The commercial real estate industry is increasingly focused on the needs of small firms where job growth is outpacing larger firms by nearly five to one, according to Emerging Trends in Real Estate 2016, co-published by PwC US and the Urban Land Institute (ULI).

Now in its 37th year, Emerging Trends in Real Estate provides outlooks for the real estate and land use industry. It includes interviews and survey responses from more than 1,800 leading real estate experts, including investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants.

“The real estate industry's traditional focus on big cities and large employers is shifting significantly as small businesses emerge as the growth engine for the U.S. economy,” said Mitch Roschelle, partner, U.S. real estate advisory practice leader, PwC. “This is creating disruption in the office sector as it finds ways to create new space models to accommodate these employers.”

10 Trends to Watch

PwC and ULI outline the top trends in real estate for 2016:

1. 18-hour cities 2.0

The real estate industry is confiden in the potential investment returns in these 18-hour markets – or markets where businesses, restaurants, and other services operate virtually around the clock. The growth in investor sentiment is evident in the 2016 top ten rankings. With the exception of San Francisco and Los Angeles, the balance of the markets are 18-hour gateway cities.

2. Next stop: the suburbs

As the cost of living and housing prices have risen in the core gateway markets, it’s apparent that suburban opportunities are gaining investor favor. In the top 40 metro areas, 84% of all jobs are outside the center-city core. That’s cause for optimism for the suburban future.

3. Offices: barometer of change

The office sector benefits from the strengthening employment numbers and a rethinking of how employees can maximize their productivity through open workspaces. Some surveyed respondents see the redesign as a way to alter work style itself, while others view it as a way to attract and keep desired talent.

4. A housing option for everyone

Economic and demographic factors influence the housing market as it deals with providing housing desired by the baby boom generation, aging millennials, a population making an urban/suburban choice, and finding a way to provide affordable housing to support a vibrant workforce. Developing better housing for everyone is passing from “nice to do” to “must do”, and that will shape housing trends.

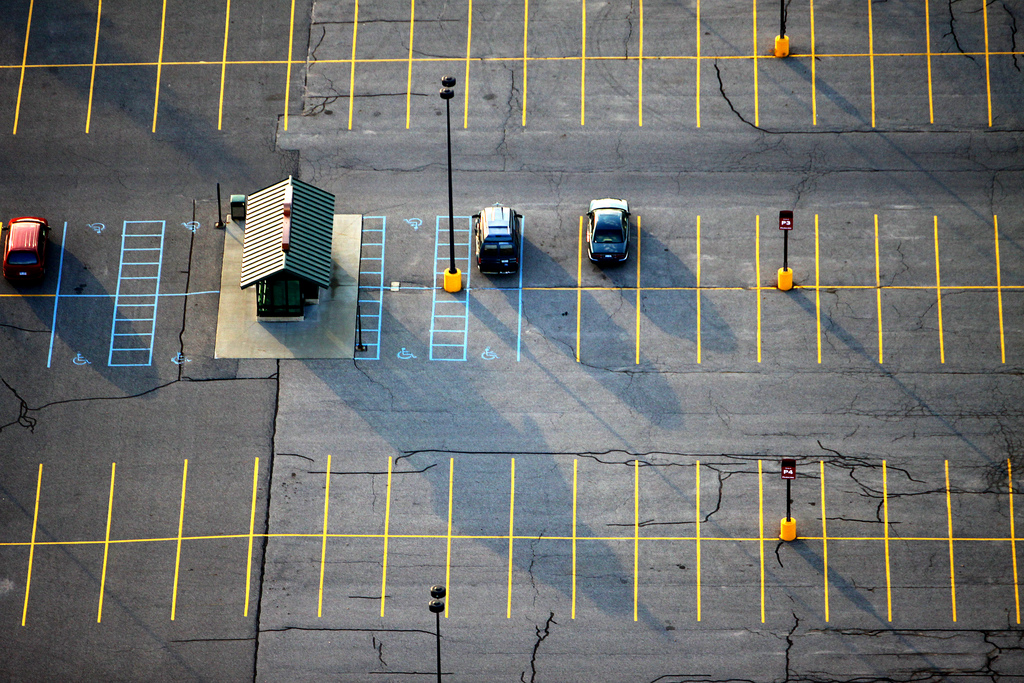

Driving rates are down and parking is a suboptimal use of land in many cities. Photo: Jeffrey Smith/Creative Commons

Driving rates are down and parking is a suboptimal use of land in many cities. Photo: Jeffrey Smith/Creative Commons

5. Parking for change

Miles traveled by car for people 34 years old or younger are down 23 percent (United States Department of Transportation – Federal Highway Administration), while the percentage of high school seniors with driver’s licenses declined from 85 percent to 73 percent between 1996 and 2010, according to the American Automobile Association. The urbanization trend and gen-Y preferences already suggest that existing parking represents a suboptimal use in land and in both 24- and 18-hour cities.

