Construction industry leaders remained confident regarding nonresidential construction prospects in February 2019, according to the latest Construction Confidence Index released by Associated Builders and Contractors.

All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

Only 3.4% of contractors expect to reduce staffing levels over the next six months, and more than 70% of survey respondents expect their sales to increase through the initial half of 2019.

Still, 31.4% of contractors expect profit margins to remain unchanged, likely due in large measure to rising worker compensation costs.

Index breakdown:

• The CCI for sales expectations increased from 68.4 to 69.4 in February.

• The CCI for profit margin expectations increased from 60.6 to 63.3.

• The CCI for staffing levels increased from 68.2 to 68.5.

“Confidence seems to be making a comeback in America,” said ABC Chief Economist Anirban Basu. “There was a time when consumer, small business and investor confidence was falling. For now, that dynamic has evaporated, with job growth continuing and U.S. equity prices heading higher of late. Contractors understand the performance of the broader economy today helps shape the construction environment of tomorrow. Accordingly, with strong economic data like the Construction Backlog Indicator—which stood at 8.8 months in February 2019—and nonresidential construction spending, which increased 4.8% year over year, contractor confidence remains elevated.

“That said, contractors continue to wrestle with ever-larger skilled workforce shortfalls, which are making it more difficult to deliver construction services on time and on budget,” said Basu. “This helps explain why the CCI reading for profit margins remains meaningfully lower than the corresponding reading for sales expectations. Despite expanding compensation costs, contractors expect to significantly increase staffing levels going forward, an indication that many busy contractors expect to get busier. The fact that the profit margin reading remains above 50 also suggests that contractors enjoy a degree of pricing power and are able to pass at least some of their higher costs along to customers. Slower growth in construction materials prices relative to last year represents another likely factor shaping survey results.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Oct 31, 2016

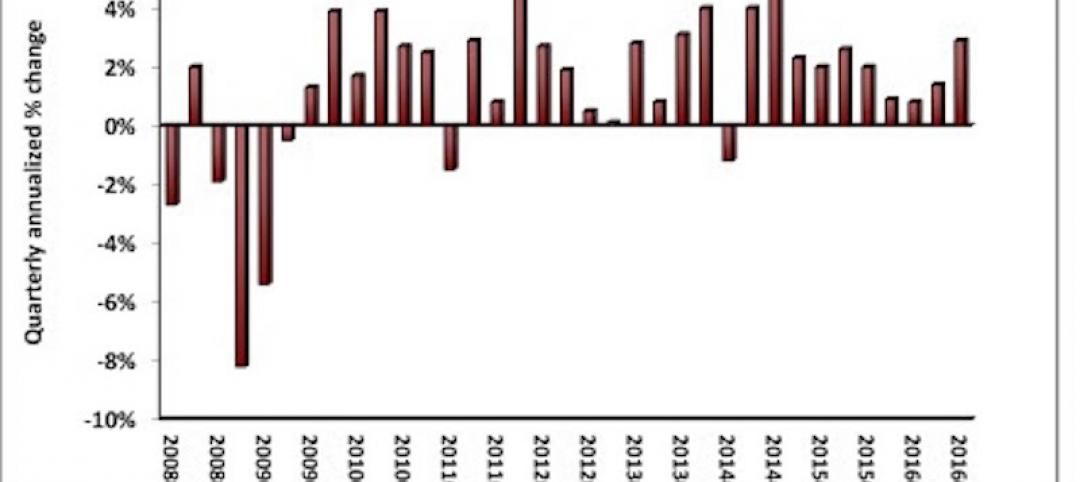

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.