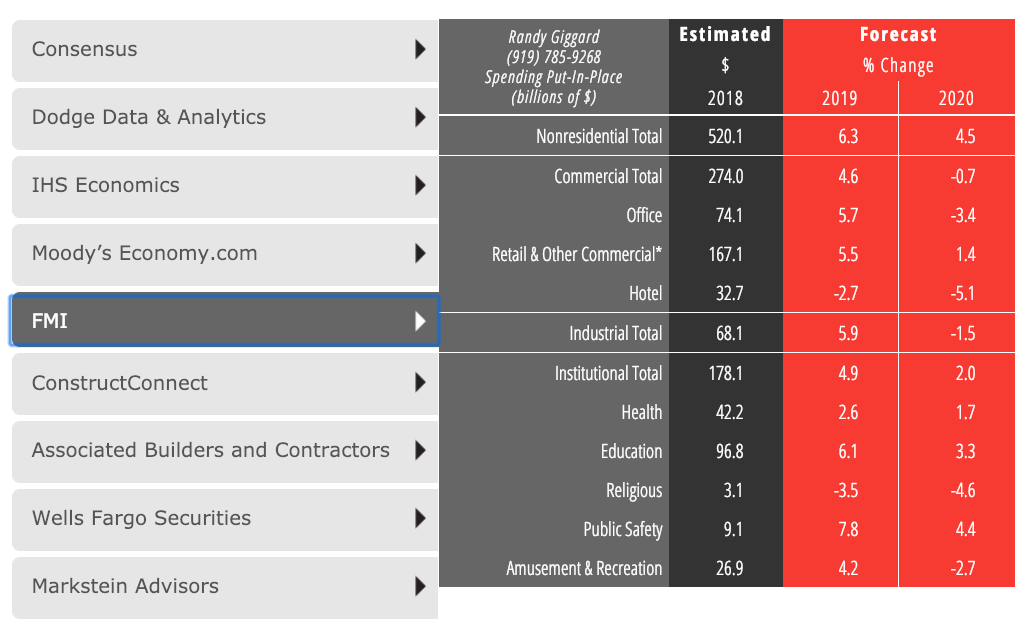

FMI

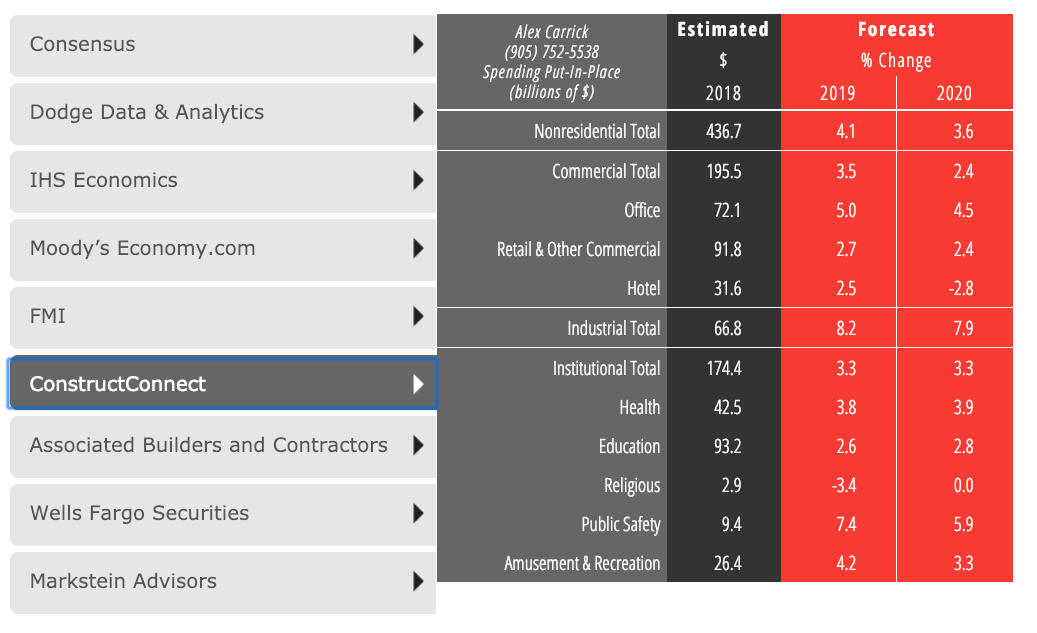

CONSTRUCTCONNECT

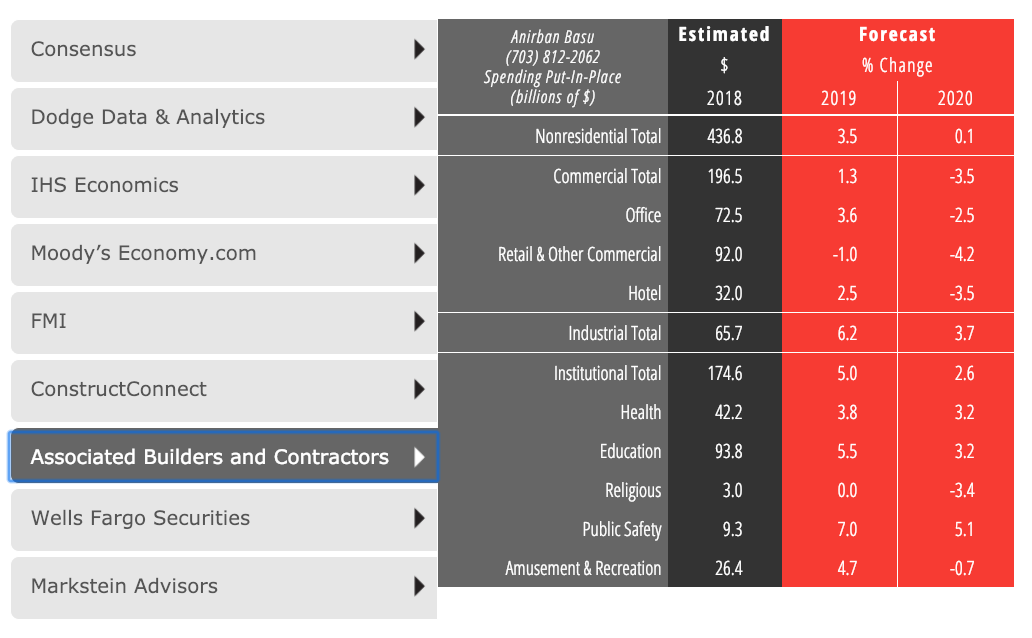

ASSOCIATED BUILDERS AND CONTRACTORS (ABC)

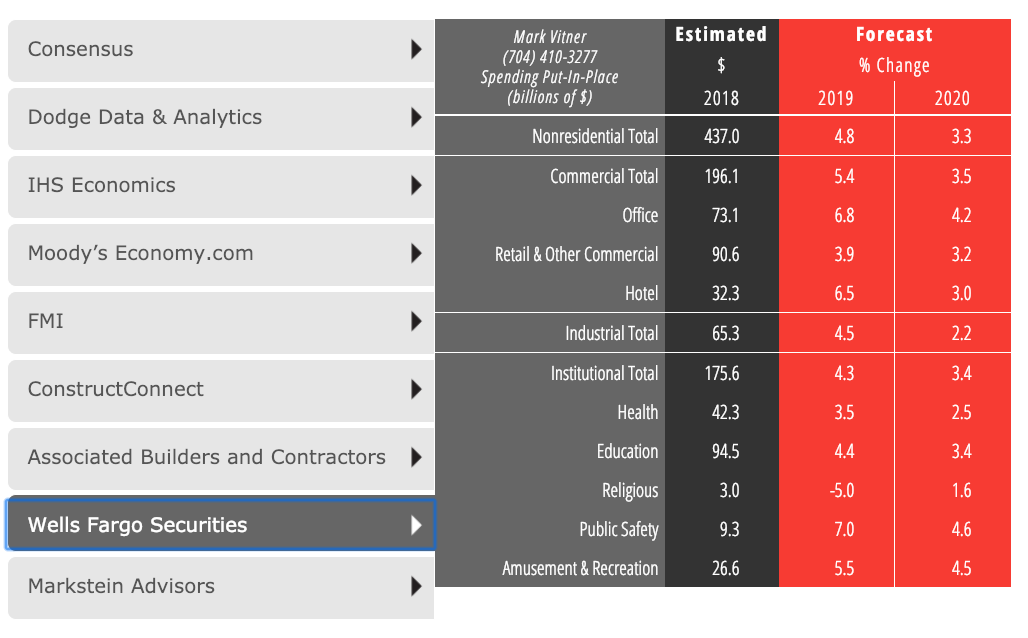

WELLS FARGO SECURITIES

MARKSTEIN ADVISORS

Notes:

• FMI's Retail & Other Commercial category includes transportation and communication sectors.

• The AIA Consensus Forecast is computed as an average of the forecasts provided by the panelists that submit forecasts for each of the included building categories.

• There are no standard definition of some nonresidential building categories, so panelists may define a given category somewhat differently.

• Panelists may forecast only a portion of a category (e.g public buildings but not private buldings); these forecasts are treated like other forecasts in computing the consensus.

• All forecasts are presented in current (non-inflation adjusted) dollars.

Related Stories

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.