6. Infrastructure: Network it! Brand it!

With urban population growth, cities are looking to prioritize maintenance and tackle critical needs in water supply and distribution, public education, aviation, vehicle and pedestrian traffic, and rail safety. This is leading to creative solutions such as high-frequency bus networks and green infrastructure. Innovative solutions to infrastructure needs is likely to mark the latter half of this decade and beyond.

7. Food is getting bigger and closer

There are many cities where neighborhood land is cheap or older buildings sit idle, and where median incomes are low and the need for fresh food is high. What is trending is the idea that urban land is the most precious and flexible of resources. Just as the reinvention of the suburbs is a story for the decade ahead, so is the creative adaptation of inner-city uses.

8. Consolidation breeds specialization

The evolutionary trends in development, equity investment, and lending are showing that “small can be powerful.” Developers may find it difficult to access sufficient capital unless they have scale, but this means fitting the quality demands of conservative lenders. That requires finding niche lenders and investors willing to fund the smaller projects; and small developers with their lenders may be accessing the most innovative parts of the business. Firms may find themselves in the middle and will need to choose which side – smaller or larger – they wish to be on.

9. We raised the capital; now, what do we do with it?

New capital will be invested in: additional markets (capital is expected to flow more freely in 18-hour cities), alternative assets (what constitutes real estate will continue expanding), old is new again (older space is being embraced and it’s making the market consider a wider range of potential investments), and alternative property types (medical office and senior housing may see a benefit from changing demographics, and data centers and lab space may be in demand due to technical changes).

10. Return of the human touch

The industry is trending toward more intensive active management. Risk management of hacking issues is of critical concern – and attention to cybersecurity will penetrate more deeply into the real estate business. Attention to individual decision-making is needed as much as ever.

5 Markets to Watch

A snapshot of the top five markets ranked by survey respondents and their outlook for each market:

- Dallas/Fort Worth – Impressive employment growth is the story behind this area’s rise to the top of this year’s survey (it ranked #5 last year), which is supported by a business-friendly environment along with an attractive cost of doing business and cost of living.

- Austin – Austin (same spot as last year) fueled by another year of diverse job creation, it remains an attractive place to live for all generations. One concern from surveyed participants is that the market is growing faster than the local infrastructure.

- Charlotte – This city (up from #7 last year) embodies many of the components of the 18-hour city. Good job and population growth along with the development of urban centers makes the market attractive to residents.

- Seattle – Seattle (#8 in 2014), is popular with domestic and global investors, offers a diverse industry base and is benefiting from growth in the technology, advertising, media and information industries.

- Atlanta – The market (which ranked #11 last year) enjoys strong growth in key sectors of the economy without the typical concern of oversupply. The lower cost of doing business is attracting corporate relocations which contribute to market growth.

Related Stories

| Oct 4, 2011

GREENBUILD 2011: Two new recycled glass products announced

The two collections offer both larger and smaller particulates.

| Oct 4, 2011

GREENBUILD 2011: Mythic Paint launches two new paint products

A high performance paint, and a combination paint and primer now available.

| Oct 4, 2011

GREENBUILD 2011: Wall protection line now eligible to contribute to LEED Pilot Credit 43

The Cradle-to-Cradle Certified Wall Protection Line offers an additional option for customers to achieve LEED project certification.

| Oct 3, 2011

Magellan Development Group opens Village Market in Chicago’s Lakeshore East neighborhood

Magellan Development Group and Hanwha Engineering & Construction are joint-venture development partners on the project. The Village Market was designed for Silver LEED certification by Loewenberg Architects and built by McHugh Construction.

| Oct 3, 2011

Balance bunker and Phase III projects breaks ground at Mitsubishi Plant in Georgia

The facility, a modification of similar facilities used by Mitsubishi Heavy Industries, Inc. (MHI) in Japan, was designed by a joint design team of engineers and architects from The Austin Company of Cleveland, Ohio, MPSA and MHI.

| Oct 3, 2011

Cauceglia to lead Allsteel’s global accounts

Cauceglia is responsible for developing new global business strategies and expanding existing business within the Fortune 500 sector.

| Sep 30, 2011

BBS Architects & Engineers completes welcoming center at St. Charles Resurrection Cemetery

The new structure serves as the cemetery's focal architectural point and center of operations.

| Sep 30, 2011

Design your own floor program

Program allows users to choose from a variety of flooring and line accent colors to create unique floor designs to complement any athletic facility.

| Sep 30, 2011

AAMA offers electronic technical documents with launch of virtual library

This new program offers a system for members to purchase annual licenses in order to offer electronic versions of AAMA publications in an effort to make AAMA’s technical information resources more readily available to their employees.