At the end of the first quarter of 2020, analysts at Lodging Econometrics (LE) report that the total U.S. construction pipeline continued to expand year-over-year (YOY) to 5,731 projects/706,128 rooms, up 1% by projects and 3% by rooms. However, quarter-over-quarter, the pipeline has contracted slightly less than 1% by both project and room counts, down from 5,748 projects/708,898 rooms at the close of 2019.

Projects currently under construction stand at an all-time high of 1,819 projects/243,100 rooms. Projects scheduled to start construction in the next 12 months total 2,284 projects/264,286 rooms, while projects in the early planning stage stand at 1,628 projects/198,742 rooms. Projects in the early planning stage are up 8% by projects and 11% by rooms, YOY. Developers with projects under construction have generally extended their opening dates by two to four months. For projects scheduled to start construction in the next 12 months, on average, developers have adjusted their construction start and opening dates outwards by four to six months. Additionally, brands have been empathetic with developers by relaxing timelines as everyone adjusts to the COVID-19 interruptions. As a result, LE anticipates a stronger count of openings in the second half of 2020, compared to the first half.

In the first quarter of 2020, the U.S. opened 144 new hotels with 16,305 rooms. While the COVID-19 pandemic has slowed development, it has not completely stalled it. There were still 312 new projects with 36,464 rooms announced into the pipeline in the first quarter.

Many open or temporarily closed hotels have already begun or are in the planning stages of renovating and repositioning their assets while occupancy is low or non-existent. At the close of the first quarter, LE recorded 769 active renovation projects/163,030 rooms and 616 active conversion projects/69,258 rooms throughout the United States.

To date, the largest fiscal relief and stimulus efforts include the unprecedented $2 trillion CARES Act, the Paycheck Protection Program (PPP), and the Paycheck Protection Program Liquidity Facility (PPPLF), with a third phase of relief having been signed by the president last week. This third phase includes nearly $500 billion to further support the small-business loan program, as well as provide additional critical funding needed for hospitals and comprehensive testing. A phase four “CARES Act 2” package is already being discussed.

In order to support the economy and build liquidity, the Federal Reserve cut interest rates to almost zero; reduced bank reserve requirements to zero; rapidly purchased hundreds of billions of dollars in treasury bonds and mortgage-backed securities; bought corporate and municipal debt; and extended emergency credit to non-banks. The Federal Reserve has signaled that it will provide more support to the economy if warranted.

Although there are discussions about opening parts of the country that are beginning to stabilize; it will be measured with phased openings designed to effectively balance a highly desired economic ramp up while following prudent health and safety precautions.

*COVID-19 (coronavirus) did not have a full impact on first quarter 2020 U.S. results reported by LE. Only the last 30 days of the quarter were affected. LE’s market intelligence department has and will continue to gather the necessary global intelligence on the supply side of the lodging industry and make that information available to our subscribers. It is still early to predict the full impact of the outbreak on the lodging industry. We will have more information to report in the coming months.

Related Stories

Market Data | Jun 2, 2017

Nonresidential construction spending falls in 13 of 16 segments in April

Nonresidential construction spending fell 1.7% in April 2017, totaling $696.3 billion on a seasonally adjusted, annualized basis, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.

Market Data | May 24, 2017

Design billings increasing entering height of construction season

All regions report positive business conditions.

Market Data | May 24, 2017

The top franchise companies in the construction pipeline

3 franchise companies comprise 65% of all rooms in the Total Pipeline.

Industry Research | May 24, 2017

These buildings paid the highest property taxes in 2016

Office buildings dominate the list, but a residential community climbed as high as number two on the list.

Market Data | May 16, 2017

Construction firms add 5,000 jobs in April

Unemployment down to 4.4%; Specialty trade jobs dip slightly.

Multifamily Housing | May 10, 2017

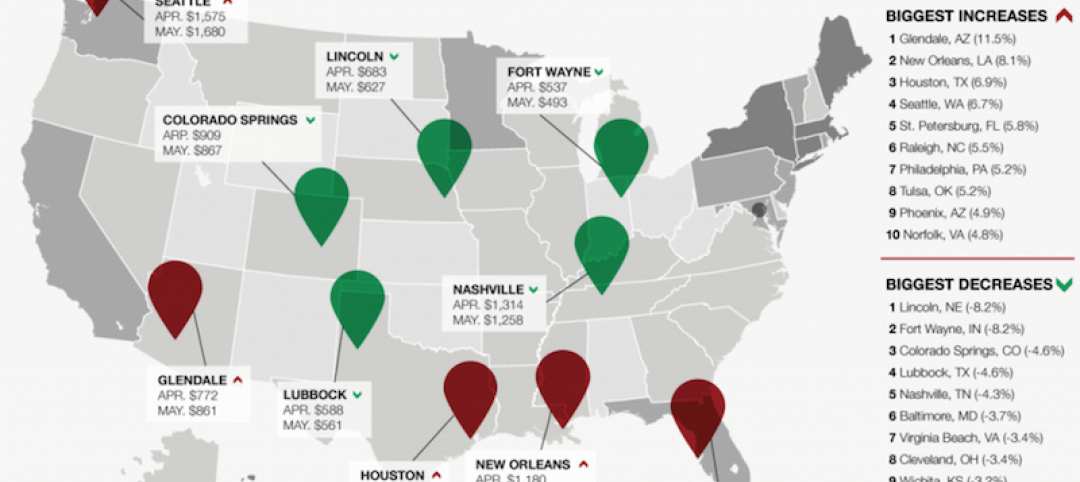

May 2017 National Apartment Report

Median one-bedroom rent rose to $1,012 in April, the highest it has been since January.

Senior Living Design | May 9, 2017

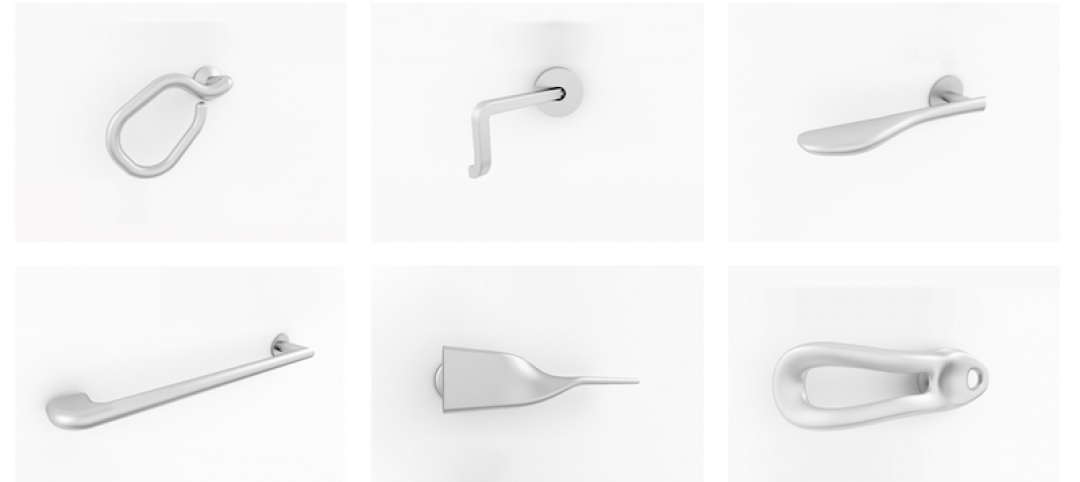

Designing for a future of limited mobility

There is an accessibility challenge facing the U.S. An estimated 1 in 5 people will be aged 65 or older by 2040.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.