Our Healthcare Program Solutions team spends much of its time representing owners as they work their way through the execution of major capital programs. Many of our team members have spent time not only on the consulting side of the owner’s team but have worked for some of the clients we serve. In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want. To do this, we spend time communicating with owners and listening to their thoughts on firms and people they hire for support. Based on that feedback, we offer the following three thoughts about what we believe our clients want—for us to collaborate, listen, and understand.

Collaborate

Most owners we partner with want teams that work effectively together to solve problems. As the primary holder of risk on any given project, owners realize there is a cost associated with poor teamwork and constant conflict. Owners do not expect perfection, but they do expect teams to find solutions to the problems we uncover (or create). They want us to learn from difficult situations and not repeat them. Certainly, the typical contract structure is at times an impediment to this way of thinking given that each firm is legally incentivized to protect themselves. With that said, we would argue that teams working together to solve problems, focusing on the greater good of the project, ultimately reduce the risk to their individual firms. In our experience, project teams exhibiting this type of behavior find themselves completing projects that meet their client’s needs.

Listen

Perhaps the most common complaint we hear from our clients is that team members are not listening to what they have to say. It’s virtually impossible to receive high performance marks from the client if you aren’t seen a good listener. One of my favorite quotes by Gene Buckley states, “Don’t try to tell the customer what he wants. If you want to be smart, be smart in the shower. Then get out, go to work and serve the customer!” Practice these simple tasks;

- Don’t interrupt when the client is talking

- Don’t inject yourself into their narrative of the problems they need your help to solve

- Just listen, quietly and intently

- Ask questions to clarify issues so your team has a clear understanding of what they’re being asked to do

- Thoughtfully bring back options and potential solutions

- Listen again, and again

Understand

Healthcare in the United States is complex and fraught with uncertainty. It often seems like the burden of navigating the rules of operating successfully are left to the clients we serve. In our experience, healthcare owners value service providers who understand the world the owner lives in—one who can think about how (or if) we can leverage the design and construction process to address some of these problems. These challenges may not always be conducive to a strict design and construction schedule. A simple example is using major capital projects to help maintain or even improve physician relationships. These key constituents have unique needs and, like all of us, want to be heard and listened to. Find the time and the way to do this. Involve them in your process and go out of your way to accommodate their daily schedule and be responsive to their thoughts.

Conclusion

Spend time considering the issues your client faces. Then, spend time considering how your area of expertise can be leveraged to address and overcome those challenges. Be flexible and willing to do whatever it takes to make the client successful. We have to partner together, no matter what side of the table you sit on.

As always, we welcome your thoughts and ideas on how we can together provide better service to our clients.

Related Stories

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 28, 2016

Worldwide hotel construction shows modest year-over-year growth

Overall construction for hotel projects is up, but the current number of hotels currently being built has dipped slightly from one year ago.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Industry Research | Sep 21, 2016

The global penetration of smart meters is expected to reach approximately 53% by the end of 2025

Large-scale smart meter deployments are underway across Western Europe, while new deployments continue among later adopters in the United States.

Industry Research | Sep 12, 2016

Evidence linking classroom design to improved learning mounts

A study finds the impact can be as much as 25% per year.

Healthcare Facilities | Sep 6, 2016

Chicago Faucets releases white paper: Reducing the risk of HAIs in healthcare facilities

The white paper discusses in detail four options used to mitigate transmission of waterborne bacteria

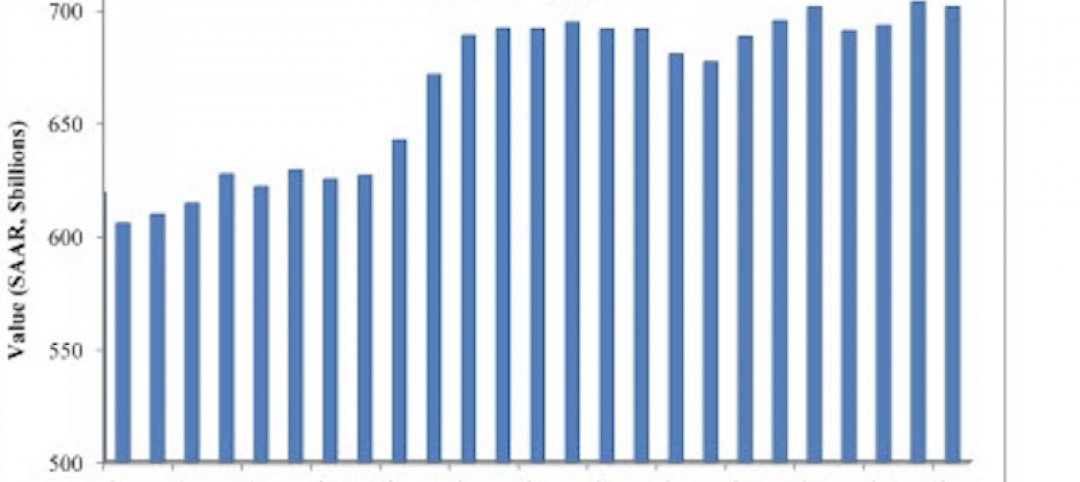

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.